We both know why you are here. It is because you’re curious, smart, and ready to navigate the thrilling, sometimes confusing world of Bitcoin. Let us clarify: this isn’t a get-rich-quick scheme, nor is it a hype train for the next ‘big thing’ in crypto. Instead, this is your one-stop guide to understanding, appreciating, and potentially prospering from Bitcoin’s unique qualities.

Bitcoin is a revolutionary technology that’s reshaping our understanding of finance, decentralization, and digital autonomy. Assuming that you either have some Bitcoin or considering getting some, you need to understand its ins and outs and that’s where these six crucial rules come in. So, here is why you are here:

Rule 1: Never Sell Your Bitcoin

Selling your Bitcoin? That’s like auctioning off a winning lottery ticket.

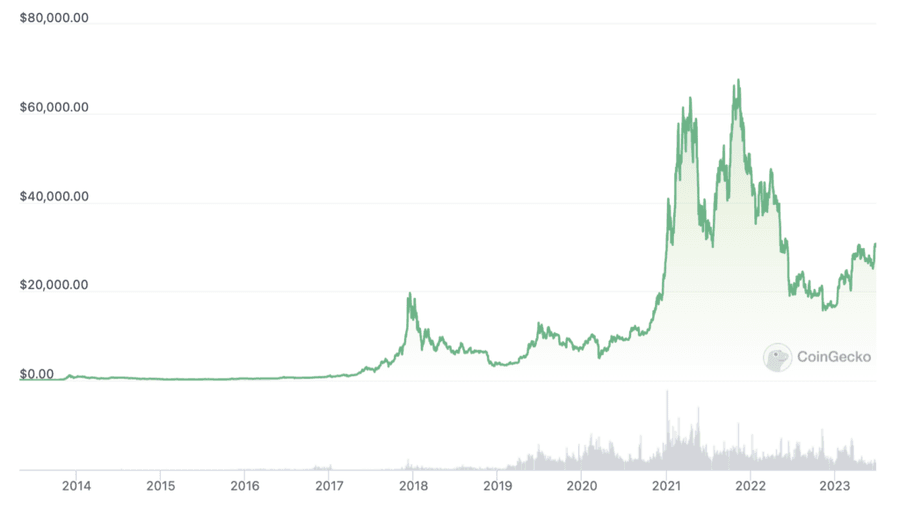

Bitcoin is not a quick cash grab, but a long-term value investment. The proof is in the pudding, with Bitcoin rising from mere pennies to hitting highs of nearly $69k, a testament to its growth trajectory. Even with valid concerns like volatility and storage, these are typical growing pains of a revolutionary new financial system. Sort of like the growing pains of a kid. Just as stock market gurus don’t flinch at daily fluctuations, Bitcoin believers play the long game, sticking through the roller coaster ride for the view from the top.

Related article: Cryptocurrency 101: A Beginner’s Guide to Understanding Cryptocurrencies, and Their Advantages

The key pillar that supports our belief in Bitcoin is its scarcity, similar to precious resources like gold, which is another compelling reason for HODLing. With a finite supply of 21 million Bitcoins and growing demand, basic economics dictates the potential for long-term value appreciation. Plus, Bitcoin’s paradigm-shifting features – decentralized operation without a central bank, resistance to censorship, borderless transactions, and 24/7 availability – add to its allure as a long-term asset.

Rule 2: Don’t Trust Anyone; Verify Everything for Yourself

Would you chug down an unknown drink from a stranger? If your answer is yes, please don’t.

The crypto verse is brimming with rogues and fraudsters ready to trade magic beans for your precious Bitcoin. J, you shouldn’t dive headfirst into any Bitcoin-related venture without doing some serious homework. Take everything with a pinch of salt.

But how does one verify everything in the Bitcoin universe? Start with the basics. Understand what Bitcoin is and how it works. Knowing Bitcoin’s origins, its functionality, and its philosophical and economic underpinnings, can save you from many pitfalls in this journey.

It’s your responsibility to verify everything. Crosscheck information using reputable sources. Understand the inherent risks and the volatility of the Bitcoin market. And remember, if something sounds too good to be true, it probably is.

Rule 3: Remember: Bitcoin WILL NOT Die

Reality check: Bitcoin is not going anywhere and we have proof.

When it comes to Bitcoin’s resilience, a few key points bolster the claim. Firstly, the world of cryptocurrencies is still in its early stages. Skeptics have proclaimed the death of Bitcoin countless times, particularly after notable market downturns and price drops. Yet, each time, Bitcoin has rebounded.

Understand that the volatility of the cryptocurrency market, while daunting to those familiar with traditional assets, is not unusual. Limited liquidity and news impacts on adoption and investor sentiment largely drive this volatility. Historical patterns have shown Bitcoin’s ability to recover from such declines.

