One thing is apparent in the Youtube comments for any video containing Sam Bankman-Fried or Caroline Elisson. Even their childhood crashes want them to languish in prison.

As terrible as each comment is, it carries more ‘thumbs up’ than the specific videos’ number of likes. You’d wonder how many lives FTX and Alameda ruined. However, according to blockchain contributor Michael Washburn, Sam Bankman-fried could be crypto’s matyre for the world’s double standards.

In a world where CEOs have done worse, some bitcoiners believe the government and the media are taking advantage of crypto’s scant regulations to mistreat a cryptocurrency entrepreneur. Former Alameda Research CEO Caroline Elison once admitted ‘the crypto industry is full of bullshit’ but for her alleged boyfriend and ex-FTX CEO Bankman-Fried, he is just yet to see the end of what was a remarkable career in crypto, entrepreneurship and effective altruism.

A video even went viral after naming SBF as the most generous billionaire and showed him giving out money to people in the streets. Did these seemingly boundless acts of generosity encroach upon the investments entrusted to FTX, casting a shadow on the very source of his short but illustrious legacy?

Innovations and Early Successes: A Leader in Trading Innovations

Sam Bankman-Fried, the graceful CEO, and apple of the public’s eye everyone thought was responsible picked up the philosophy of effective altruism while attending the Massachusetts Institute of Technology for his physics bachelor’s degree.

A doctoral student from Oxford introduced SBF to effective altruism. This philosophy justifies the accumulation of large sums of wealth to be distributed for good social causes that can save or transform lives. Hence, this persuaded the physics undergraduate to leverage his aptitude for math to meet the world’s philanthropic needs. So it was that shortly after graduating, SBF joined a quantitive trading firm called Jane Street where he traded exchange-traded funds and equities. According to Brittanic’s profile of young SBF, Jane Street must have been where he picked up the practice of trading.

Read more: FTX’s Big Bang 2.0: How do Investors get Benefited?

A year later, he left his stint at Jane Street and joined the Centre of Effective Altruism where he applied arbitrage strategies he’d learnt to push the boundaries of his trading profits. This increased his payouts and in the same year, he used the same arbitrage skills and trading innovations to co-found Alameda Research LLC, an arbitrage quantitative trading firm. By taking advantage of Bitcoin’s different prices across different exchanges and countries, Alameda would some days make as much as $1 million dollars in profit per day.

Alameda was a blackhole, one would say but for the Wall Street Journal, Sam Bankman’s puppet was destined for a collapse. Because the firm managed several profitable and reasonable profits in its initial days, most investors were willing to ignore common trading red flags as the hype around Sam Bankman-Fried and Alameda heightened amidst the rise of SBF’s next company, FTX Exchange.

After one year in business, the Bitcoin bear market came and some of Alameda’s profitable bets began going against the company. The trading firm made tons of millions of dollars in losses that resulted in a 70% decline in the company’s value. This prompted Alameda’s then-CEO Sam to go looking for extra funding. This is how SBF came to sponsor the Inaugural Binance Blockchain Week Conference with the infamous $150,000 which lured hundreds of thousands of prospective lenders on the grounds of high returns. For Sam Bankman Fried, these returns would be high whatsoever, regardless of any regime, left or right.

FTX – The WonderKid crypto who awed WallStreet

The most apparent thing about Sam Bankman Fried’s pitch deck for FTX was an extremely confident tone for a supposedly new trading platform. According to the Deck, investors were guaranteed the chance to recall their entire investments where the company would lose 2%+ of their funds per month.

In a tone similar to what a Spielberg movie would spell, ‘from the creators of the West Side Story & Jurassic Park’ ; FTX pitch deck would continue to brag about the founders’ activities at former company Alameda and returns of upto 110% in annualized profit between 2018’s March and October.

More investors were willing to part with tons of millions to invest in FTX just after SBF came from the Binance event. However, they failed to notice the red flag in the gaudy promises and instead chose to believe the then-media hype around SBF and his earlier reputation at a cutting-edge quantitative trading platform.

During those days, it was common to see an FTX ad targeting institutional investors and bragging about itself as the safest place to invest digital assets. Safest in the universe.

