Grab your popcorn as we unpack the drama behind the Luna Classic’s price. Who knows, maybe, you’ll discover the secret to turning your dreams into reality!

Luna Classic (LUNC), the UST stablecoin whose collapse dealt a serious blow to the crypto space after losing its dollar peg in May 2022, has recently experienced a significant surge in value and brought a glimmer of hope amidst the mishmash of bearish sentiments. The remarkable rise in the value of LUNC resulting from the community’s implementation of numerous initiatives aimed at giving the network utility has made the crypto asset gain a high rank in trading volume. As a result, can Luna Classic reach $1 is now a buzzword, and this article aims to address this and also the pertinent question: is Luna a good buy?

What Is Terra Luna Classic?

Terra Luna Classic is the remnant of the original Terra Luna, a Cosmos-based blockchain network of the Terra ecosystem that launched way back in 2018. The blockchain used an algorithmic-based stablecoin backed by a combination of the U.S. dollar’s stability and blockchain network to give users a secure and affordable way to settle transactions. The network was founded by blockchain startup Terraform Labs, co-founded by Daniel Shin and Do Kwon.

So how did we end up with these two crypto versions – the Terra 2.0 and the Terra Luna Classic, and what is the Luna Classic future? The Terra ecosystem started as a vibrant blockchain network worth over $40 million and had two native tokens, namely Terra Luna (LUNC) and TerraUSD (TerraClassicUSD). The Terra blockchain operated a price balancing model for their two cryptos that involved minting and burning LUNA tokens to maintain the price of their UST stablecoin to the U.S. dollar peg.

Terra Luna was the blockchain’s native token designed as a staking and governance tool. Owning the token offered holders voting rights in the ecosystem’s governance structure and the ability to participate in transaction validation and earn rewards by staking LUNA. Moreover, holders could participate in burning LUNA tokens and the process of minting Terra’s UST stablecoin or another one that was pegged to the local Korean fiat currency.

While stablecoins are traditionally tied to and backed by a particular fiat currency, Terra’s stablecoins operate on a totally different system. Rather, they are stablecoins that use an algorithmic set of rules and conditions to back their value instead of using fiat currencies. Terra users use the system to sustain the price of their stablecoins linked minus a corresponding physical asset.

Unfortunately, the algorithm-based UST stablecoin depegged on May 9, 2022, after maintaining a positive value against the U.S. dollar value for 18 months. The ensuing ripple effect followed the actions of a big crypto whale dumping millions of UST (TerraUSD) crypto coins on March 9, 2022, resulting in the stablecoin deviating from its one USD peg.

Consequently, the cryptocurrency market became flooded with UST and LUNA coins, creating a fear of missing out (FOMO) among investors. The resultant panic in the crypto market saw investors dumping more UST coins and further destabilizing UST so that it depegged over 70% of its value to hit a low price of $0.30. Moreover, the crash of the UST stablecoin affected Bitcoin and the entire crypto market, which is yet to recover fully.