The most notable of these downturns range from the 2011 flash crash, where Bitcoin tumbled from $32 to a mere $0.01 due to security issues at the now-infamous Mt. Gox exchange, to the dramatic 2022 crash, where Bitcoin fell from its peak of $68,000 to below $20,000, spurred by the crisis of algorithmic stablecoins and the collapse of TerraUSD Classic. This punctuates a pattern of dramatic price fluctuations including the 2015 bear market triggered by a Chinese regulatory crackdown, the 2017 plunge amid a crypto winter and regulatory concerns, and the 2021 slump fueled by ESG-related fears. Despite these tumultuous times, Bitcoin’s jumped back.

Rule 4: Only Spend Your Bitcoin Within the Circular Economy That Is Developing Around the Bitcoin System

Just like how coin(money) collectors wouldn’t use their rare pieces as everyday currency, Bitcoin should ideally be spent within the developing circular economy around the Bitcoin system. Here’s why:

By spending Bitcoin within its ecosystem, you help increase the number of transactions using Bitcoin, thereby encouraging more vendors to accept it. The more transactions that occur within this ecosystem, the more robust it becomes. Bitcoin enthusiasts are keen on promoting this approach as it not only supports the growth of Bitcoin but also encourages vendors to accept it.

Thankfully, a rapidly growing number of businesses, big and small, are accepting Bitcoin as a form of payment. This includes major companies like Starbucks, PayPal, Microsoft, and even insurance company AXA in Switzerland. Mastercard facilitates cryptocurrency transactions, and customers of Pavilion Hotels & Resorts can use various tokens for bookings. In the travel industry, airBaltic and LOT Polish Airlines accept Bitcoin for flight fares, while Expedia partners with Travala to accept Bitcoin for hotel bookings. Even Coca-Cola vending machines in Australia and New Zealand accept cryptos.

Bitcoin was initially conceptualized as a “peer-to-peer electronic cash system.” As such, encouraging its use as a form of payment within its own ecosystem is a direct realization of this vision. By using Bitcoin in this way, you’re not only contributing to the growth of a dynamic digital economy but also participating in a financial revolution. So, stick to Rule 4 and contribute to the evolution of the Bitcoin ecosystem.

Rule 5: No One Can Give You Any Guarantees Other Than Those of the Bitcoin Protocol

This rule emphasizes the fundamental truth of Bitcoin: its security, integrity, and operation rely on its mathematical and cryptographic protocol. While human beings are unpredictable and often fail to keep their promises, the Bitcoin protocol, like any math-based system, is consistent, reliable, and transparent. Here’s why:

Bitcoin operates through a set of specific rules that every node in the network agrees to follow. These rules define how transactions and blocks are handled, verified, and added to the blockchain. They detail everything from the structures of transactions and blocks, to the way the proof-of-work is verified, and how the difficulty of mining adjusts over time. This protocol ensures that all Bitcoin clients maintain consistency and preserve the security of the network.

Related article: Bitcoin Chronicles: The Epic Saga of Digital Currencies and Its Influence on Money Matters

It’s also important to note that Bitcoin is a peer-to-peer network. Users send transactions to this network, and nodes operating in adherence to the Bitcoin protocol validate these transactions. The protocol’s rules guarantee that these transactions are legitimate and have not been tampered with, using proof-of-work mining. This system allows nodes to verify and add blocks to the blockchain, creating a consensus on the state of the Bitcoin ledger.

So, when it comes to Bitcoin, the only guarantee you have is the protocol itself. There are no promises or assurances from individuals, institutions, or governments.

Rule 6: Constantly Seek to Increase Your Knowledge

Understanding Bitcoin goes beyond merely knowing how to buy, sell, and store it. It extends to comprehending the technical aspects of the blockchain, how transactions are verified, how new blocks are added, and the rules governing these processes.

Having a solid grasp of market trends allows you to make more informed decisions about your investments. The crypto market, while promising, can be quite volatile, and understanding these fluctuations can help manage potential risks. Also, being abreast of global economic events, technological advancements, and regulatory changes can give you a clearer view of the crypto landscape.

Lastly, remember that the quest for knowledge is not a solitary journey. Engage with the community, participate in discussions, attend seminars, and read widely. Even platforms like Google Scholar offer a plethora of academic articles that can further enrich your understanding of Bitcoin and blockchain technology.

In essence, be proactive in your learning. Equip yourself with the knowledge needed to navigate the crypto waters safely and effectively. As in any field, in the world of Bitcoin, knowledge truly is power.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice.Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL FM strongly recommends contacting a qualified industry professional.