Stablecoins are among the lesser-talked-about tokens in the crypto community, but they are an essential part of the crypto ecosystem. Tether is the crypto firm primarily known for stablecoins, mainly due to the company’s most famous product, the USDT, which is pegged to the almighty US dollar. But while the USDT is Tether’s biggest product, the company is reputed for supporting other stablecoins pegged to other world currencies. That is exactly why Tether’s latest update shocked the world.

Tether has just abandoned its Euro stablecoin (EURT) due to its inability to comply with MiCA regulations in Europe.

— Jacob King (@JacobKinge) November 27, 2024

Now, ask yourself: what will happen when the Trump administration introduces its stablecoin regulations next year? USDT will fail to comply and be forcibly shut… pic.twitter.com/l8OsSiuf3C

In a November 27 statement, the Stablecoin issuer announced that it would be ending support for one of its popular offerings–the Euro-pegged stablecoin EURt. The move comes at a time when other competitors, such as Circle’s EURC, are dominating the Euro-pegged stablecoin market.

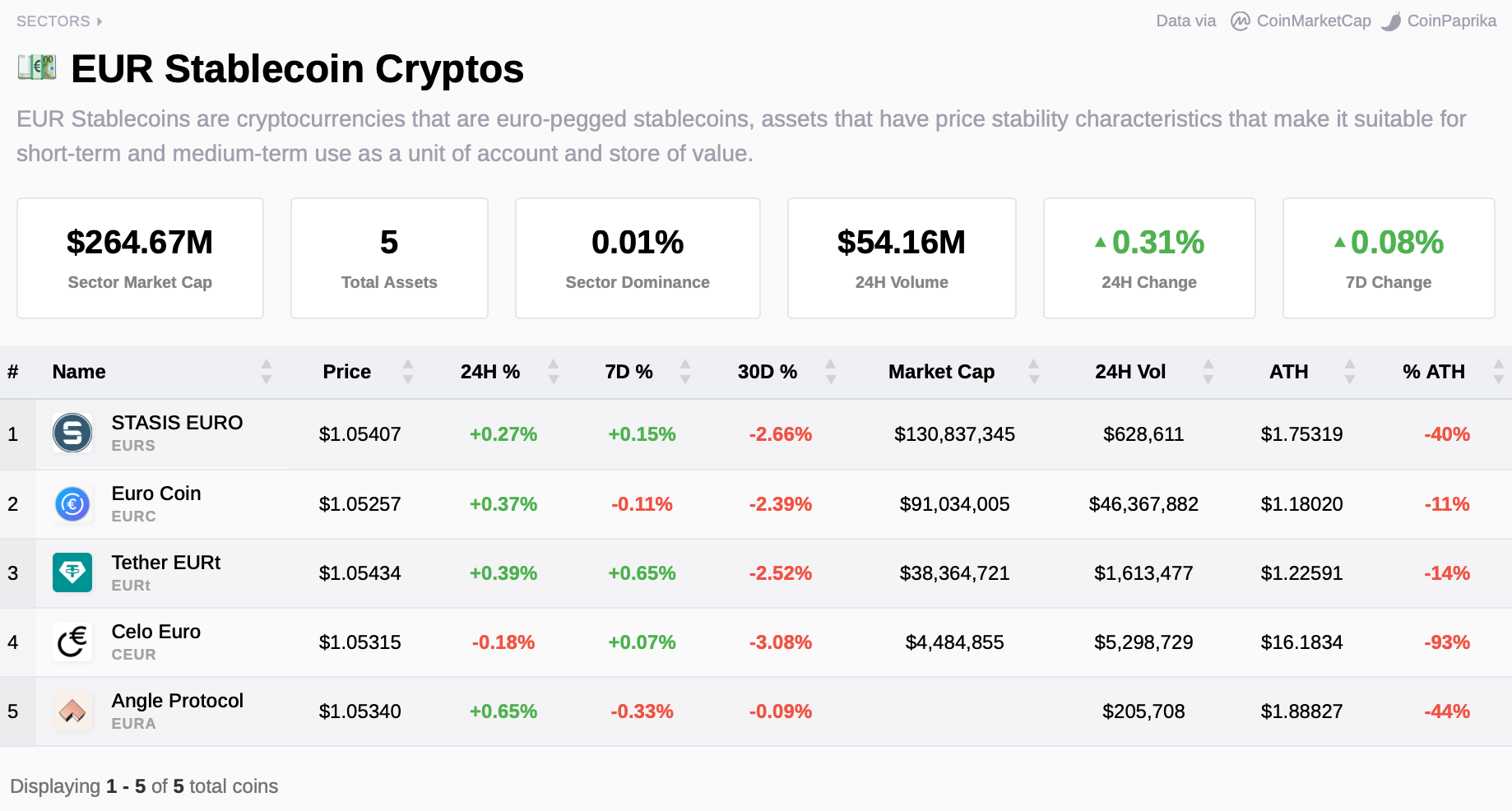

CryptoSlate’s data shows EURt trailing far behind other competitors in market cap. The Tether-issued EURt is worth a mere $38 million, while the industry leader Stasis’ Euro and Circle’s EURC are worth $130 million and $90.5 million, respectively.

Tether revealed that it had already discontinued minting any new EURt token since the company’s last issuance request was processed in 2022, and it will not be accepting any new issuance requests for the stablecoin. In light of the discontinuance, the company has allowed all holders of the soon-to-be redundant token to redeem all their EURt holdings until November 27, 2025, a full year from the announcement.

Tether has discontinued EUR₮ to focus on MiCAR-compliant stablecoins like EURQ and USDQ, powered by its Hadron technology. With over 300 companies and institutions requesting demos, it’s clear: the future is tokenized. https://t.co/7wZ0AQYLYL

— Tran Hung (@spaftu) November 27, 2024

According to the crypto firm and its CEO, Paolo Ardonio, the decision aligns with its broader strategic direction, considering the newly evolving regulatory frameworks in the stablecoin market.

Antonio pointed out the EU’s Markets in Crypto-Assets Regulation (MiCA) as one of the contributors to the end of the EURt. He criticized the law, stating that the strict cash requirements it places on firms could bring systemic risks to banks and digital assets.

Following the company’s resignation on the supply and circulation of the EURt, Ardonio noted that Tether will now focus more on its new Hadron initiative, calling it a “top priority in the European region.”

Tether’s boss also stated that the company’s new tokenization platform, Hadron, has the potential to revolutionize the accessibility of asset tokenization for institutions, governments, fund managers, and private companies.

Hadron by Tether—your platform to tokenize anything, anywhere. Now accepting beta testers. Whether you’re a banker, asset manager, hedge fund, pension fund, or even a nation-state, join us and be part of the future of digital finance. Sign up today!

— hadron_tether (@hadron_tether) November 15, 2024

👉 https://t.co/xxUkgIxe15 pic.twitter.com/u61TXDFxyv

Other companies, such as the Dutch fintech firm Quantoz, have already leveraged Hadron to issue their EURQ and USDQ stablecoins. These tokens, powered by the Hadron system, are fully compliant with the EU’s Markets in Crypto-Assets Regulation (MiCA). Tether is intensifying efforts to make its products more compliant with strict regulatory demands.

Still on Hadron, Tether will also focus on other MiCA-compliant stablecoins using the Hadron tool. Hadron has been described as a tool aimed at helping issuers simplify the process of managing stablecoins. It offers wholesome blockchain interaction and stays compliant with the Anti-Money Laundering mechanisms.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL FM strongly recommends contacting a qualified industry professional.