The stories behind the top haunted tokens are scarier than the entire Scream franchise and even The Nun. Well, not really. But these cursed cryptocurrencies have, at one point, been the worst nightmare for many people and the entire market.

Some of these tokens are still being traded. However, there’s a high chance that if you add them to your portfolio, they could spell DOOM for you.

As we celebrate the Halloween season, let’s take a look at the top 5 haunted tokens you should be aware of and why they deserve to be in the scary crypto stories hall of fame.

Terra (LUNA)

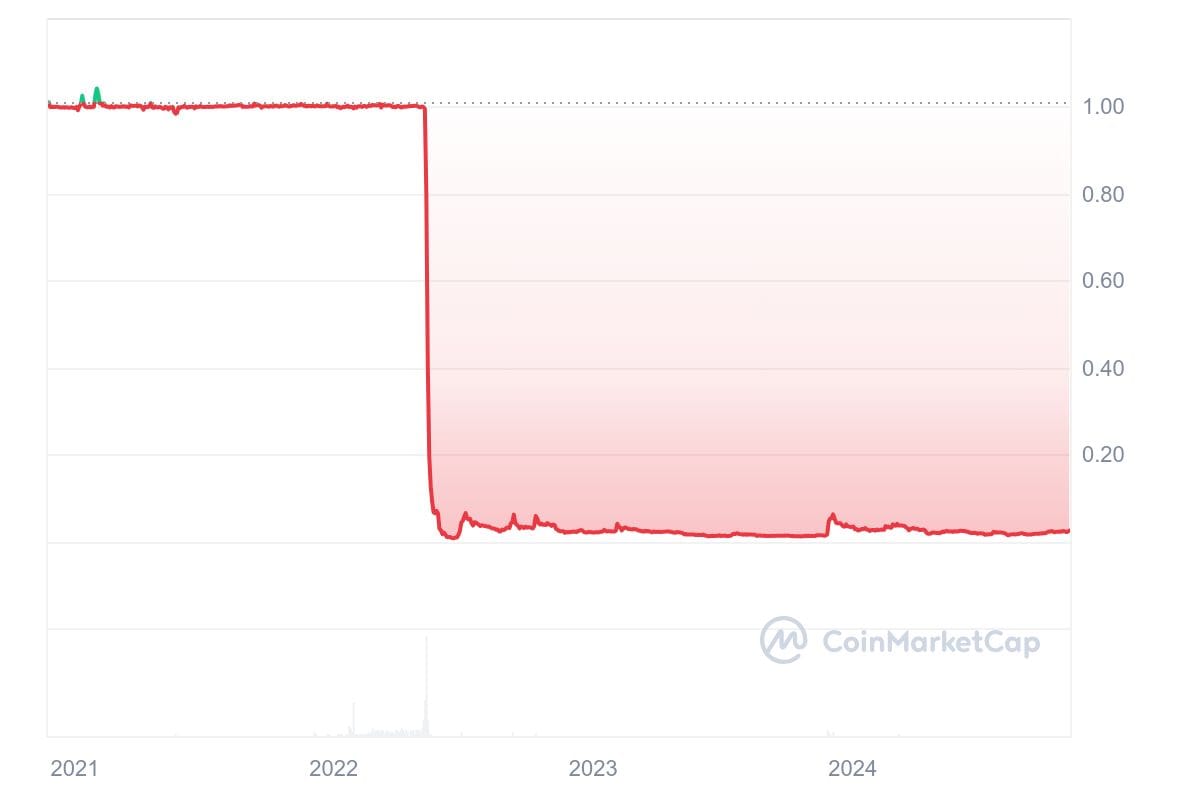

LUNA is the perfect horror story come to life. Don’t believe me? Just take a look at the chart below.

It’s one thing for a token to reach an all-time high, then fall slightly. But going to 0?

And here’s the crazy part: if you had bought $1,000 LUNA in 2020, you’d be enjoying a $37,000 portfolio a year later—a huge 3,600% profit.

So what’s the horror story of the LUNA token? Before we continue, know that there are two Luna tokens: Terra Classic (LUNC) and Terra (LUNA). This is important to our horror story, and here’s why.

