Australia’s largest stock exchange, the Australian Securities Exchange (ASX), may greenlight the creation of several spot Bitcoin exchange-traded funds (ETFs) by the end of 2024. According to Jeff Yew, CEO of Monochrome, Australia’s spot Bitcoin ETFs could see inflows of $3 to $4 billion within the first three years.

Related: Australia’s Progressive Approach to CBDCs: RBA’s Vision for the Future of Money

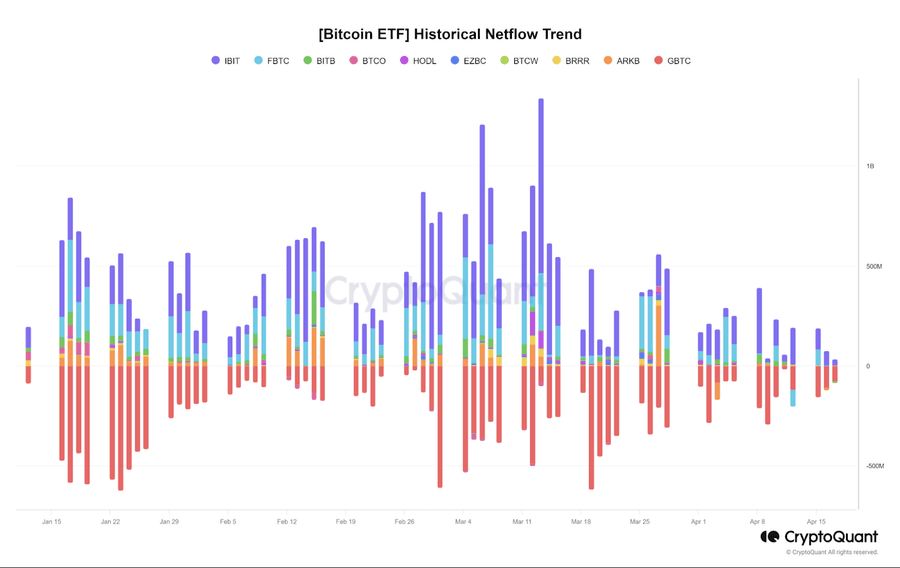

Applications emerged after US Bitcoin ETFs amassed $53 billion this year, including proposals from BlackRock Inc. and Fidelity Investments. Funds investing directly in Bitcoin and Ethereum will commence trading in Hong Kong on Tuesday. Issuers aim to capitalize on the sharp cryptocurrency rebound, with Bitcoin hitting an all-time high of nearly $74,000 last month.

The significant influx of funds into US-based ETFs has bolstered confidence in launching products in Australia and proves that digital assets are here to stay.

Justin Arzadon, Head of Digital Technology at BetaShares

Mirroring the actions of fund issuers in the United States and Hong Kong, sources familiar with the matter, cited by Bloomberg, anticipate the approval of spot Bitcoin ETF applications from VanEck Australia and local ETF-focused fund manager BetaShares by the year’s end.

The Case for Bitcoin ETFs

Jeff Yew, the CEO of crypto asset management firm Monochrome, which has an app on a rival exchange, named Australia as the “land of plenty” when it comes to cryptocurrencies, expecting Australian spot Bitcoin ETFs to rake in $3 to $4 billion in net flows over the initial three years.

Yew explained that the demand for Bitcoin ETFs would primarily stem from fund managers seeking Bitcoin exposure, self-managed superannuation fund (SMSF) investors, and a smaller yet significant appetite from retail traders.

SMSF investors currently have direct access to Bitcoins on crypto exchanges, which, he likened to “ticking time bombs” if crypto exchanges were to go bust.

The Australian Tax Office reports over $1 billion worth of crypto sitting on exchanges, with a large chunk of that owned by SMSF investors.

On the flip side, Bitcoin ETFs offer these investors tightly regulated and therefore safer access to digital assets, Yew said.

Moreover, Australia’s $2.3 trillion pension market could contribute to the influx of investments. About a quarter of the country’s pension assets are in self-managed superannuation programs, allowing individuals to choose their investments. According to Jamie Hanna, Deputy Head of Investments and Capital Markets at VanEck Australia, they could be purchasers of spot cryptocurrency funds.

With self-managed super funds, brokers, financial advisors, and platform money, there’s a big enough target market here to get this ETF to a decent size.

Spot Bitcoin ETFs in Australia

The latest applications mark the second wave of spot Bitcoin ETF launches in Australia since the initial listing two years ago on CBOE Australia, the country’s junior exchange responsible for less than a fifth of stock trading volume.

Sydney-based firm Cosmos Asset Management debuted a spot Bitcoin ETF in 2022, only to delist it later that year due to lackluster inflows. The Bitcoin ETF Global X 21Shares, launched in the same year, boasts assets of around $62 million. Monochrome Asset Management, led by former Binance Australia CEO Jeff Yew, recently filed for another platform launch on CBOE Australia.

Monochrome initially applied for a spot Bitcoin ETF on ASX on July 14, 2023, but later shifted to Cboe Australia — a much smaller exchange — due to ASX’s slow approval process.

“We switched to Cboe because it offers more realistic timelines and a more transparent listing structure. It’s no secret that ASX has had regulatory issues lately,” Yew remarked. “I think their appetite for pushing new products is just constrained.”

More Info:

- Binance Repression in Nigeria is a Threat to Web3

- Japan Becomes the Land of Web 3!

- The USA has Created a Consortium to Control the Development of AI

Yew still anticipates Cboe Australia to approve his firm’s application “in the next few weeks.” As the second wave of spot Bitcoin ETF applications unfolds, industry players remain optimistic about the prospects for cryptocurrency adoption in Australia.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL FM strongly recommends contacting a qualified industry professional.