The Bank for International Settlements (BIS) has teamed up with the central banks of France, Japan, South Korea, Mexico, Switzerland, the United Kingdom, and the Federal Reserve Banks of the United States to delve into the world of asset tokenization within the monetary system, alongside private financial institutions.

The proof-of-concept projects aim to establish a centralized platform for cross-border CBDC payments and tokenized money transfers.

Related: Cryptocurrency 101: A Beginner’s Guide to Understanding Cryptocurrencies, and Their Advantages

The Agora Project

The initiative, called “Project Agora” (from the Greek word for “market”), is set to build upon the concept of a unified registry proposed by BIS, which merges tokenized deposits from commercial banks with tokenized wholesale money from central banks. “This could enhance the functioning of the monetary system and offer new solutions using smart contracts and programmability capabilities, while preserving its two-tier structure,” wrote BIS, adding:

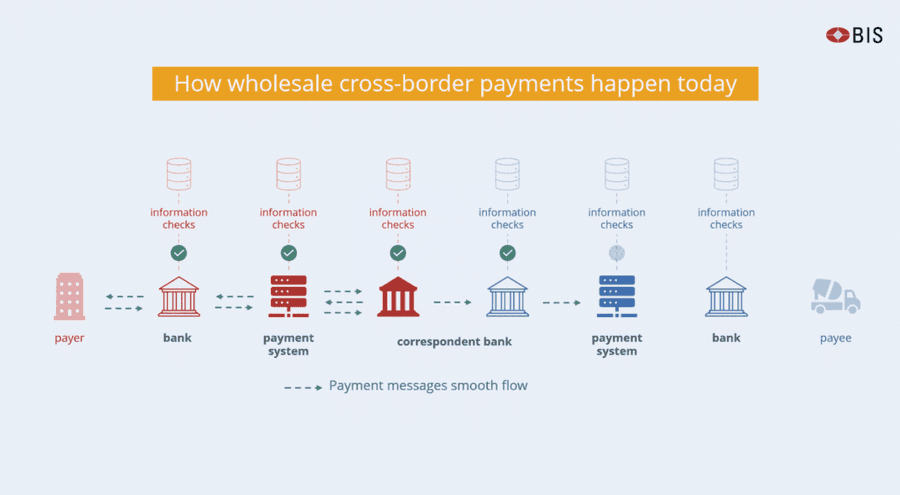

This significant public-private partnership aims to address a range of structural deficiencies in how payments are currently made, particularly across borders, which pose a variety of challenges: differing legal, regulatory, and technical requirements, as well as working hours and time zones.

The project, based on BIS’s unified registry concept, will explore how tokenized deposits from commercial banks can seamlessly integrate with tokenized wholesale money from the central bank within a government-private programmable foundational financial platform.

Important: Governance Tokens: Explainer for Dummies

Smart contracts could unlock new ways of settlement and unleash types of currently impossible or impractical transactions, thereby opening up new possibilities for the benefit of businesses and people alike.

This significant public-private partnership will aim to overcome a range of structural deficiencies in how payments are made today, particularly across borders, which pose a variety of challenges: differing legal, regulatory, and technical requirements, as well as working hours and time zones. Plus, the added complexity of ensuring financial integrity control (e.g., anti-money laundering and customer due diligence) is often duplicated multiple times for the same transaction, depending on the number of intermediaries involved.

Specific instructions and requirements will be issued in due course, and private banks will be given a grace period to join the partnership. Hyun Song Shin, an economic advisor and the head of research at BIS, explained that tokenization integrates the functionality of a conventional database with the regulations and principles governing transfers.

Bridging the Gap in Digital Finance

The BIS will appeal to private financial institutions to express interest in joining the Agora project. The IIF will act as a mediator and organizer of participants from the private sector. It is anticipated that several regulated financial institutions representing each of the seven currencies will participate. Detailed instructions and requirements will be provided at a later time. Being a member of the IIF is not a mandatory condition for participation.

Meanwhile, Cecilia Skingsley, Head of the BIS Innovation Center, discussed a “common payment infrastructure” that allows payment systems, ledgers, and data registries to be compatible with digital currencies.

Today, numerous payment systems, ledgers, and data registries require integration with other complex systems. In Project Agora, we aim to explore a new common payment infrastructure that could bring together all these elements and enhance the efficiency of collaborative work within the basic digital financial infrastructure. We are not just testing the technology; we are testing it in the specific operational, regulatory, and legal conditions of the participating currencies along with the financial companies operating within them.

BIS projects typically have an experimental nature and are aimed at studying and providing public goods to the global central banking community.

More Info:

- Deutsche Bank completes trial of tokenized investment platform;

- Top Blockchain Projects of 2024;

- JPMorgan Explores Blockchain-Powered Deposit Tokens for Faster Transactions and Reduced Costs.

BIS has shown great interest in recent cryptocurrency innovations related to financial centralization. On January 23, the BIS Innovation Center added six new projects exploring cybersecurity, combating financial crime, central bank digital currencies, and green finance.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL.FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL.FM strongly recommends contacting a qualified industry professional.