There is increased investor confidence in the cryptocurrency market. Famous figures have voiced their optimism for better days ahead in the crypto world.

"I invested in crypto. Only what you afford to lose, right?" - Elon Musk, CEO of Tesla and SpaceX

"Cryptocurrency will be the biggest opportunity for wealth creation in our lifetime." - Anthony Pompliano, Podcaster & CEO of Pomp Investments

“I do think some digital currency will end up being the reserve currency of the world” – Brian Armstrong, CEO of Coinbase

Their sentiments echo what crypto enthusiasts have known all along, that crypto is here to stay.

Altcoin projects have resulted to raising capital as a strategy to finance their operations. Altcoins, short for alternative coins, refer to all cryptocurrencies besides Bitcoin. They gained their name for being alternatives to both Bitcoin and traditional fiat currencies. The first altcoins emerged in 2011, and since then, the market trends have boomed, boasting thousands of these alternative digital assets.

Snapshot of Altcoin Fundraising

In April, the capital raised in the crypto sector was $1.02 billion across 161 investment rounds, according to RootData. That's a bit less than March's $1.09 billion from 186 rounds, but still a hefty sum.

Some standout investments include BlackRock, a major asset management firm, dropping $47 million into Securitize, a project focused on tokenizing real-world assets. Meanwhile, Paradigm and Coinbase teamed up to raise a whopping $225 million for Monad, a brand-new Layer-1 blockchain aiming to take on heavy hitters like Solana.

Blockchain technology firms are leading the charge in VC funding this year, with $1.7 billion in investments so far.

In 2024, blockchain infrastructure companies are making it rain with venture capital, scoring a cool $1.7 billion. Decentralized finance (DeFi) protocols aren't far behind, bagging $626 million in investments. Meanwhile, decentralized autonomous organizations (DAOs) seem to be living on a budget, scraping together a mere $3 million so far this year.

Throughout the year, the industry has drummed up a total of $3.67 billion across 604 funding rounds, showing serious growth potential to outshine the $9.3 billion raised in 2023. Since June 2014, the blockchain sector has amassed a jaw-dropping $100 billion across 5,195 funding rounds, according to data from DeFiLlama.

Top Altcoin Fundraising Projects

Monad: Racing Ahead with $225 Million

Leading the pack is Monad, boasting a staggering $225 million in funding. What’s got investors swooning? How about a Layer-1 blockchain that’s speedy and efficient? With 10,000 transactions per second and block times quicker than a microwave popcorn cycle, Monad is not playing around. Plus, it’s EVM-compatible, which means it plays nice with all your favorite Ethereum apps. Smart move, Monad.

Monad Labs is excited to announce a $225M fundraise, led by @paradigm pic.twitter.com/cRchQd506k

— Monad ⨀ (@monad_xyz) April 9, 2024

Berachain: Making Waves with $169 Million

Next up is Berachain, raking in a cool $169 million. What sets Berachain apart? Well, besides its fancy Proof-of-Liquidity magic trick, this blockchain knows how to gain investor interest by through promises of enhanced liquidity and governance. It’s like the financial equivalent of getting your cake and eating it too—deliciously appealing.

Berachain's Public Testnet bArtio B2 is now live.

— Berachain 🐻⛓ (@berachain) June 9, 2024

Hot Bera Summer begins at:

🐻 https://t.co/Wozhn32KfW 🐻 pic.twitter.com/jwv4IQNoPB

Farcaster: Socializing with $150 Million

Don’t count out Farcaster, pulling in $150 million to revolutionize social networks. Imagine Facebook, but without Mark Zuckerberg peeking over your virtual shoulder. Farcaster puts data control back in your hands and lets developers build apps without asking for mom’s permission. It’s social media, reinvented for the people, by the people.

EigenLayer: A Staggering $100 million

EigenLayer, the company pioneering the Ethereum restaking protocol, revealed a major milestone this week with a $100 million investment from the prestigious venture firm Andreessen Horowitz. This funding round places EigenLayer among the elite few to secure a nine-figure venture investment in recent months, alongside notable names such as Hong Kong exchange HashKey and the interoperability platform Wormhole.

Bullish Ethereum.