For this reason, Sam Bankman-fried won once again in his Reach for Riches story, thereby putting FTX and Alameda once more in the spotlight of crypto investments and algorithmic trading.

FTX’s Cutting-Edge Model

FTX’s hallmark became apparent at the height of the Covid-19 pandemic as the exchange remained resilient in a bear environment where every other crypto trading company was collapsing. In 2020, FTX Trading Limited had only marked 1 year in business and in 12 months; the exchange had managed to attract continued investments which enabled it to create some revolutionary trading products.

One such product was its native token, the FTX Token (or FTT). In order to attract more customers, the exchange promised generous discounts to anyone conducting trades using FTT. Alameda Research, which until this point Sam Bankman had promised would have no relationship with FTX, became the market’s largest holder of the FTT token. Thereby, allowing the quantitive trading firm to serve as FTT’s market maker and maintain the token’s price stability. For Bankman, a crypto exchange, a broker, a native token and a market marker were the right match for maximum quantitive efficiency, real-time clearing, aggregate risking and reliable settlement.

He was wrong. But the fact it took only 1-2 years for Alameda and FTX to catapult him into the Forbes List of Billionaires; it was only a matter of time until he realized it.

The Rise and Fall of Sam Bankman-Fried – The Effective Altruist

Successes and Failures

In 2020, Sam Bankman-Fried the graceful, young and reputable CEO subscribed to two religions, a true Bitcoiner and a revolutionary philanthropist. At a time when many blockchain firms were signing for Chapter 11, FTX came to their help and bailed them out. One such firm was BlockFi, which FTX agreed to credit over $250 million.

In the same year, Bankman-fried individually donated large amounts of money to political campaigns in the United States, sponsored Joe Biden’s presidential campaign and became the 2nd largest individual donor to the Democratic party. For effective altruism to be effective, SBF supported various causes for social justice including supporting pandemic preparedness projects, malaria prevention causes and poverty alleviation. All of these crypto philanthropy values became the heart of promoting FTX, the core of FTT marketing campaigns and the lifeblood of Bankman-Fried’s public image.

Did it even take long for Bankman to catch the attention of congress members? NO. Sam Bankman-Fried appeared twice in the U.S congress as a spokesperson for better digital assets regulations. In his statement to Congress, he pleaded with lawmakers to create healthy regulatory policies around existing financial laws and respond positively to digital assets evolution.

A Lesson About Risk and Market Volatility: The Bear Market of 22

Fast-forward to mid-2022, came the cryptocurrency market crash which partly resulted from the collapse of Terra Luna. Terra’s stablecoin UST was algorithmically designed to maintain a stable value in the crypto market even during turbulent times. There are two things in common for Terra and SBF, they both ought to have known the “road to hell is paved with good intentions”

But in 2022, hell was yet to break loose for FTX in its journey to win the crypto derivatives market. However, the hell of this downfall was going to be paved by mishaps of market manipulation and careless risk-taking.

Regulatory Challenges, Downfalls and Setbacks

On one hand, FTX was performing well, to the extent of bailing out some more embattled crypto firms such as Voyager. On the other hand, Alameda Research was in wallowing in trouble. As a result of the bear market of 22, the majority of cryptocurrency investors began recalling their funds from crypto platforms. Alameda was no exception, driven particularly by what was happening in less successful cryptocurrency platforms where some were becoming insolvent or closing down. When Alameda’s customers recalled their funds, the firm noted a big discrepancy in its balance sheet and sought help from FTX. In order to salvage the situation, FTX Exchange illegally loaned Alameda multi-million dollars to carter for customer deposits and withdrawals. This was Sam’s next mistake.

