So, the SUI ETF has just made it to the SEC’s public register. Sounds official, right? Yep, the formal review process for one of the first altcoin-based ETFs in the U.S. (after Ethereum, of course) has officially kicked off. Can’t say we didn’t see this coming.

The Sui Foundation made sure to point out that this filing "marks the formal start" of the review process. And I mean, if it's written on a blog, it must be true. It's following the S-1 registration by 21Shares in April, which is basically crypto-speak for "let's get institutionalized, people."

The Big Leagues Want In

The buzz around SUI is real. With over $300 million invested globally in SUI-based ETPs (that's exchange-traded products, not some random acronym), demand for U.S. exposure is climbing faster than your grandma’s curiosity about crypto. Most of this investment has been through Euronext Paris and Amsterdam listings, so the U.S. is playing catch-up.

Nasdaq just filed to list the 21Shares SUI ETF — a spot ETF backed by the SUI token.

— Sui (@SuiNetwork) June 10, 2025

From $300M+ in global ETP inflows to a potential U.S. listing, institutional momentum for Sui is very real.

Next stop: institutional adoption. pic.twitter.com/5AGtmXimHs

Sui’s tech game is strong, though. It's object-oriented programming and horizontally scalable infrastructure support everything from DeFi to gaming and tokenizing real-world assets (because why not tokenize your real house while you’re at it?).

Numbers don’t lie. Sui ranks eighth in total value locked (TVL), with a jaw-dropping $1.944 billion deployed across its platforms. And its stablecoin market cap has skyrocketed over 190% YTD, hitting $1.1 billion. Oh, and did we mention that its stablecoin transfer volume hit a cool $110 billion in May? Yeah, this isn’t just some passing phase.

Oops, There Was a Hack... But It's Fine

Here’s a plot twist: The $260 million Cetus hack happened, and it froze the network, you know, just a little hiccup. The whole decentralization thing was called into question, and then came the $162 million recovery plan that stirred up even more controversy.

But, don’t worry, Sui’s back, baby. The network’s TVL bounced back, and it’s been giving the "we’re resilient" speech ever since. To show just how serious they are, Sui even forked out $10 million for a security overhaul. They’re sharing the accountability now, so no more “it’s not my fault” excuses.

SUI Price is on the Up and Up

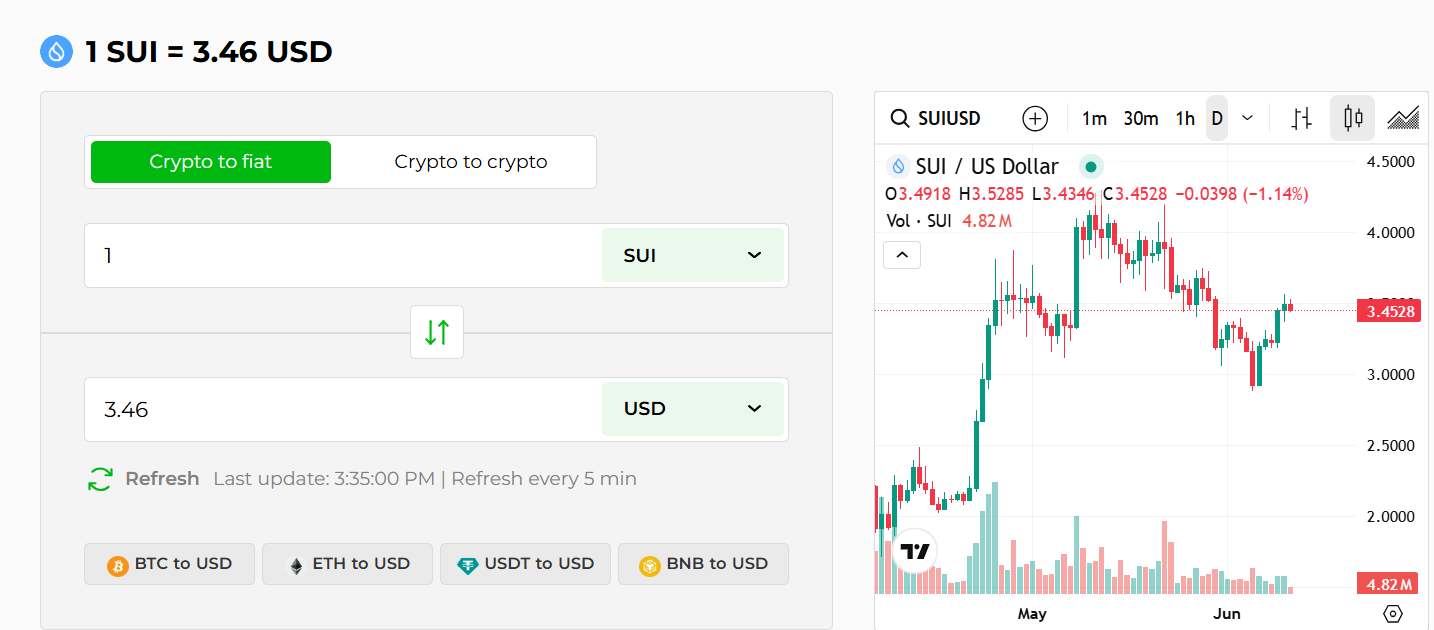

Despite all that drama, SUI is back in business. The price is up 17% since June 1, currently sitting at $3.46. Okay, maybe that’s not quite the next Bitcoin, but hey, progress is progress.

Kevin Boon, President of Mysten Labs, summed it up nicely:

“The NASDAQ filing is a big moment. We’re proud to help 21Shares make SUI accessible to every investor.”

So, yeah, the future’s looking bright… as long as we’re not talking about the hack, of course.

Altcoin ETF Summer, or Just a Cool Breeze?

The idea of a "broader Altcoin ETF Summer" is gaining steam, and Bloomberg analyst Eric Balchunas is taking a keen interest. But let’s not get ahead of ourselves. “The further you get from BTC, the less assets there will be,” says Balchunas. Ouch. Reality check.

Still, Osprey’s Solana filing could push the SEC into speeding up decisions on altcoin ETFs, so who knows? Maybe it’ll be a hot summer after all.

Meanwhile, the SEC has delayed a decision on the Hedera ETF, extending the comment period. What’s that? Do they need more time? Yeah, sure, take all the time you need, SEC.

In any case, whether or not Sui makes it to the big leagues of mainstream finance remains to be seen. But the demand? It’s looking pretty ready.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource, and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice. HODL FM strongly recommends contacting a qualified industry professional.