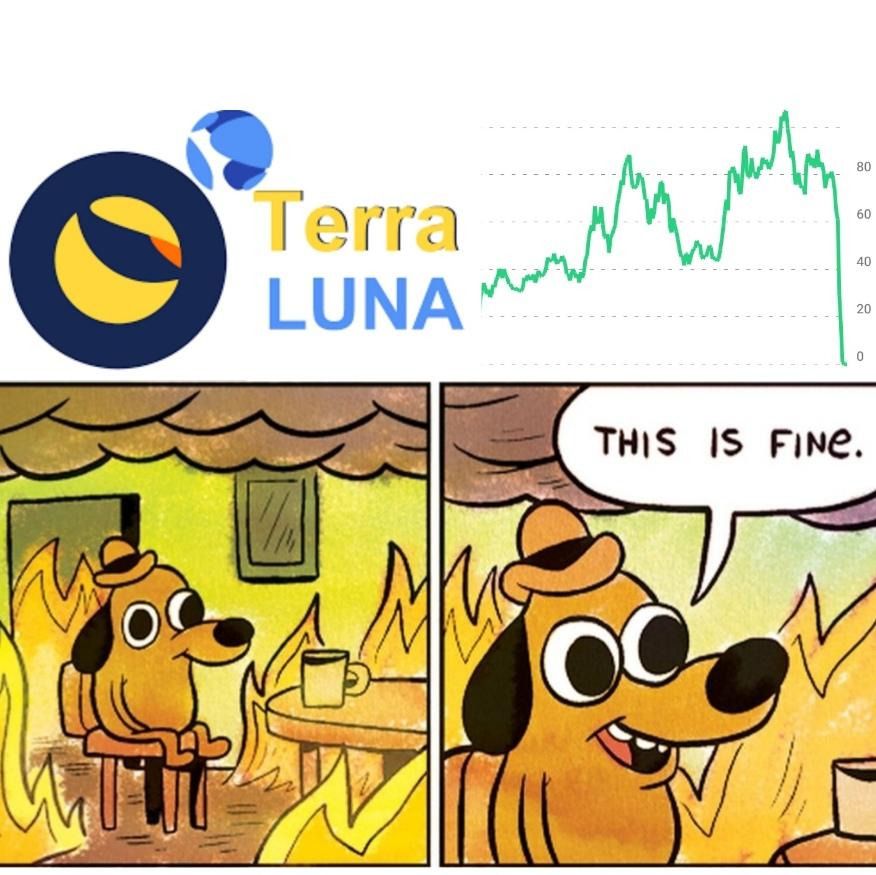

The Terra protocol algorithm had been created with an innate burn-mint instrument to enable LUNA tokens to stabilize the price of stablecoin UST, heralded hyperinflation. The ensuing spiral effect created a trillion tokens to back the UST that unfortunately devalued LUNA’s price from $80 to under a dollar at $0.10 and the UST below a cent overnight. The net result was all developers and projects supporting the Terra ecosystem abandoning the now rudderless ship with no activity on the blockchain for days on end.

Soon after the cataclysmic crash, Terra blockchain co-founder Do Kwon quickly hatched a revival on the Terra Developer forum, which was accepted by a large percentage of the community members and validators. This action by Do Kwon saw the creation of a new blockchain, Terra 2.0, and the rebranding of the ill-fated blockchain as Terra Classic, and the old native crypto coin was rebranded LUNC as it exists today.

How Does Terra Luna Classic (LUNC) Work?

When asking if Terra classic reached $1, you need to remember that before it came crashing down in mid-2022, the original LUNA became among the leading crypto projects during its time, featuring a multi-billion dollar market capitalization. As an integral part of the two-currency ecosystem, LUNA and the TerraUSD, the dollar-pegged stablecoin, LUNA was the volatile crypto. At the same time, UST was an algorithmic stablecoin pegged to the U.S. dollar.

LUNA was designed to use a complex computer algorithm to manage the maintenance of the UST dollar peg by inflating or deflating the coin’s supply based on the market’s demand for the UST stablecoin. At the time, UST coins were redeemable for one USD worth of LUNA. Moreover, the system was designed such that it burned one USD worth of LONA coins every time the algorithm minted one UST coin. As a result, any market cap growth experienced by UST translated positively to the value of LUNA.

During its heyday between September 2020 and May 2022, LUNA was a thriving ecosystem famous for decentralized finance (DeFi) platforms that enabled users to participate in yield farming using LUNA and UST coins. However, LUNA was unable to handle the huge amount of sell-offs and panic withdrawals amounting to billions of dollars following UST’s massive de-peg from the Anchor Protocol DeFi platform. The effect was a massive devaluing of LUNA, with the coin tumbling over $100 per coin to a fraction of the USD cent. The crypto community became furious when over $60 billion was lost during the Terra Luna implosion.

The Terra community quickly voted to reinstate the project and renamed LUNA Terra Classic Luna (LUNC), while the Terra blockchain forked and created a new LUNA crypto in the process. Before it became LUNC, the original LUNA was popular with DeFi crypto, but most of the utility disappeared with the rebranding to Terra Luna Classic. Will Luna go back to 1 dollar as the highly speculative cryptocurrency without a major utility is now a serious concern among users?

Luna classic $1 now looks like a distant dream for a coin trading at $0.0000574 at the time of writing, according to CoinMarketCap. As an extremely volatile cryptocurrency with highly unpredictable price changes, on the one hand, many people can’t give a definite LUNC crypto price prediction. That’s all because, unlike the other crypto projects where new partnerships, features, or software development plans affect the value positively, LUNC’s price movements are tied to any specific developments.

On the other hand, those who answer the question, can Luna classic hit $1 positively believe the coin’s high volatility makes LUNC an excellent digital asset for traders who can employ advanced trading tactics like arbitrage trading. This strategy involves buying a crypto asset at a low price on a cryptocurrency exchange and reselling it immediately on another one where the price is higher. LUNC’s rapid price fluctuations have made it suitable for this kind of trading, where experienced traders are earning considerable profits.

Despite the challenges currently facing Luna Classic and its being a highly speculative cryptocurrency without any serious use case, LUNC is supported by over 50 centralized and decentralized cryptocurrency exchanges. Interested investors can buy LUNC using Tether (USDT) or EUR, USD fiat currencies in most centralized exchanges, or using Binance USD (BUSD) or USD Coin (USDC) in most decentralized exchanges.

