This is HODL FM - the world’s only publication in crypto that remembered to wish you a wonderful, and generous Ramadan.

Today we are talking about gas costs and how Ethereum’s recent upgrade will leapfrog innovation. Some peeps see frogs and think about their PEPE coins. Anyway, let’s jump into the agenda of the day.

Related: Kalshi Prediction Market Launches Crypto Betting in US Dollars

Ethereum fees be like, “We are not sending your $10 without a $50 tip”

We could drone on and on about high network fees but after the Dencun upgrade, degens will no longer complain about the cost of sending their decentralized emails over Ethereum.

Dencun, the latest upgrade on the largest altcoin network rolled out last week.

Why? Definitely for three good reasons:

- Modify the block reward and delay the difficulty bomb (this is meant to make things easier for the transition to Ethereum 2.0).

- Improve the proof of stake consensus algorithm

- Implement various Ethereum Improvement Proposals (EIP) which include EIPs 1559 for improving the fee structure,2929 for boosting security and stability, as well as 2537 for improving privacy and scalability.

By achieving the above three, Ethereum has managed to boost scalability, improve network security, and most importantly, reduce gas fees.

So what has reduced gas fees got to do with you? Besides, you were still sending your $50 using other affordable networks which charge less than $0.01. Well, imagine if you had to pay $100 to mint an NFT worth $15. It gets more serious at the height of a bull market with meme coins launching left, right, and centre.

Reduced fees on Ethereum make the network less costly and more healthier to build. Participants also benefit from affordable DEFI opportunities such as liquidity staking, lending, borrowing, or swapping.

Let’s look at two of the most promising impacts that the new upgrade and its less costly fees will have industry-wide:

- Increased adoption of smart contracts

- Increased capabilities and functionalities of Non Fungible tokens (NFTs).

Proliferation of Smart Contracts

Smart contracts are gaining mass attention from builders and entrepreneurs who want to drive asset investments and adoption through blockchain tokenization.

The smart contracts sector is projected to grow to $8.79 billion by 2030 at 26.3% CAGR, according to Fortune Business Insights. Decentralized applications are the largest driver of the sector.

Other factors that will contribute to the sector’s growth are applications of the blockchain in various industries across manufacturing, supply chain, logistics, democracy, gaming, social media, marketing, artificial intelligence, real estate, and the metaverse.

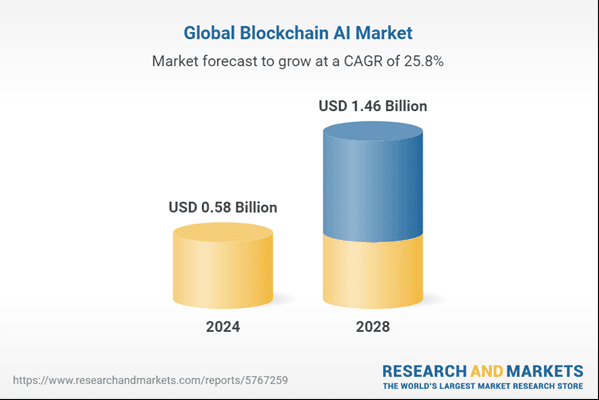

Smart contracts will also play a significant role in artificial intelligence by enabling dynamic decision-making. The blockchain AI ecosystem is valued at $500 million and is projected to reach $1.46 billion by 2028.

Ethereum is important to this narrative because it is the bedrock of smart contracts-driven projects. Even as bitcoin contracts emerge following the launch of ordinals last year, Ethereum is still commanding the market. As such, a fall in Ethereum’s gas fees means more investors, developers, and retail traders entering the space.

Enhanced Capabilities of Non-Fungible Tokens

NFTs are still in their nascent stage despite several experts dismissing them as pointless and lacking in utility. The space rose into popularity in 2021 after the Beeple auction, but crashed many months later when the hype settled.

In 2024, the space has really improved with the widespread popularity of fractionalized ownership and tokenization of real-world assets which is happening thanks to NFTs. Various companies have implemented NFTs and Ordinals to represent ownership of real-world assets (RWAs) on the blockchain.

More Info:

- Ethereum’s Big Upgrade has Polygon (MATIC) and Arbitrum (ARB) Leading in Fresh Gains

- Analysts Opinion: Chances of ETH ETF Approval by May Reduced

One of the companies making moves in the space is Artfi which recently released a tokenized fine art collection from Sacha Jafri, an artist known for the largest fine art painting in the world and a record holder of the most expensive artwork by a living artist.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website HODL FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort HODL FM strongly recommends contacting a qualified industry professional.