Today’s HODL FM dives into Ethereum’s ETF excitement and why the optimism has not yet fueled a rally to $4,000.

Actual listing and trading of spot Ethereum exchange-traded funds (ETFs) is yet to commence later than expected despite the United States Securities and Exchanges Commission (SEC) greenlighting the product on 23rd May 2024. There is still uncertainty on the date of issuance since the commission is yet to approve the S-1 filing from each Ethereum ETF applicant.

The s-1 filing is like the last short into the goal before a crypto ETF product begins trading, and there have been speculations that the SEC may have provided the greenlight ahead of last minute political pressure on Democrats who want backing from the crypto community.

Conversion of Grayscale’s Ethereum Trust into a Spot Product has Stired Some Worry

Furthermore, ether investors have been feeling a bit like they’re walking barefoot on Legos ever since the approval of the spot Ethereum ETFs first stage, especially when they think about the Grayscale Ethereum Trust (ETHE) potentially morphing into a spot instrument. If the fund administrator decides to mantain its $11 billion fund fees sky-high, far above what competitors are charging, it’s going to be like watching a slow-motion train wreck with Grayscale’s GBTC outflows drowning out any inflows from the likes of BlackRock, Fidelity, VanEck, and ARK 21Shares.

However, an important discussion that has come up is the reason why Ethereum price is hanging below $4000, and whether derivative bets could be suppressing the largest altcoin’s price below the $3,900 support.

These three factors, uncertainity on how long the SEC will take to approve the S-1 filing, and fears around conversion of Grayscale’s Ethereum Trust into a spot ETF instrument have led to more inquisition among traders on what may be stifling Ethereum’s price. Moreover, President Biden’s repealing of the SAB 121 guidance by the SEC has raised more regulatory concern among crypto investors and strengthened their uncertainty on an imminent approval of the S-1 filing.

Derivatives Trading Data Indicates a Balance Between Shorts and Longs

Since traders and investors have no power to predict how long the SEC will take to approve the filings, analysts have shifted their attention to trading metrics and help evaluate whether market participants are on the bearish side following multiple failed bullish attempts to sustain price levels above $3,900.

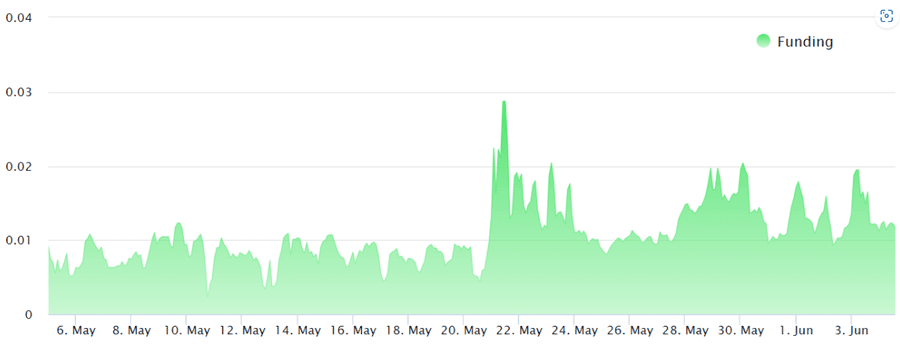

One of these metrics is the funding rate on perpetual swap contracts. Exchanges calculate the funding rate per every 8 hours, where a positive rate indicates buyers are implementing highly leveraged longs. Looking at the metric, the weekly funding rate has remained positive since 21st May 2024 but its percentage has been insignificant. Thereby indicating a balance between the demand for long and short bets on Ethereum’s perpetual bets.

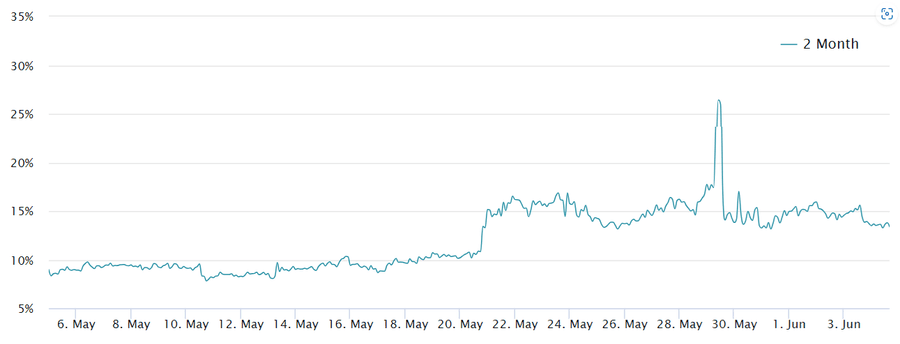

However, the funding rate metric may fail to paint a clear picture of the market given certain external factors surrounding perpetual swaps. The annual premium (extra cost) of monthly futures contracts for Ether (ETH) often have a value that doesn’t match the current price of Ether because they settle later, so sellers usually want 5% to 10% more. But when the market is excited, this extra cost can jump to 20% because buyers are willing to pay more to take on more risk. The premium for monthly futures contracts for Ether jumped to 15% on 21st May 2024 when the price of ETH surged to $3,800. But by 3rd June, as the initial excitement wore off, this premium dropped to 13%.

While 13% is still a bit above the average level, it’s not high enough to indicate that people are very optimistic about ETH in the short term.

Bottomline

This data doesn’t mean investors are shaking in their boots about the spot Ethereum ETF launch. It’s just a global game of regulatory whack-a-mole. Hong Kong thought it’d spice things up by banning unlicensed exchanges, Paraguay decided to play crypto cop and nab unregistered mining equipment, and a couple of U.S. Senators suggested that Iran was using digital assets to fund their next villainous plot.

More Info:

- What Does Spot Bitcoin ETF Mean for Investors?

- Bitcoin Critically Fell After the ETF Approval. What’s Next?

- The SEC Has Lost Control Over The Crypto Sector by Approving Ether ETF

Clearly, there is so much into play when it comes to Ethereum’s suppressed levels. However, the derivatives funding metric does show there is low confidence in spot Ethereum ETFs ganering strong net inflows. All of which narrows the chances of an Ethereum rally above $4,000.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL FM strongly recommends contacting a qualified industry professional.