Bitcoin is down about 10% since the Securities and Exchange Commission approved the ETF listing. The price fell by about $4,000, signaling a growing “sell the news” sentiment in the market, sparking debate about how low the price of BTC could go soon.

Read More on ETF: Spot Bitcoin ETFs Debut with $4.6 Billion Trading Volume, But Zero Inflows

The ETF’s Influence

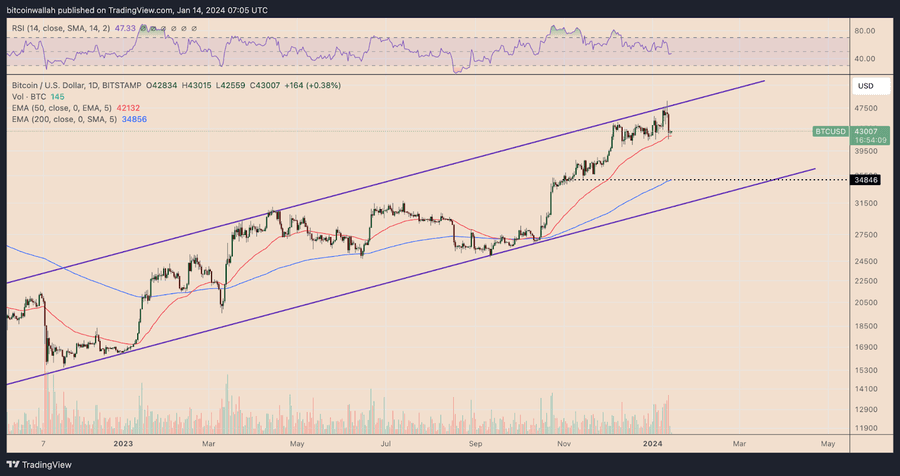

Bitcoin shot up to $49,000 within a few hours of the announcement and dived to over $43,000 by January 12th. Meanwhile, technical chart models are suggesting the possibility of the sell-off party continuing in the coming days or weeks.

The 50-day Exponential Moving Average (the red wave) played the supportive friend around $42,120, with prices waltzing above it as of January 14th. However, the Relative Strength Index (RSI) is doing the moves near the midline, suggesting a lack of a strong bullish impulse.

So, if BTC decides to break below the 50-day EMA, it might be on the lookout for its next support near the bottom line of the bullish channel. This trend line happens to groove with Bitcoin’s 200-day EMA (the blue wave) around $34,850 – a level unseen since the great consolidation phase of the fourth quarter of 2023.

Experts Confidently Predict a Fresh Surge on the Horizon

Ray Salmond, CoinTelegraph Analyst

For Bitcoin’s long-term price performance, it’s likely the size and consistency of inflows into ETFs will be major players, along with the juicy reports at the end of the first and second quarters.

I’m itching to see how institutions will remix their portfolios with BTC and what consumer goodies will pop up next year. In the short term, all eyes are probably going to swing back to Bitcoin having its semi-birthday bash in April and the historical impact it’s had on prices.

Personally, I’d be quite content if Bitcoin consolidated in the price range of $50,000 to $56,000 for the next couple of months or so.

Rudy Takala, Opinion Editor at CoinTelegraph

In 2020 – the last year of the Bitcoin halving – its price soared by 500%, and then, of course, did the classic double take in 2021. Following the same script, this year’s end-of-year price will probably be somewhere north of $200,000. Right now, it seems absurd, and the difference in market capitalization compared to 2020 would be as absurd as trying to teach a fish synchronized swimming. But this year, the situation looks bullish!

Lucas Kiely, Yield App CEO

We’re witnessing some “sell the news” shenanigans, but only from a handful of short-term traders. HODLers aren’t budging – certainly not before Bitcoin does its legendary halving show, which has historically been the spark for epic rallies. The long-term holders’ gang is at a solid 76%, higher than a browsing level at any other moment in history.

Sure, there might be a little rollback, but nothing that’ll make you spill your morning coffee. Breaking the $50,000 threshold might take a hot minute. But come June, the halving will be the belle of the ball, and the price should be higher.

Where Can the Bitcoin Cash Splash Coming From, Besides the Halving?

Beyond the Bitcoin Halving Forecast, take a moment to appreciate Lucas Kiely’s revelation that over 76% of Bitcoin holders are long-term holders. If you’re banking on them tossing their stash overboard at $42,000 a pop, well, prepare for disappointment.

On another note, the ETF suppliers have been playing detective for the past few months, having a chat with countless clients. So, their predictions might be the most solid in town. According to BlackRock, ARK, and Invesco, if they hit their bullseye, these three could pump a whopping $11 billion into Bitcoin within a year. We will likely see a lot more money flowing into Bitcoin through these investment vehicles.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL FM strongly recommends contacting a qualified industry professional.