Dear investors and crypto enthusiasts, today we bring you news that will definitely spice up your daily routine: Kalshi, the prediction and betting platform, surprises us again with its new chips. What did they come up with this time?

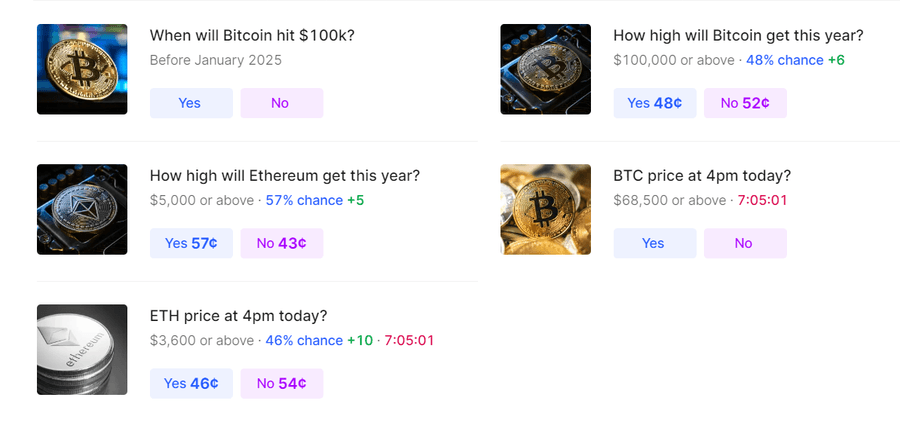

The American prediction market platform, Kalshi, is rolling out the red carpet on Monday for its clients, introducing five new event contracts to bet on various market price movements for Bitcoin and Ethereum, as reported on their website.

Five new offerings on Kalshi include a market events contract predicting the future price of bitcoins, where users can bet on five upcoming target prices for this year — $75,000, $80,000, $90,000, $100,000, and $150,000 or higher. Other event contracts include assessing the price of Ethereum and Bitcoin daily at 4:00 PM.

While the bets are based on cryptocurrency prices, users can wager in US dollars rather than cryptocurrency. Kalshi allows users to bet mainly on “yes or no” propositions in various areas, including the likelihood of another Federal Reserve rate hike or a hurricane hitting New Orleans in 2024.

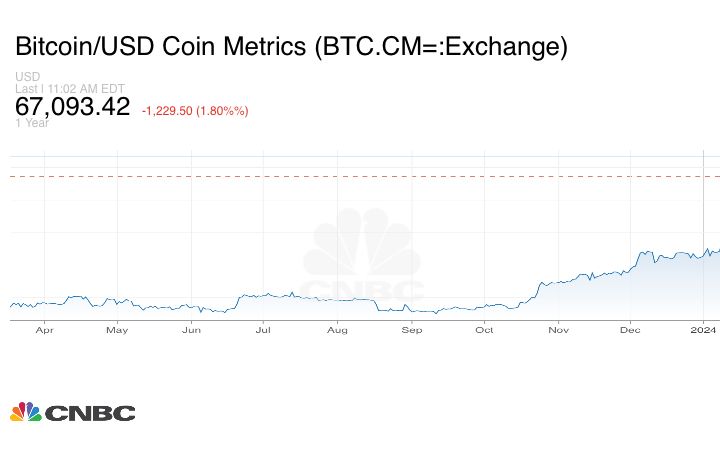

The launch of Kalshi’s new prediction markets comes against the backdrop of exponential growth in cryptocurrency markets since the latter half of last year. The surge happened around the same time as the introduction of Bitcoin spot exchange-traded funds in the United States. Additionally, the GMCI 30, an index that tracks the performance of 30 representative cryptocurrency tokens, surged by about 115% compared to the latter part of 2023.

Debates over a market bubble ensued following the Bitcoin price drop

Based on data from Coin Metrics, Bitcoin traded above $72,000 late Thursday evening before experiencing a drop to approximately $67,000 on Friday, representing a decline of about 7%. By Friday afternoon, the price had risen to around $68,900.

Over the past week, Bitcoin’s price has undergone a correction: from a record high of over $73,000 to a low of less than $65,000 on Sunday. While last week’s Bitcoin price drop sparked debates over whether there could be a bubble in the latest cryptocurrency bull cycle.

Bitcoin is still up roughly 60% since the beginning of the year, but last night’s drop came from almost record highs. The cryptocurrency has surged in recent months, partly due to expectations, and then demand from new Bitcoin ETFs launched in the US in January.

I think it’s a healthy move. We’re removing some of the leverage that has built up in the system.

Chris Marsalek, on CNBC’s “Squawk Box” on Friday

Rapid rises and steep declines have been a constant feature of Bitcoin’s history. During the previous bull market, Bitcoin surged beyond $68,000 in November 2021. However, approximately a year later, its value plummeted below the $20,000 mark.

More Info:

- New Era of Gaming: Blockchain Changed The Gaming World!

- Telefónica Boosts its Coverage in Mexico and Cuts Costs with Helium Hotspots

Crypto enthusiasts argue that the volatility of the asset class should decrease as Bitcoin matures. The emergence of Bitcoin ETFs, which make cryptocurrency more accessible to a wider range of investors, theoretically could help reduce this volatility.

In the crypto sphere, every day feels like you’re not just an investor but a true oracle of financial markets. Let’s hope that the new contracts on Kalshi not only allow you to earn but also provide a dose of enjoyment from playing with the fate of Bitcoin and Ethereum.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL FM strongly recommends contacting a qualified industry professional.