Uptober seems to have finally caught up with the bulls in the second week of October, with Bitcoin surging to $67,000.

Here HOLD.FM's end of week digest to report on what went down in the crypto industry.

Spotlight on the Top Gainers and Losers of the week

Top 3 Gainers (7-Day Performance)

- BOOK OF MEME (BOME): Solana based memecoin , BOME topped the last seven days as the highest gainer after reaching $0.009108 with a 55.70% increase.

- Cats in a dogs world (MEW): Cats in a dogs world, another memecoin became the highest gainer of the week with a percentage increase of 50.50% to reach $0.009108.

- Ethena (ENA): Synthentic dollar protocol, Ethena returned to the top charts after its token ENA gained 43.31% over the last one week to reach $0.3892.

Top 3 Losers (7-Day Performance)

- Maker (MKR): Decentralized finance protocol Maker saw its token MKR reach $1205 after dropping by 12.32% over the last seven days to become the week’s biggest loser.

- Helium (HNT): Decentralized Internet of Things infrastructure Helium and its token HNT became the second biggest loser of the week with an 8.19% loss.

- Uniswap (UNI): Decentralized exchange protocol Uniswap became the week’s third largest loser with a drop of 7.31% to reach $7.46.

Ireland is drafting new and urgent crypto regulations ahead of EU money laundering crackdown

Ireland is gearing up to roll out new crypto regulations, just in time for the EU’s upcoming crackdown on money laundering and terrorist financing. Finance Minister Jack Chambers is leading the charge, drafting "urgent" legislation to bring the country’s crypto rules up to speed, according to The Irish Examiner.

However, Chambers has been a bit cryptic (pun intended) about what these rules will actually look like or when they'll come into play. It’s worth noting that Chambers, who only took on the finance role in June 2024, doesn’t have much of a track record when it comes to crypto regulation. So, it’s anyone’s guess what his approach will be.

What we do know is that the EU’s Anti-Money Laundering and Countering the Financing of Terrorism Act, set to kick in on December 30, 2024, will give EU countries' Financial Intelligence Units (FIUs) beefed-up investigative powers, including the authority to suspend suspicious transactions.

The sweeping package of measures will also introduce an EU-wide ban on cash payments exceeding €10,000, along with far stricter reporting requirements for a variety of financial services firms, including crypto exchanges.

It’s important to note that the revamped Anti-Money Laundering and Countering the Financing of Terrorism Act shouldn’t be mixed up with the Markets in Crypto-Assets Act (MiCA), which focuses specifically on virtual assets like cryptocurrencies and stablecoins. Both laws are scheduled to take effect in December 2024, so the crypto world will be getting a double dose of regulation just in time for the holidays.