Terra Classic was formerly known as Terra but was later renamed after the crash. What we now know as Terra is the product of a fork after the main blockchain exploded. So, in our story, we will use LUNA to represent the now LUNC, up until the horror event.

It all started with a smart young Stanford graduate with a bright future named Do Kwon. Do Kwon created the LUNA token as part of the Terra ecosystem to support global payments along with a sister token called UST (more on this later).

Terra launched in 2018 at a humble price of $1.3 and quickly became a worldwide star token. By early 2022, LUNA had reached an all-time high of $120, and it was receiving huge investments in billions.

So, how did everything go downhill? Tragedy struck on May 7, 2022, after large withdrawals of the sister token UST were made on the Anchor protocol and caused a depeg. This started a series of events that led to more LUNA getting minted and devaluing existing tokens.

Even after Luna Foundation Guard sold all their Bitcoin reserve, it still wasn’t enough to save the cursed token. By May 13th, Luna had died, taking over $60 billion out of the crypto market with it.

In fact, it was one of the first incidents that ended the 2021/2022 bull run.

USTC

Our next story is also related to the LUNA story—in fact, its the main cause of the LUNA collapse. USTC was an algorithmic stablecoin created to maintain a 1:1 peg with the US dollar. But unlike other stablecoins like USDT and USDC, it isn’t backed by the actual US dollars but by a complex relationship with LUNA that no one seemed to understand.

Things went south after someone from nowhere unstaked and liquidated over $2 million worth of UST all at once. The result? Panic selling that caused a depeg.

Many people lost their life savings in the process.

- One investor lost over $450,000 and was unable to pay their bank.

- A Canadian investor lost over $30,000.

- A Slovenian computer science student lost $2,200, which was his first crypto investment.

- A teacher lost over $17,000.

None of these people will be forgetting this nightmare anytime soon.

Starknet Token

You’d know a token is haunted when other platforms launched on it experience misfortunes. That is the story of Starknet.

Now, Starknet token shouldn’t be on this list yet given that it was deployed in February 2024. But it does qualify as one of the top cursed cryptocurrencies to avoid. Here’s why.

First, Starknet’s aidrop had all the familiar signs of a cursed token. There were issues with the eligibility criteria and also the vesting schedule for founders and investors. Many people complained that a lot of the STRK tokens would flood the market almost immediately after launch, killing the price.

And it did happen. Vitalik Buterin, one of the benefactors of the token, unlocked and liquidated about 1.26 million STRK tokens. The single act alone—coupled with Vitalik’s status in the industry—led to the token falling below its launch price.

The curse spread to other projects launching on top the Starknet chain. For instance, ZKX, a derivative platform built on Starknet, crashed, with its token price falling by over 95%. All this happened in a SINGLE DAY.

Important Statement 30.07.24

— Eduard (@0xEduard) July 30, 2024

With much regret, we have to announce the discontinuation of the ZKX protocol. Despite our best efforts, we have been unable to find an economically viable path for the protocol.

