Alright, ladies, gentlemen, and digital daredevils! We promise to guide you through the convolutions of digital currencies, blockchain technology, and the wild world of decentralization, making it as palatable as grandma’s apple pie and twice as enlightening. So, strap in and hold on tight; it’s going to be fun!

Kick-off: Demystifying Cryptocurrency and Blockchain

First things first, let’s get the basics down. What’s cryptocurrency? Simply put, it’s a digital or virtual form of currency that uses cryptography for security. But it’s not just for tech wizards or Wall Street mavericks anymore; it’s increasingly becoming a crowd favorite. From your yoga instructor investing in Dogecoin to your hairstylist chatting about Ethereum, it’s becoming increasingly tough to not get swept up in the crypto craze.

Read more: Cryptocurrency: Key Terms and Concepts

Yet, discussing cryptocurrencies without understanding blockchain technology, their foundational bedrock, is like trying to explain the internet while skipping over the concept of web pages. It doesn’t quite work. The word ‘blockchain‘ might sound like something you’d stumble upon in a game of Minecraft, but it’s actually a revolutionary technology that’s shaking the pillars of our financial institutions.

Definition and Characteristics

Cryptocurrencies are like the money in your wallet, but digital, and a bit on steroids. These are decentralized forms of digital currency, operating on a technology known as blockchain, which ensures a level of security and privacy that traditional banks have long struggled to offer.

The term ‘decentralization’ might seem like a word tossed around in a sci-fi movie, but in the world of cryptocurrencies, it’s a game-changer. Decentralization means no central authority, like banks or governments, have control over your funds. Instead, you are the sole commander of your digital wealth, armed with your cryptographic keys and the internet as your playground. It’s financial freedom, but not as we know it.

Zooming in on Popular Cryptocurrencies

While the cryptocurrency universe is burgeoning with over 5,000 different types of cryptocurrencies, each unique and intriguing in its way, let’s focus on the superhero trio: Bitcoin, Ethereum, and Litecoin.

First up, the Tony Stark of crypto, Bitcoin.

Introduced to the world through a white paper by the mysterious Satoshi Nakamoto in 2008, Bitcoin has taken the financial world by storm. Lauded as the ‘digital gold,’ Bitcoin is a beacon of decentralization and scarcity. This scarcity, akin to gold, is what adds to its appeal and value. Want to know more? Nakamoto’s white paper is a treasure trove of knowledge about Bitcoin.

Read more: Bitcoin Chronicles: The Epic Saga of Digital Currencies and Its Influence on Money Matters

Next on our list, Ethereum.

The brainchild of wunderkind Vitalik Buterin, Ethereum is more than just a cryptocurrency. It’s a platform for creating decentralized applications (Dapps) using something called smart contracts. Intrigued? Get a better understanding by visiting Buterin’s enlightening whitepaper.

Finally, let’s cast the spotlight on Litecoin, a key player in the crypto league.

Drawing parallels with the precious metal market, Litecoin is frequently described as the ‘silver’ complement to Bitcoin’s ‘gold’. Created by the innovative Charlie Lee, Litecoin was designed to be nimbler and more accommodating for miners compared to its Bitcoin counterpart. Intrigued? There’s a whole universe to explore around Litecoin that’s just a click away. So, if you’re ready to dive headfirst into the vibrant world of Litecoin, don’t hold back and plunge right in.

Read more: The Top Cryptocurrencies to Invest in June 2023

The Inner Workings of Cryptocurrencies

The world of cryptocurrencies is underpinned by a network of cryptographic keys, digital wallets, and a complex mining process. Ensuring transparent operations is a critical aspect of building trust in a digital world. However, understanding these elements needn’t feel like deciphering the Enigma code.The emerging field of artificial intelligence can potentially aid in addressing the security concerns associated with cryptocurrency transactions.

Read more: Cryptocurrency: Key Terms and Concepts

A cryptocurrency wallet is a digital wallet where you ‘store’ your cryptocurrencies. But here’s the twist: wallets don’t actually store your crypto, but your private and public keys. Think of your public key as your email address and your private key as the password. But unlike email, if you lose this password, there’s no ‘Forgot Password’ link to save your skin. Harsh, but true.

The mining process and consensus algorithms are the backbone of cryptocurrencies. In a nutshell, mining involves validating transactions and adding them to the blockchain. As a token of gratitude, miners are rewarded with a few sparkling new coins. On the other hand, consensus algorithms, like Proof of Work (PoW) or Proof of Stake (PoS), set the rules of the game, defining how transactions are approved.

The Advantages of Cryptocurrencies Unmasked

“Cryptocurrency’s Power Trio: Security, Decentralization, and Turbocharged Transactions”

- The Digital Alcatraz: Ensuring Your Security and Privacy

Cryptocurrencies are the digital equivalent of Alcatraz, guarded by a fortress of cryptographic protocols that ensure the security of transactions. Unlike the conventional banking system, where trust in a third party is mandatory, cryptocurrencies set you free. You’re the sole custodian of your wealth, operating under the radar with a comforting cloak of pseudonymity. It’s an operation so discreet that it could give secret agents a run for their money risks

2. Unleashing Financial Power to the People: Decentralization

Decentralization is the rallying cry of cryptocurrencies, a financial inclusion that transfers power from institutions to individuals. The moment you connect to the internet, you transform into the president, CEO, and CFO of your personal bank. This seismic shift democratizes finance, opening doors of opportunity to those previously shunned by traditional banking systems. It’s the financial equivalent of David toppling Goliath.

3. Supersonic Transactions and Wallet-friendly Fees: Revolutionizing Payments

Enter the world of cryptocurrencies, and you leave behind the sluggish pace of traditional money transfers. Your transactions don’t crawl; they sprint, zipping across the globe faster than you can blink. And while they’re breaking the speed barrier, they’re not breaking the bank. Cryptocurrency transaction fees often undercut traditional banking charges, delivering a financial speedboat at dinghy prices. It’s a monetary revolution that gives you the best bang for your buck, in the blink of an eye.

Risks and Challenges: Not all Sunshine and Rainbows

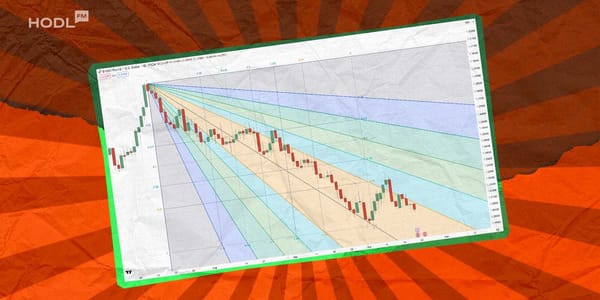

Remember the rollercoaster metaphor? Cryptocurrency prices can swing wildly, often triggered by speculative trading. This volatility can offer lucrative opportunities but also poses significant risks. Hence, always invest responsibly, and don’t put in more than you can afford to lose.

Future Perspectives and Adoption: The Dawn of a New Era

Blockchain and cryptocurrencies have potential applications beyond just finance. From healthcare to supply chain, the possibilities are staggering. The use of smart contracts on platforms like Ethereum could revolutionize industries, and the shift towards mainstream acceptance is growing, although regulation is still a gray area.

The End is Only the Beginning

Congratulations, intrepid explorer! You’ve successfully traversed the wild terrain of the cryptocurrency landscape. But remember, we’ve only just scratched the surface. With a firm grasp of the basics, you’re ready to delve deeper into the crypto-verse. Stay curious, stay cautious, and keep exploring this exciting new frontier!

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice.Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL FM strongly recommends contacting a qualified industry professional.