The absence of OpenAI’s ChatGPT in China created a void that a new wave of AI startups China is vying to fill. This article examines the four leading Chinese AI unicorns trying to establish themselves as leaders in the generative artificial intelligence scene to take advantage of the existing OpenAI competition to develop advanced ChatGPT alternatives in China.

Related: OpenAI Unveils GPT-4 Turbo Upgrade and Account-Free Access

Introduction to Chinese AI Unicorns

As generative artificial intelligence (AI) technologies become increasingly popular, four Chinese tech startups have crossed the $1 billion valuation mark to attain unicorn status. The four, Zhipu AI, Moonshot AI, MiniMax and 01.ai, that are out to acquire substantial AI marketshare China with AI products, have garnered substantial local investment support.

Even with the global popularity and dominance of OpenAI’s ChatGPT, its absence in the Chinese subcontinent has created a unique market for local AI unicorn companies. According to a recent report by data provider IT Juzi, there are at least 262 Chinese AI unicorns shaping the AI and semiconductor sectors in China.

Leading Chinese AI Unicorns

Zhipu AI, with a workforce of over 800 employees and a current valuation of an estimated $2.5 billion, is the current leader of the pack of AI startups in China. The firm conducted a fundraising round in March and gained significant funding from local investors. The supported by a local group of venture capital Chinese unicorns aims to tap top talent at Tsinghua University in Beijing to create the most popular AI products.

The firm’s closest competitor, Moonshot AI, which is also valued at $2.5 billion, has targeted office workers and students with text summarization technology. The Moonshot AI growth is spearheaded by Kimi, a viral chatbot experiencing explosive growth, having garnered over 12.6 million visits in March. Kimi seems poised to rival Chinese search giant Baidu’s Ernie Bot, which garnered 19.9 million visits during the same period.

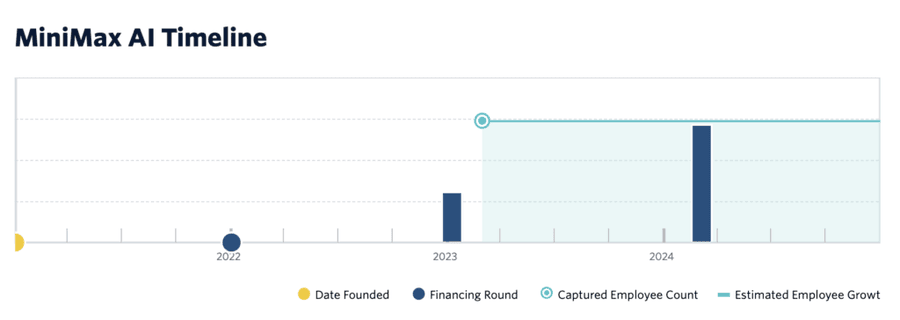

MiniMax and 01.ai: Sector Leaders

Shanghai based MiniMax, on the other hand, has given the concept a totally different approach, invading the gaming market using anime-themed characters. Also valued at $2.5 billion, MiniMax gaming AI employs interactive characters that are designed to generate jokes, responses or even flirt with users.

Meanwhile, 01.ai, valued at $1.2 billion, chose to develop and deploy a lineup of open-source Yi models which are specially customized for the Chinese market. The models are built on Llama, a free-to-use Meta product have been ranked high on Hugging Face scoreboards for their reading ability, coding, common sense reasoning and math, among others. The other popular models in their lineup include the productivity-focused Wanzhi.

All four Chinese AI unicorns have received funding from Alibaba Tencent’s AI investment, one of the largest supporters of AI technology development. Alibaba is following in the footsteps of Microsoft, which poured billions of dollars’ worth of funding to support the development of OpenAI.

China’s AI Landscape

According to the Global AI Talent Tracker 2.0 report, China is a great source country for AI talent. The report states that the Chinese made up one-tenth of elite AI researchers in 2019, and the figure reached 26% in 2022. Despite the significant growth in Chinese AI unicorns, the subcontinent still has some catching up to do with market leader the United States.

Statistics from Global Unicorn Index 2024 by Hurun Research Institute indicate that the US has over 700 unicorns compared to China’s 340. In terms of geographical distribution, Beijing leads with 114 unicorns, followed by Shanghai and Shenzhen with 63 and 32 unicorns, respectively. The report further highlights the role Chinese Big Tech companies like Alibaba, Tencent Holdings and Baidu have played in nurturing and incubating AI unicorn companies.

Artificial intelligence has emerged as a potentially disruptive and transformative force within the Chinese economy as it reshapes industries, drives innovation and fuels economic growth. China has, over the past few years, strategically invested in AI research and development and gone on to position itself as a global leader in AI technology development. Rapid advancements in AI have the potential to impact different sectors of the Chinese economy and create both challenges and opportunities.

Despite growing domestic support, the report states that over 70% of Chinese unicorns receive their support from international funders. Nonetheless, there’s fear that escalating geopolitical tensions in AI technology between the United States and China could potentially threaten future fundraising efforts for Chinese AI unicorns. For example, the recent signing of an executive order restricting American investment in sensitive technologies by US President Joe Biden could create additional challenges for AI startups in China in the near future.

Conclusion and Future Outlook

The entry of Chinese AI unicorns into the generative artificial intelligence sphere signifies a notable development in the ongoing global technological competition. Amid the escalating United States-China geopolitical tensions in AI, the AI startups in China have strategically stockpiled state-of-the-art AI semiconductors to position themselves as significant players, addressing an existing gap and providing ChatGPT alternatives in China.

More Info:

As a result, China is positioning itself to become a significant market player within the global AI scene in the foreseeable future. With a domestic population of at least 1.4 billion potential consumers and ongoing developments within the blockchain and cryptocurrency China niches, there’s a fertile ground to thrive for a plethora of potential AI applications that could emerge. Moreover, the Chinese government has pronounced its ambitious mission to embrace and support AI and emerging technologies wholeheartedly.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL FM strongly recommends contacting a qualified industry professional.