Isn’t it nice when you wake up and check the Bitcoin price to find it breaking resistance above $40k, then $50k, and now $60k? The crypto’s king has had an impressive start to the year, and February was particularly generous.

The Securities and Exchange Commission’s (SEC) approval of the first BTC exchange-traded funds (ETFs) and the upcoming halving event are fueling the rally, and Bitcoin is so close to updating a record high.

However, some analysts warn of a potential major correction before celebrating another ATH.

Should we get ready with some solid stop losses?

Matrixport Co-Founder Says Correction Is Imminent

Daniel Yan, who co-founded Singapore-based crypto services company Matrixport, said on X that a major correction might be on the horizon as Bitcoin is updating the year-to-date peak.

He stated:

“Euphoria: the sentiment of the market has come to a level where I think we should be cautious – may be a good idea to revisit my pinned tweet on the size of potential corrections. I think we should see another healthy ~15% correction by end-April.”

According to Yan, March is a tricky month, with the US Federal Reserve holding another meeting to decide monetary policy and with the halving event ahead.

JPMorgan Anticipates Decline to $42k After Halving

Elsewhere, analysts at banking giant JPMorgan also predict a major correction shortly after the halving frenzy is fading away, although they don’t specify how far BTC may reach before the correction.

As per a report seen by Fortune, JPMorgan argues that the halving event would increase the production costs of mining, causing a price drop to $42,000. The report says:

“The Bitcoin production cost has empirically acted as a lower bound for Bitcoin prices.”

The analysts expect production costs to surge 100% to about $53,000 after halving. This might lead to a 20% drop in the Bitcoin network’s hashrate, suggesting that smaller miners won’t be able to catch up with the competition.

Billionaire and crypto investor Mike Novogratz also thinks that a correction makes sense now. The CEO of Galaxy Digital told Bloomberg:

“I wouldn’t be surprised to see some corrections and some consolidation. If it corrects, it might correct to the mid-$50,000s, before taking off to the new high.”

Interestingly, Novogratz said during his short interview that this is the first time in history that we have a true price discovery for Bitcoin, pointing to the recently approved ETFs.

Correction or Not, This is Already Amazing

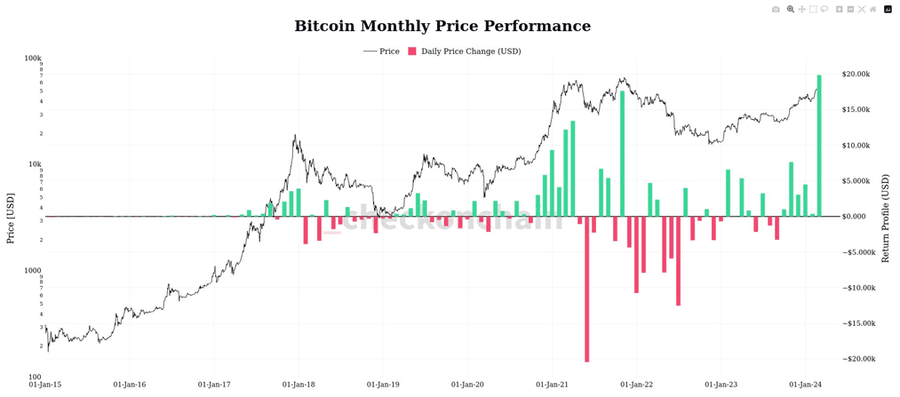

While we don’t know how much time is needed for another record high, Bitcoin fans can already celebrate, as February was the month with the highest gains in dollar terms.

Last month, the largest crypto coin by market cap made BTC holders happier by 43%, if I can put it that way.

Considering these massive gains, history has shown that a correction or at least some consolidation period is really possible.

Let’s grab some popcorn and see what happens next. Don’t forget about those stop losses though.