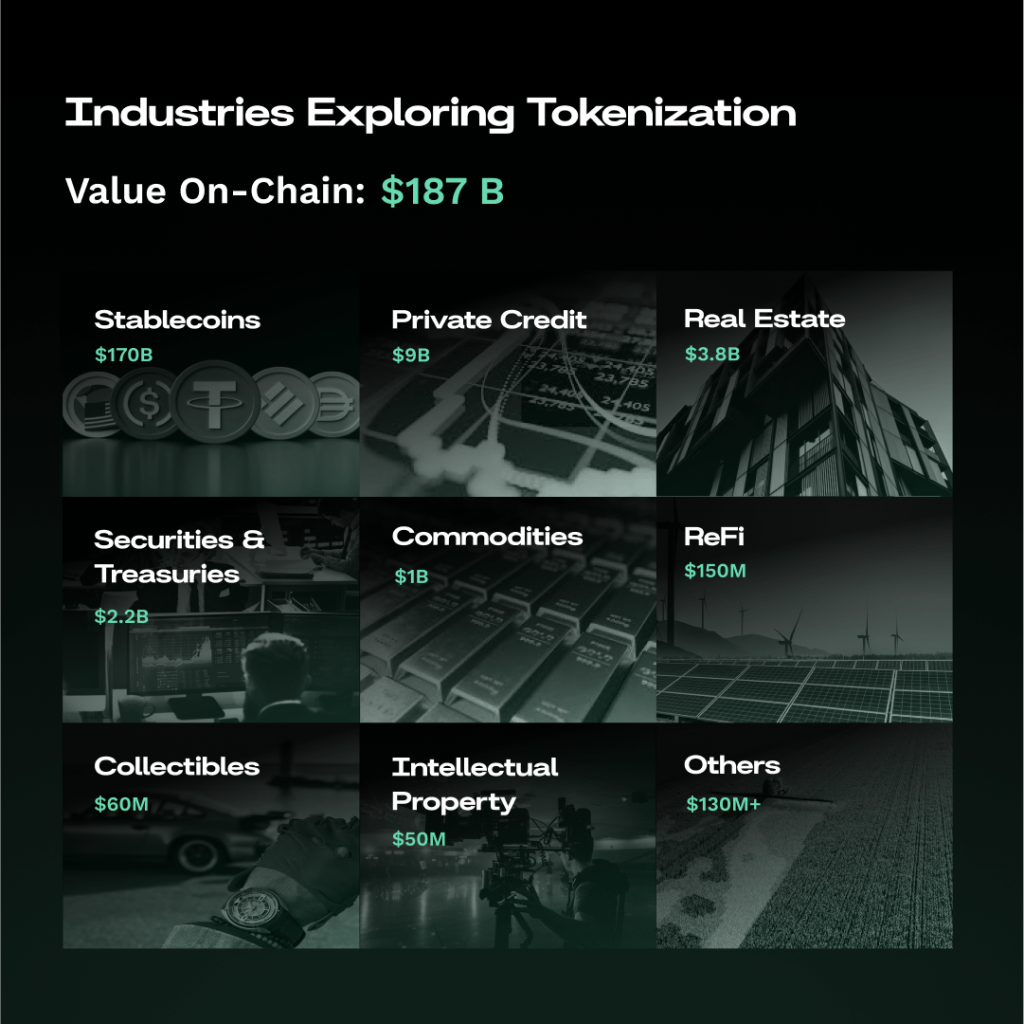

RWA tokenization industry set for 50x growth by 2030: Report

The real-world asset (RWA) tokenization sector has had its glow-up moment in 2024, setting the stage for some serious growth through the rest of the decade.

According to Tren Finance's research report, some of the biggest financial institutions and consulting firms are predicting that the RWA tokenization market could balloon more than 50 times by 2030.

Most estimates peg the market’s future value somewhere between a casual $4 trillion and an eye-popping $30 trillion. Safe to say, there's some serious cash on the horizon.

If the sector hits the middle-ground prediction of around $10 trillion, we’re talking about a jaw-dropping 54-times growth from where it stands today.

Considering that real-world assets, including stablecoins, are currently valued at just $185 billion, the growth potential is huge. It's like watching an underdog stock suddenly become a blue-chip giant.

The Optimus robots at Tesla’s Cybercab event were human assisted

Tesla’s Optimus robots strutted their stuff at last week’s glitzy Cybercab reveal, and boy, did they put on a show. These high-tech mingled with the crowd, serving drinks and dancing in a gazebo like it was their day job.

If Optimus could actually hold a deep convo in a dimly lit crowd, while processing both visual and verbal cues like a pro – well, that’d be nothing short of turning sci-fi to reality.

Playing charades with the Tesla Optimus robot last night. This is either the single greatest robotics and LLM demo the world has ever seen, or it's MOSTLY remote operated by a human. No in between. pic.twitter.com/vCqzk8DDdO

— Marques Brownlee (@MKBHD) October 12, 2024

Robert Scoble mentioned that humans were "remote assisting" the bots, which is tech speak for “puppeteering from behind the curtain.” Even an engineer admitted the bots use AI to walk, but talking?

That’s where humans stepped in, which Morgan Stanley’s Adam Jonas later confirmed, basically saying, humans were pulling the strings.

And if that wasn’t enough of a giveaway, the fact that each robot had a unique voice – plus their picture-perfect, immediate responses – made it clear these boots were definitely phoning it in... with help from their human friends.

I talked with an engineer.

— Robert Scoble (@Scobleizer) October 11, 2024

When it walked that is AI running Optimus.

It is real impressive they brought so many out in crowds at @tesla’s event. https://t.co/CtmCKPrL4T

One of the robots – or, more likely, the human doing their best robot impersonation – awkwardly confessed to an attendee, “Today, I am assisted by a human.”

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL FM strongly recommends contacting a qualified industry professional.