— EigenLayer (@eigenlayer) May 23, 2024

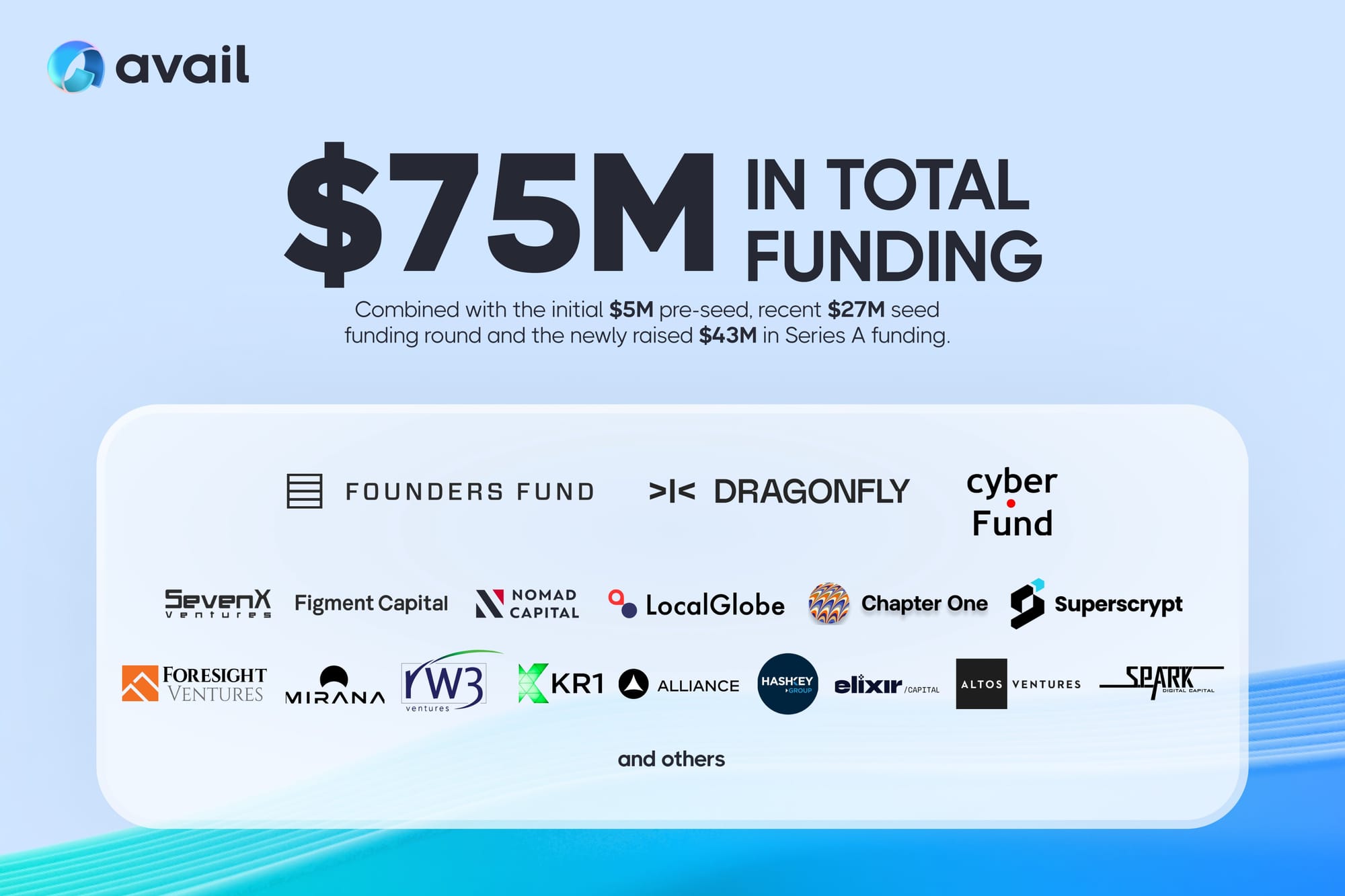

Avail: $75 Million to Power the Web3 Infrastructure

Avail, a modular blockchain base layer, has successfully raised $75 million across multiple investment rounds, highlighting venture capitalists' growing focus on resolving data availability challenges within blockchain technology. On June 4, Avail concluded a highly oversubscribed Series A round, securing $43 million. This amount adds to the $32 million previously raised through pre-seed and seed rounds. Anurag Arjun, co-founder of Avail, intends to allocate these funds towards further developing the permissionless unification layer for Web3.

Eclipse Labs: $50 million

Claiming to be Ethereum’s speediest Layer-2 solution, Eclipse has raised $50 million in a Series A funding round led by Placeholder and Hack VC, boosting its total funding to $65 million.

— Eclipse 🌑 (@EclipseFND) June 26, 2024

Looking Ahead: Big Money Moves

With all this cash flying around, heavy hitters like Pantera Capital and Paradigm are on the prowl for major funding for new crypto funds. Pantera Capital is eyeing a massive $1 billion raise, aiming to make waves comparable to Andreessen Horowitz's record-breaking $4.5 billion fund back in May 2022.

Interestingly, despite the crypto funding frenzy, Andreessen Horowitz recently secured a whopping $7.2 billion for investments across various tech sectors. They decided to give the crypto kitty a break and explore other playgrounds for now.

Why you Should Care

As money pours into the crypto market, it's not just about the Benjamins; it's also about the talent. With companies expanding and new projects popping up like mushrooms after rain, there's a mad dash for skilled pros in blockchain development, DeFi, and related fields.

This surge presents a golden opportunity for web3 recruitment wizards to match top-tier talent with groundbreaking projects that are reshaping finance and tech. For those eyeing a career in blockchain or companies aiming to snag the best talent, understanding the ins and outs of blockchain hiring and meeting the quirky needs of emerging crypto ventures is the name of the game.

As blockchain and crypto mature, the need for stellar talent is no joke. Companies that can snag and keep top talent will be primed to harness the game-changing power of blockchain and lead the charge towards a decentralized digital future.

Parting Shot

Altcoin fundraising projects represent the cutting edge of blockchain technology. They shape the future of finance by acting as the building blocks of the decentralized economy.

Remember, in the world of altcoins, fortune favors the bold, and those who stake their claims early. Happy investing, fellow cryptocurrency adventurers.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL FM strongly recommends contacting a qualified industry professional.