No risk no gain. But not for pro traders who need more convincing that Ethereum’s support at $3000 will shoulder their risk appetite.

This is HODL FM, the first web3 publication to climb mountains of cluttered, filtered, unfiltered, censors, and uncensored insights to bring you a clear, concise, and humorous dive into crypto. Our biggest win is saying it as it is.

Our topic for today is all about numbers. Ethereum’s Numbers

Show us the numbers. Where are the numbers? What do you mean you don’t have the numbers? You gotta pump those numbers up.

Founder, investor, venture capitalist, trader, degen. We’ve certainly heard or mentioned such phrases but with a stern tone. If that’s not you, probably you are the kind of dude who says, ‘Please back it up with a source” using a more empathetic tone.

Ethereum’s derivatives data show intense pressure on the $3000 support level due to declining risk appetite among professional traders

Investors have pegged most of their hopes on the approval of an exchange-traded fund by the Securities and Exchange Commission (SEC). The challenge is that we have almost a month to wait for a decision from the commission. On the downside, a cloud of doubt has engulfed the possibility of approval, with VanEck Investment Firm CEO Jan Van Eck stating the chances of acceptance in May are slim. Seven more applications from prominent names like Fidelity, Blackrock, and ARK 21Shares are still pending. Yet, the SEC has done little to provide any constructive feedback which has reduced the odds of approval to 35%, says a senior Bloomberg analyst for ETFs, Eric Balchunas.

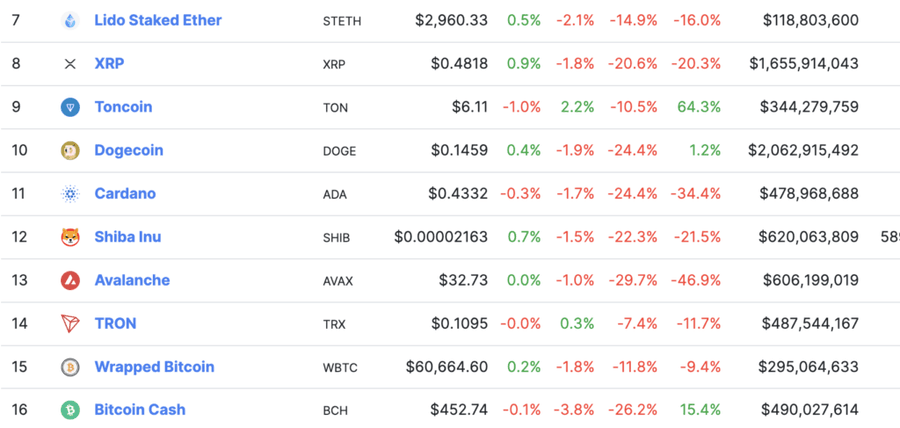

We could partly blame Ethereum’s dimming prospects for its declining market price. However, we saw Bitcoin drop all the way to $63,000 from the $70,000 highs. In the 7 days leading to April 17th, Bitcoin, Ethereum, BNB, and Solana fell by 9.2%, 13.7%, 9.3%, and 20%, respectively.

For a more comprehensive and elaborate analysis, it’s reasonable to compare Ethereum’s perfomance relative to its top competitors operating in the DApps space. One of those we should add to the list above is Tron which is position #14 on CoinGecko’s top 100 cryptocurrencies and experienced a steeper decline of 7% over the previous 7 days. Apparently, the declines do not reflect activity within each of the cryptocurrency network’s DApp activity.

For example, analytics from DeFiLlama indicate Ethereum’s Total Locked Value (TVL) has been on a month-to-month upward trajectory of 14.8% in the 13 months leading to mid-April. BNB’s TVL has remained stable in those months with 9.5 million Binance Coins (BNBs).