Is Terra Luna Classic (LUNC) a Worth Investment?

Is Luna a good buy? This is your next logical question, considering that Terra Classic, when it was known as Terra (LUNA), achieved its highest price yet at $119.18 on April 5, 2022. On the same date, the crypto token also achieved an all-time high market cap of $41 billion. Sadly, this was exactly one month before the UST collapse, which led to the massive crash of the native LUNA token.

Soon after the crash, the LUNA community voted to mint trillions of LUNA tokens to create the highest circulating supply within the cryptocurrency market. As a result of the unprecedented decision, the massive supply completely affected the token’s perceived value. Available data shows that the coin has a current market supply of 5.82 trillion tokens and is priced at $0.00005805 at the time of writing, which is close to 99.99994% lower than its price all-time high in 2022.

If we took a hypothetical situation where LUNC bounces back and reaches the $119.18 all-time high price, the digital asset would hit a $690 trillion market cap. To put it into perspective, note that the total market cap of the New York Stock Exchange (NYSE) is $22.65 trillion. When asking if Luna Classic reaches $1, it’s, therefore, safe to start by predicting it may never reach its all-time high price any time soon unless it goes through some massive token burns soon.

In the meantime, with LUNC currently trading at $0.00005805, any chance of that happening would give Terra Luna classic investors that chance to make at least 10,000% ROI if the ecosystem ever regained its previous demand. And talking about demand, Terra Classic’s DeFi ecosystem has also suffered a massive run.

According to data from DeFiLlama, the total value locked (TVL) among LUNC protocols currently stands at a low of only $1.6 million. The current figure remains relatively low, considering that the figure was $16.20 billion when the Terra blockchain was one of the most valuable blockchain ecosystems. While LUNC currently ranks among the least valuable DeFi protocols, the Terra Classic community must work harder to ensure the token gets back to its original position and attains its all-time high demand.

What Is Terra Luna Classic (LUNC) History of Price?

As we consider the possibility of a Luna Classic $1, you should remember that LUNC has undergone some turbulent price movements, especially after 2022. Terra Luna’s price was relatively stable between $0.20 and $0.60. Nonetheless, the 2021 Bull Run brought good fortunes to the entire cryptocurrency market, so the price broke the $1 barrier at the end of January 2021.

LUNA experienced a substantial price movement in early 2021 when it closed the first quarter at $2o in March, followed by a brief price reduction before regaining its phenomenal growth in July 2021. Terra closed the year 2021 with a high of $99.92, and after a slight drop in January 2022, the token once again regained the upward trajectory before hitting the all-time high of $119.18 on April 5, 2022, before it started going south.

LUNA started crumbling in May 2022 following UST’s losing its dollar peg and went all the way down to near zero. The community’s decision to launch a new coin and rebrand into LUNC has seen Terra Classic’s price fluctuating as it recovers from its phenomenal crash. The coin’s value has remained highly volatile ever since. Terra’s average price for 2021 has so far been $0.0001122 after reaching a maximum price of $0.0002070.

What Are the Predictions for Terra Luna Classic (LUNC) Price?

LUNC Price Prediction for 2024

According to every recent price prediction for Luna Classic, it’s expected that LUNC will hit the $0.00069 mark in 2024 should everything that’s happening remain constant. The minimum price for Terra Luna Classic would be around $0.00058 in 2024 in the event of a market downturn or a maximum of $0.00085 by the end of 2024. All existing market sentiments show the possibility of LUNC’s value continuing to grow, especially if investors pour into the project.

LUNC Price Prediction 2025

LUNC could attract an increase in investments in 2025, and by then, it is expected that the average price for Luna Classic will be in the direction of $0.00094 if current growth continues and the projects maintain the current tempo. More investment could lead to greater adoption, which will see the token’s value and market cap increase. Should we experience a Bull Run any time soon, the LUNC coin’s value could reach $0.0011 in 2025. The minimum price we can expect for Terra Classic in 2025 should be at least $0.00086. However, in the event that the bulls come raging, don’t be surprised to see LUNC breaking its previous records.

LUNC Price Prediction 2030

From the look of things, Luna Classic will survive beyond 2030, especially considering its strong community support and the possibility of more listings in popular cryptocurrency exchanges. Can Luna Classic hit $1 in 2023? Most likely, but forecasts show the price could hover around $0.81 in 2030. Additionally, most other cryptos also indicate positive moves by 2030, while the maximum possible value of LUNC could be around $1.23 that year. The Terra Luna team would need to go out of their way and launch new initiatives or get listed in the major crypto exchanges to make these predictions a reality. However, in the event there is a Bear Market, then LUNC’s value could slump down to $0.59 in 2030.

