It seems Bitcoin is having commitment issues. The alpha crypto just can’t seem to decide whether it wants to settle down at $64,000 or aim a little higher and cozy up to $65,000.

Why? Well, there aren’t any big events or news that could give Bitcoin the push it needs to pick a direction and stick with it.

Related: Bitcoin ETFs Fuel Parabolic Potential. Analysts Predict New Highs Amid Surging Inflows

It’s as if Bitcoin is waiting for a sign from the universe before it makes a move. Perhaps a skywriter spelling out “BTFD” or a fortune cookie message reading “HODL on tight!”

Meanwhile, the big money players (a.k.a. institutional investors) have been running for the hills. U.S. spot Bitcoin ETFs have seen almost $300 million in net outflows over the past two days alone, bringing the total outflows since June 10th to a staggering $879 million.

Fidelity’s FBTC fund saw the biggest exodus yesterday, with investors yanking out $175 million. Even the mighty Grayscale Investments wasn’t immune, with its GBTC fund shedding $65 million.

So What’s Spooking the Big Players?

It appears the Federal Reserve’s hawkish stance last week left institutional investors feeling super uneasy. The dot plot now suggests the Fed foresees only one rate cut before 2025. Cue the sad trombone sound effect.

This lack of confidence has taken its toll on Bitcoin, which has slumped 6% over the past week according to CoinGecko. Even derivatives traders are feeling the pain, with $32 million in liquidations over the past 24 hours – $20 million of which came from overly optimistic longs who thought Bitcoin was ready to settle down and start a family at $65k.

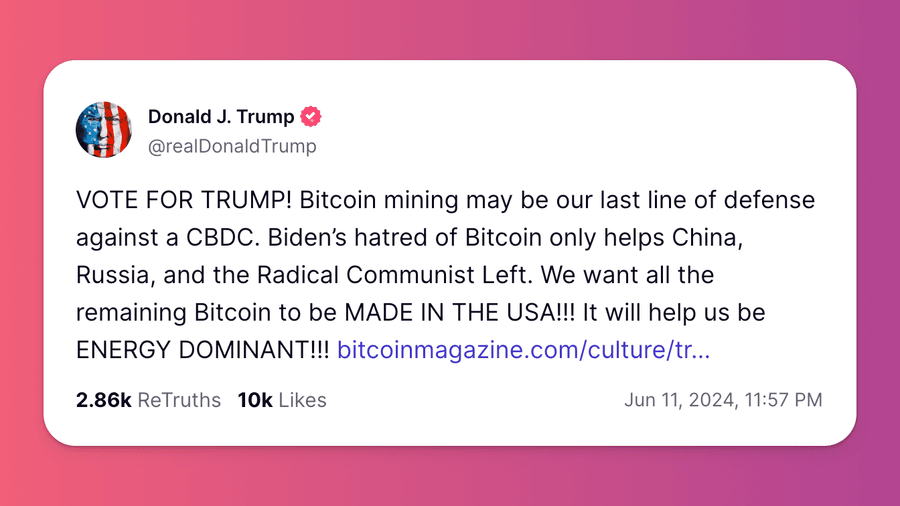

But amidst the gloom, a potential ray of hope has emerged from an unlikely source: former president and current Florida Man-in-Chief, Donald Trump. After a meeting with Bitcoin miners, Trump took to his totally-not-a-knockoff social media platform, Truth Social, to declare that he wants “all remaining Bitcoin made in the USA.”

While the logistics of this remain unclear (will we see MAGA-hat wearing miners chanting “Build the Blockchain”?), Trump’s pro-mining stance could be a boon for U.S. miners in the coming months.

Mining stocks outperformed Bitcoin last week, with Bitfarms surging 34% and CleanSpark gaining 19%. Apparently, when Trump speaks, the market listens (or at least the bots do).

On the other hand, the mining industry is going through big changes. Older, less efficient equipment is being replaced with brand-new, more energy-efficient machinery. This has resulted in miners depleting their Bitcoin reserves to keep the lights on and upgrade their rigs.

With the withdrawals still likely ongoing, analysts warn that investors should remain cautious. If Bitcoin dips below $64,000, it could trigger a larger correction and potentially signal the start of an early bear market—or, as we like to call it, “Hibernation Season.”

More Info on BTC:

- New Research Proves Bitcoin Enthusiasts Are Not Psychopaths

- 10,000 Bitcoins Later: Commemorating the First Crypto Pizza Transaction

So, for now, Bitcoin’s still doing its little dancy dance between $64k and $65k.

Will it finally pick a side and stick with it? Or will it keep everyone guessing like a flaky Tinder match? I’ll leave that to you to decide.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL FM strongly recommends contacting a qualified industry professional.