Solana has once again astonished the DeFi world, solidifying its position as a leader in the decentralized finance ecosystem. The platform recently hit a series of all-time highs, including a yearly peak of $267 earlier this month and an impressive $100 billion in monthly DEX volume for November 2024.

$100B in DEX monthly volume 🤯#Solana 🔥🔥 pic.twitter.com/RNIXF8t3yN

— Erhan K (@ErhanKOfficial) November 22, 2024

If DeFi had a leaderboard, Solana would run laps around the competition. In November, its monthly DEX trading volume skyrocketed to $109.8 billion, up 109% from $52.5 billion from October's $52.5 billion. Compared to major competitors like Ethereum ($55 billion), Solana holds a commanding lead due to its scalability, low fees, and high throughput.

Adding fuel to the fire was the meme-coin frenzy, which brought an influx of new users into the ecosystem. Platforms like Raydium and Pump.fun have been generating millions in monthly fees, becoming key drivers of the increased DEX activity.

Solana's fundamentals are at ATH.

— Aylo (@alpha_pls) November 17, 2024

It's the dominant chain by most metrics right now, and has the largest share of DEX volume.

It's currently ~29.5% of Ethereum's market cap, and is continuing to be repriced. $SOL will be heading into price discovery soon. pic.twitter.com/hcb0vFVfoX

What’s Next for SOL’s Price?

SOL has been on a strong run, hitting an all-time high of $267 in early November. However, as of now, its price has pulled back to $240.77, down 2.58% over the last 24 hours.

Technical indicators suggest the asset is entering a consolidation phase. The RSI sits at 71.67, hinting that SOL is edging close to overbought territory. Meanwhile, Bollinger Bands point to critical support at $225.11, a level that could serve as a springboard for a fresh rally.

Holding this zone may open the way to a retest of $267 and a possible reach of $300. Otherwise, SOL risks falling to $182.53.

Fundamental Growth Drivers

Steady development and adoption remain the cornerstone of Solana’s success. As of November 24, ecosystem development activity scored 20.81 – slightly down from previous months but still solid enough to support its long-term stability.

In addition, Solana’s growing popularity among institutional investors highlights its potential. By late 2025, the much-anticipated approval of a Solana ETF by the SEC could open the floodgates for significant capital inflows into the ecosystem.

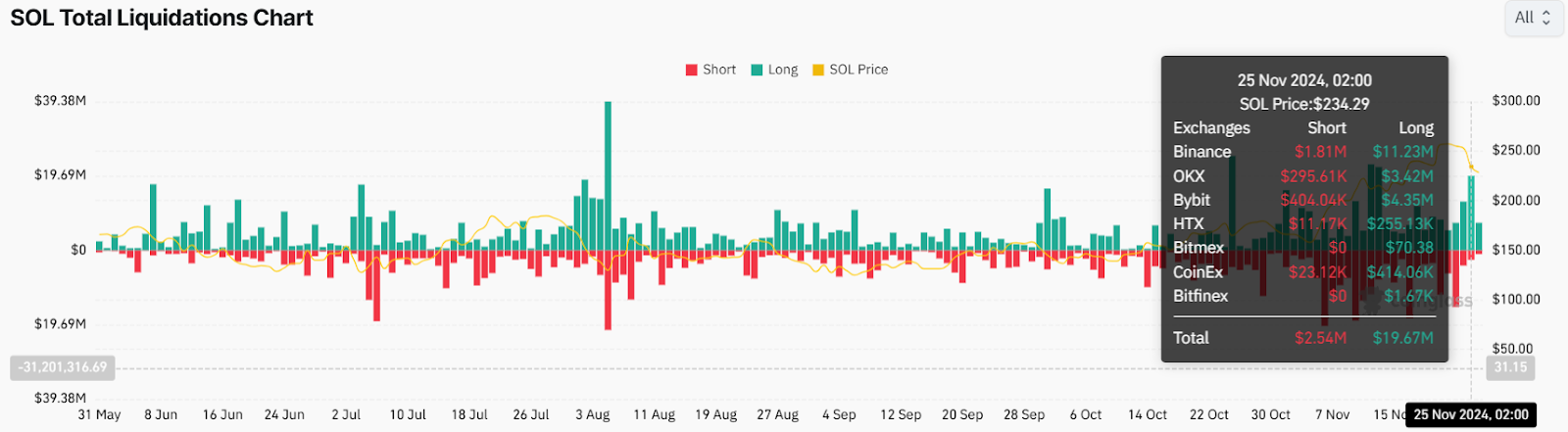

The market seems equally optimistic: on November 25, long positions worth $10.47 million were liquidated, compared to just $1.17 million in shorts. This suggests that bullish sentiment is running high among traders, who are betting on SOL’s continued rise.

Analysts attribute this confidence to strong on-chain metrics, including a record-breaking 25 million active addresses, and the broader crypto market’s recovery, fueled in part by Donald Trump’s victory in the 2024 elections.

Institutional support from players like Bitwise, the potential ETF launch, and increasing DeFi activity further cement Solana’s position as a serious contender to Ethereum.

Yet, with great success comes great responsibility. Solana must tackle the challenge of maintaining network stability amid surging demand. While its adaptability and low fees have handled the strain so far, future scalability will be critical to its competitive edge.

If Solana can hold the $225 support level and break through the $267 resistance, reaching $300 could be just a matter of time. However, the coming months will reveal whether Solana is ready to meet the challenges posed by its rapid adoption and increasing demand.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL FM strongly recommends contacting a qualified industry professional.