Read also: Terra (Luna) Classic Price Forecasts for 2024, 2030

LUNC Price Prediction 2040

In the long run, the Terra Luna community would need to work hard to reduce the high token supply since a low volume is naturally considered a good sign for any crypto project. Our long-term forecast sees a time in the future when LUNC prices begin stabilizing, and this could be as far as the year 2040, by which time its average price could be $2.87. Terra Classic could achieve a maximum price of $3.19 by 20240 or a minimum price of $2.56 at the current growth rate. However, a Bull Run could cause the token to surge further than that.

For any investor with the capacity to hold for the long term, there’s every indication that LUNC has great potential, but, as usual, we can’t possibly make a most accurate long-term prediction. Most pundits believe that LUNC could hit the $7.04 mark by 2050, with expected highs of around $8.23 and lows of $6.47. Once again, a bull rally could alter these predictions and make the token skyrocket to pass our predictions.

Remember that when the LUNA coin came crashing down in May 2022, traders all over got curious about whether the Luna Classic will recover fast enough to touch the $100 mark again. However, according to our price prediction for Luna Classic, there’s very little chance the token will arrive at $100 any time soon. Nonetheless, if you are a long-term holder asking, can Luna reach $1? Then, you should be planning to hold LUNC as your retirement plan. That’s all because Terra Classic’s greatest undoing is the increased supply of tokens such that the high supply will make crossing the $1 mark an uphill task for the Terra Luna Classic.

What Are Terra Luna Classic (LUNC) Latest News?

The latest Luna classic news indicates that the battered Terra Classic community has proposed to invite the Six Samurai Engineering team back into their stable. According to the proposal by Pholuna, the Terra Classic community members are in touch with Solid Snake, the Six Samurai co-leader, for a possible re-engagement.

Pholuna is on record for blaming the Layer-1 Joint Task Force (L1JTF) for sabotaging some $700,000 on the automated decentralized exchange protocol Astroport. While this automated DEX on Terra’s network provides powerful liquidity support, Pholuna believes there’s still light at the end of the tunnel as far as reviving Astroport Classic is concerned.

Among the prominent community members who cosigned the proposal include Pholuna, Ecop and Jook Knights, and Oneiric Stake validator, among others. In the meantime, the entire Terra community brigade is voting live to approve the recommendation for Terra Station. Still, recommendation 11788 has split the community down the middle.

In other news, the world’s largest cryptocurrency exchange by trade volume, Binance, has extended support toward Terra Luna Classic’s latest upgrade by introducing great changes on the chain. According to the news, the Terra Luna Classic community approved the said proposal by voting 99.85% “Yes” votes for the core upgrade submitted by the developer group L1 Terra Classic Task Force (L1TF).

The upgrade will be implemented at the block height of 14,514,000 to facilitate the dropping of withdrawals and deposits of tokens via the Terra Classic network at least one hour before the upgrade. At the time of the upgrade, margin, and spot trading of USTC and LUNC will continue operating unabated. The said upgrade will include, among other things, cosmos SDK upgrade, tendermint migration to CometBFT, IBC-go to v6, and wasmd. Moreover, it will also facilitate the implementation of earlier changes passed, such as availing the burn tax to the distribution module.

Binance will handle all the technical issues involving users, including reopening of deposits and withdrawals, as soon as the network is considered stable enough to continue running. Binance will duly inform all users of the progress via an announcement. The exchange had earlier in July announced supporting Terra Classic’s ongoing upgrade, which happened immediately following the network’s Terra Classic v2.4.0 upgrade.

Other Luna Classic news indicates the network is leaving no stone unturned in its bid to deal with a rising tide of spam proposals on the blockchain. According to a groundbreaking proposal, the proposal aims to alter some fundamental aspects of the ecosystem to eliminate most of the constant proposals flooding their system. The Terra Classic community is seeking some fresh air that will restore sanity within the blockchain.

Among the most significant aspects of the proposals is increasing the minimum deposit required to propose substantially, seeing that the 1 million LUNC figure is ineffective. The new proposal suggests that the community raise 5 million LUNC as the minimum deposit. This move will act as a deterrent against the hordes of spammy proposals that have inundated the platform.

Conclusion

So, will Luna go back to 1 dollar? The resounding answer is yes, but that won’t happen just yet. Given the prevailing market conditions and current price, LUNC would take at least seven years or more to get back to the one-dollar-per-token value.

According to most pundits, the Terra Luna community will have to burn the midnight oil and create an environment that will attract DApps for a chance to secure a good future for the LUNC token. Finally, will Terra Classic reach $1? Maybe, but the network must burn at least 50% of the existing coin and still work very hard to achieve this feat.