This is the weekly coin analysis by HODL FM, a piece that breaks down important on-chain activity and historic performance of cryptocurrencies.

Here is what we prepared for you:

- Ethereum crashed resistance and now trades at a crucial level.

- Bulls are having it all.

- Analyst believes an Ethereum ETF could blast Bitcoin’s price as well.

- Odds of Approval for Spot Ether ETFs up from 25%.

Related: Bitcoin Breaks $71K: Analyzing the Factors Behind the Rise

No Way Through for Bears

The bulls have pranced back into Ethereum’s market, leaving the bears pawing miserably at the $2,850 like a fly reaching for the bottom-most cookie inside a jar. The best illustration would be a pack of bears scratching their heads, wondering why their detonator just wont detonate doomsday on Ethereum’s price floor.

Buyers managed to catapult the price out of the bearish channel at $2,850 , where the price of Ether struted its way its way up to $3,400, and broke above $3,700. The channel was a difficult one to break, which made the bulls feel more like knights inching toward’s a dragon’s lair. Multiple times before yesterday’s bullish breakout, the bears charged back at the bulls for attempting to cross above $2,850.

Frenzy for Ethereum ETF is Back like it Never Left

The recent decision regarding United States spot Ether exchange-traded funds (ETFs) has influenced the projected Bitcoin targets for Filbfilb, the co-founder of the trading suite DecenTrader.

According to Filbfilb, the worst-case scenario for Ethereum’s current price would be the regulators giving the ETF a big, fat thumbs down. And this means only one thing for Ethereum’s performance, this would be a little time travel back to the pre-hype days, before yesterday and today when the odds of approval for an Ethereum ETF had returned to 75%. Just a round-trip ticket to where we started—no biggie!

If Ethereum Trades in Sync with BTC, is the Other Way Round Possible?

However, on the flip side, Filbfilb hinted if the ETF gets a green light, Bitcoin could strap on its moon boots and blast off into price discovery territory, possibly even reaching a jaw-dropping $80,000. So, it’s either back to the future or straight to the moon. Besides, ETH/BTC trading pair has hit its highest level in 2-months since May 21, as we write this.

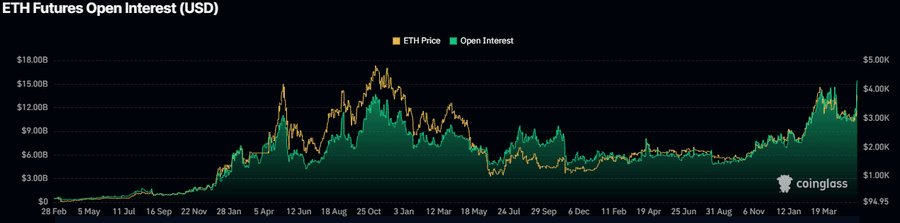

Following this week’s activation of the Ethereum ETF hype, and Bloomberg’s senior ETF analyst Eric Balchunas projections for an ETF approval going from 25% to 75% , Ethereum’ futures market’s open interest has soared by 24.3% on the 3-day chart from $11.25 billion to a staggering $14.87 billion.

An increase in open interest usually supports a bullish outlook in the crypto world. It’s like the investor equivalent of a standing ovation, where buyers are running the show and the bears are extras on a Broadway show.

More Info:

- Millennium Management Reveals $2B Investment in Bitcoin ETFs

- How a Single Whale Impacted Bitcoin’s Price

- White House Rejects FIT 21 Crypto Legislation

Elsewhere in Ethereum policy, the United States Securities and Exchanges Commission has asked companies that applied to issue spot Ethereum ETFs should update key filings associated with their applications.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL FM strongly recommends contacting a qualified industry professional.