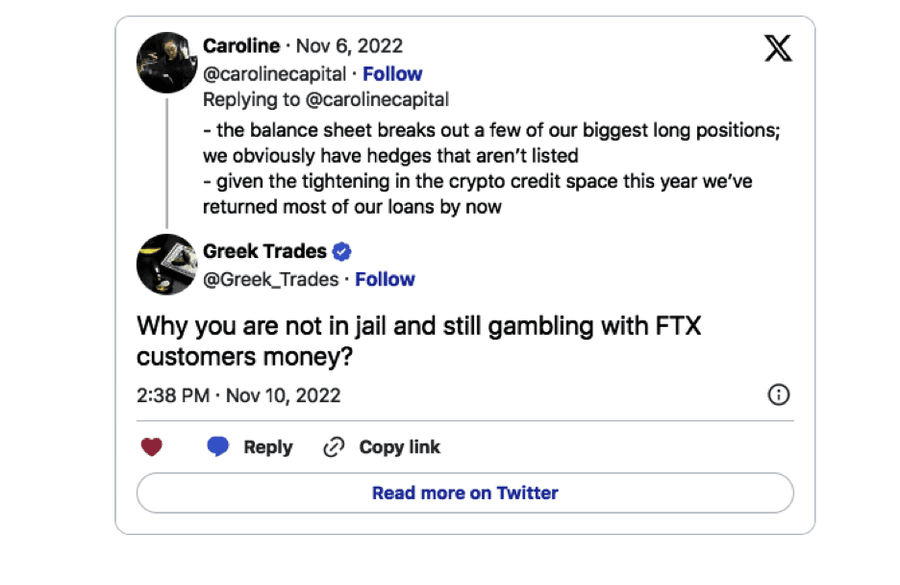

In November 2022, a news coverage website brought to the public’s attention a leaked balance sheet from Alameda Research. This resulted in more scrutiny around the relationship between FTX, FTT leveraged tokens and the trading firm, Alameda Research. According to the balance sheet, Alameda was propped up by its holdings of the FTX tokens, FTT. This suggested without any doubt that FTT tokenomics had a weaker foundation than had been made clear to the public, thereby shaking customer confidence. As a result, hundreds of thousands of customers started offloading their investments and funds from Alameda. A few days later, Binance CEO Changpeng Zhao issued a statement to sell its holdings of FTT tokens. Rampang FTT selling followed the announcement, resulting in an FTX asset run due to fewer funds for paying off the withdrawals. On Nov 11 2022, reports detailed that over $1 billion in customer funds were missing from FTX.

Criminal Charges and Court

A congress hearing in December 2022 revealed FTX collapsed as a result of careless accountability, lack of transparency and a bookkeeping system based on instant messaging, basic accounting software and funds mismanagement. On December 12 2022, Sam Bankman-fried as the disgraced CEO of FTX went into custody in his Bahamas home after being indicted on 2 counts of civil criminal charges by the CFTC, 8 counts of criminal charges by the U.S Department of Justice and other charges by the Securities and Exchanges Commission.

Since the start of 2023, the FTX founder’s lawyers have been constantly on the defense having to deal with all kinds of litigation against the founder and the collapsed exchange. In August, Judge Lewis A. Kaplan, a Federal District Court Judge revoked requests for bail and sent Mr Bankma-Fried, 31 to jail in a hearing where prosecutors alleged that the defendant had interfered with witnesses multiple times.

Lessons in Crypto

Sam Bankman-Fried, once believed to be the next Warren Buffet now faces the risk of having to spend his entire life in prison. The former CEO and his now-defunct exchange serve as cautionary tales for small-medium-sized businesses in any industry to avoid the lure of leveraged returns by conducting proper risk management and due diligence.

Read More:

- Meet the Biggest Crypto Villains to Walk the Earth!

- The Real Reasons Silvergate Collapsed

- The Crypto Bunker: FTX’s Bold Plan for Surviving the Apocalypse

Apparently, the exchange could have alleviated the risks by understanding what they were getting into; and avoiding the trap of using excessive margins on customer funds. Nevertheless, it is not quite possible to prevent all business risks, particularly in a volatile and nascent industry like the crypto sector. This is probably the reason a section feels the government, and the law are applying unfair policies in crypto regulation to punish entrepreneurs. Which to an extent limits the entrepreneurial journey of the world’s innovators. Nonetheless, investors, some who lost their life savings to the FTX meltdown believe something could have been done.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL.FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL.FM strongly recommends contacting a qualified industry professional.