(1) All markets have been delisted, positions have been closed and all…

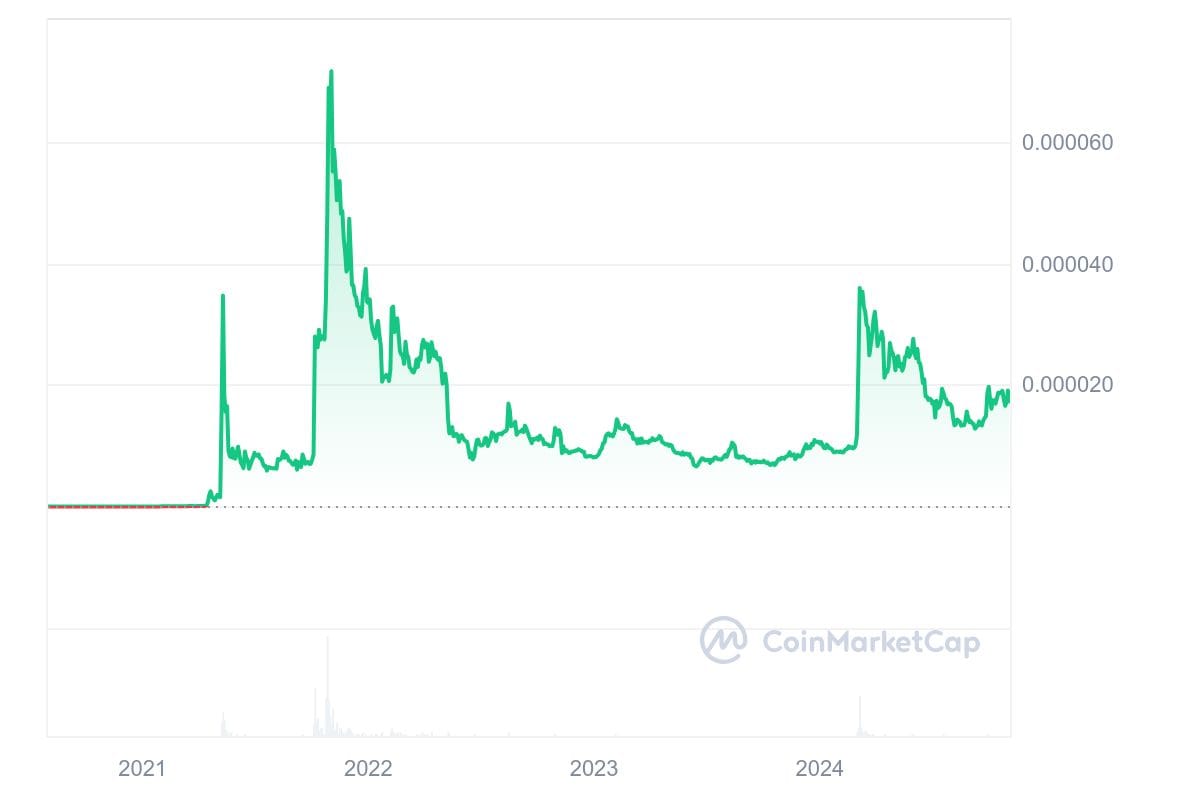

Shiba Inu (SHIB)

You might be wondering: Why is Shiba Inu hanging out in this dark alley? Shiba Inu is a top 15 token and its chart looks good (1395295.22% growth since launch).

Shiba Inu was also the supposed “Dogecoin killer” and got tons of celebrity engagement. In fact, it was one of the first memecoins that people felt would get to have some utility besides just being a joke.

The truth is that there’s a lot of misfortune following the token because every incident that was supposed to boost the token ended up doing the exact opposite.

- In 2021, Vitalik got 50% of the supply. It first boosted credibility but later caused some market issues.

- Vitalik later donated $1 billion worth of SHIB and burned 40%. It didn’t improve the rankings at all. Instead, it crashed the token. Side note: don’t give your tokens to Vitalik.

- Same 2021, SHIB’s Coinbase listing was counterproductive, leading to a 50% crash.

- In 2022, SHIB’s metaverse project caused a lot of trouble when someone tried to draw a Swastika sign on it.

More: 'Biden is Dead' Meme Coins Are Everywhere - What Does This Mean?

FTX Token (FTT)

The FTX collapse is still one of the scariest crypto stories because of how big the scandal was.

FTX was a crypto exchange that seemed too big to fail. Everyone trusted them with their life savings, company savings, and whatnot. But when the tragedy struck, it took the entire crypto market with it... and some lives.

Everything happened after news of Alameda Research’s shady pile of FTT tokens. Then Binance CEO Changpeng Zhao announced that they’ll be selling all their FTT holdings due to some “recent revelations.”

After much digging, here’s what was found:

- Over $8 billion in customer deposits were nowhere to be found.

- FTT token crashed by 99% in a few days

- Withdrawals on the FTX platform was disabled

If you thought LUNA and UST were bad, multiply that by 2000%, and you get the magnitude of damage caused by FTT.

One victim who lost over $65,000 cried that he doesn’t know how to look at his friends whom he recommended FTX to and also lost money. And we do feel sorry for him!

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL FM strongly recommends contacting a qualified industry professional.