The recent approval of spot Ethereum ETFs by the U.S. Securities and Exchange Commission (SEC) marks a significant milestone for cryptocurrency policy, and this move could seriously undermine the SEC’s ongoing crackdown on the crypto industry. Let’s dive into where the SEC went wrong in maintaining its authority, and how this will impact the future regulation of the crypto sector in the U.S.

Related: SEC Approves Ether ETFs: Exploring the Pitfalls

SEC vs. CFTC

As digital assets continue to gain mainstream acceptance, debates rage over which federal agency should have jurisdiction to regulate and enforce rules on cryptocurrency.

The SEC’s approval of spot ETFs essentially labels Ethereum (ETH) as a commodity, according to Coinbase’s Chief Legal Officer Paul Grewal. In this scenario, ETH would fall under the oversight of the Commodity Futures Trading Commission (CFTC) instead of the SEC, which handles securities regulation.

This distinction is critical for ETH since the SEC’s mandate is to oversee securities and protect investors. On the other hand, the CFTC regulates commodities like raw materials and agricultural products, focusing on preventing market manipulation and fraud. As a result, the CFTC’s regulatory framework for commodities is generally less stringent compared to the SEC’s interpretation of securities laws.

Perhaps the approval of Ethereum ETFs will bring the regulatory clarity the sector has been seeking. If ETH and similar cryptocurrencies are not considered securities, then the SEC has no jurisdiction to regulate these assets under the Securities Act of 1933 and the Securities Exchange Act of 1934.

This means the SEC can no longer claim these tokens are investment contracts under the Howey Test. If ETH and similar tokens are commodities, crypto lawyers can argue in court that these cryptocurrencies are not investment contracts involving an “expectation of profits from the efforts of others” — a critical element the SEC must prove under the Howey Test.

Related: Ethereum ETFs Filing Process Sees Abrupt Progress, Odds Jump Back to 75%

Ethereum ETF Decision Could Reshape Crypto Law

The recent SEC approval of the Ethereum ETF has serious potential repercussions for both ongoing and future legal battles in the digital asset sector. By assuming that ETH and other similar tokens are commodities, the SEC might have significantly limited its authority to aggressively regulate the crypto sector.

If courts are receptive to the idea that ETH and potentially other cryptocurrencies are commodities, this could turn the tide in SEC lawsuits against major crypto trading platforms like Coinbase and Kraken.

These lawsuits are based on the SEC’s argument that specific tokens traded on these platforms are securities. However, if Ethereum and similar tokens are deemed commodities, it could pave the way for renewed motions to dismiss the SEC’s cases against Coinbase and Kraken.

Should federal judges in these cases accept this argument, it would effectively dismantle the SEC’s claims that both Coinbase and Kraken are offering trading in unregistered securities.

Crypto lawyers are likely to leverage the ETF decision to reshape existing strategies regarding how they advise clients in the digital asset sphere. These strategies might include advising crypto sector clients to emphasize the commodity nature of their tokens and platforms to better shield them from SEC influence.

If the legal defense teams of Coinbase and Kraken successfully get the pending SEC lawsuits dismissed based on the Ethereum ETF decision, it could establish highly favorable legal precedents. These precedents would impact future regulation of the digital asset sector and fuel a new wave of blockchain innovation in the U.S.

More Info on ETFs:

- What Does Spot Bitcoin ETF Mean for Investors?

- Bitcoin Critically Fell After the ETF Approval. What’s Next?

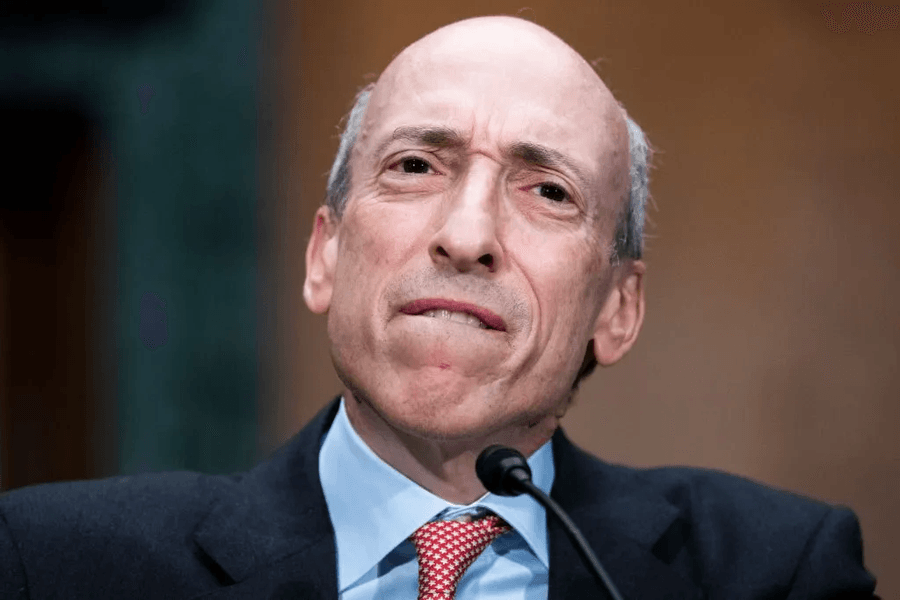

Such an outcome would deal a heavy blow to SEC Chairman Gary Gensler, who is already under scrutiny from critics. They argue that his aggressive enforcement approach is stifling growth in the digital asset technology sector in the United States and pushing innovation overseas to more favorable jurisdictions.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL FM strongly recommends contacting a qualified industry professional.