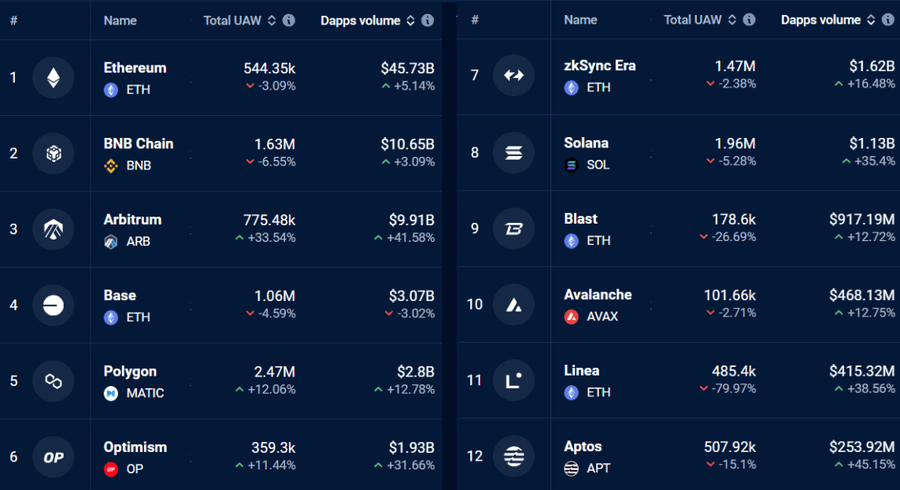

One clear takeaway from this analysis is that Ethereum holds the upper hand compared to its alternatives. But we cannot conclude that, either, because not every DApp demands a large deposit base. For this reason, a nuanced assessment would examine active user counts and transaction volumes.

DappRadar analytics show Ethereum has dominated DApp volume charts in the last 7-days at $45.7 billion. A significant stride away from its second competitor BNB Chain with $10.65 billion.

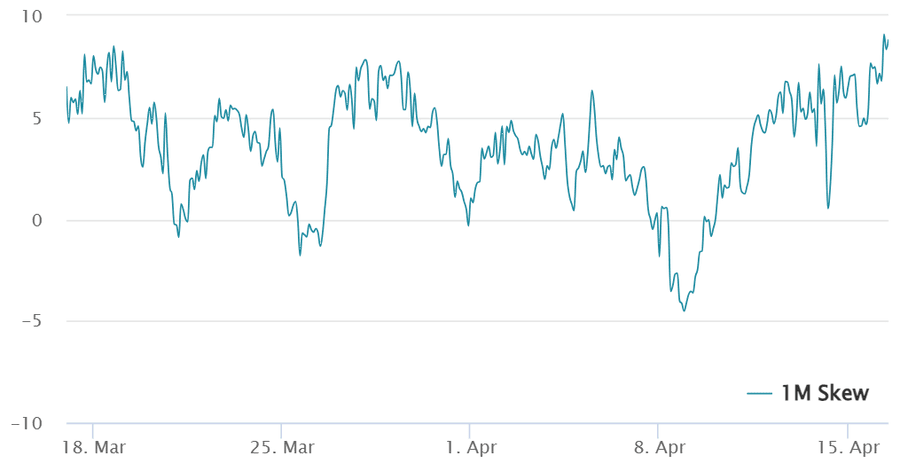

Ethereum Options are also crucial when gauging overal sentiment among professional traders regarding ETH’s market prospects. A suitable on-chain indicator for this is the delta skew metric. More traders anticipate a fall whenever this metric crosses 7%, while the sentiment is bullish when the delta skew metric crosses below -7%. Yesterday (April 16th), the ETH options skew metric breached a two-month high and crossed 7% after hovering around neutral sentiment for days.

Although Ethereum has performed better compared to BNB Chain, Solana, Tron, and other DApp alternatives, there is still a growing risk aversion among derivative market traders. This is another way of saying things are not looking good around the current levels where ETH is hovering around the $3000 main support. Hence, we should not completely overlook the possibility of a correction towards $2900.