A wallet address linked to Tron founder Justin Sun came under scrutiny Thursday after being blacklisted by World Liberty Financial (WLFI), just days after the token began public trading. On‑chain data from Arkham and Nansen shows the blacklist designation followed the movement of around $9 million worth of WLFI tokens to crypto exchange HTX.

🚨 Justin Sun claims his $WLFI tokens were “unreasonably frozen” and is urging the team to unlock them.

— HodlFM Team (@Hodl_fm) September 5, 2025

He argues that early investors deserve equal rights and that freezing tokens violates the legitimate rights of investors. pic.twitter.com/5WATloRyxb

Sun denies selling tokens

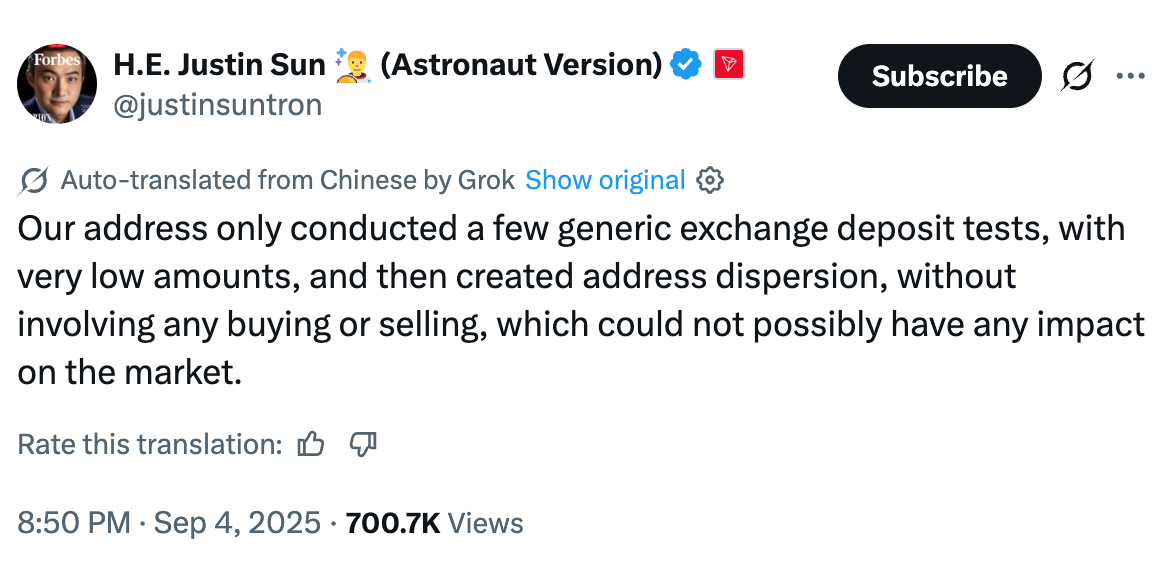

Speculation grew that WLFI was restricting Sun from selling tokens to prevent added price pressure. Sun, however, responded on X in Mandarin, saying the transfers were only “routine deposit tests with very small amounts” before redistributing to another address.

He emphasized that there was no buying or selling involved and that the movements “could not possibly have any impact on the market.” Sun has previously said he has “no plans to sell unlocked tokens anytime soon,” describing himself as aligned with WLFI’s long‑term mission.

Excited to share my thoughts on $WLFI — I truly believe this will be one of the biggest and most important projects in crypto. 🦅

— H.E. Justin Sun 👨🚀 (Astronaut Version) (@justinsuntron) September 1, 2025

We have no plans to sell our unlocked tokens anytime soon. The long-term vision here is too powerful, and I’m fully aligned with the mission.…

Analysts weigh in

Blockchain analysts have been divided over the situation. Nick Vaiman, co‑founder and CEO of Bubblemaps, said he did not believe Sun moved tokens with the intention of selling.

“He barely moved funds to centralized exchanges, and this morning’s transfers were just from one address to another,” Vaiman said, adding that Sun’s explanation appeared genuine.

Another Bubblemaps researcher, the pseudonymous Deebs, noted that the cited $9 million transfer was “simply a transfer to another wallet under his control. He did not send those funds to an exchange (yet).” Still, analysts cautioned WLFI may have internal conditions for early investors, like token lockups, that could explain the blacklist.

WLFI price action and supply moves

WLFI launched trading on Monday as part of a decentralized finance project tied to U.S. President Donald Trump. The token briefly reached about $0.32 before sliding sharply below $0.18 by Thursday, down more than 22% on the day, according to CoinMarketCap.

In response, WLFI moved to shore up market confidence. On Wednesday, the project burned 47 million tokens in an effort to reduce supply, though total circulating supply still stands at nearly 99.95 billion tokens. The team has also floated a buyback program funded by protocol fees, with all repurchased tokens earmarked to be burned.

Exchange data shows WLFI trading has been especially active in South Korea, particularly on Upbit and Bybit, while retail investors globally have experienced volatile swings in its first week of trading. Myriad prediction markets suggested widespread skepticism, with users betting the token would see red within its first 69 hours of activity.

Retail vs. early investors

Early presale participants, including Sun, bought WLFI at just $0.015 per token (around a $1.5 billion valuation). Even after the latest declines, that price still leaves them sitting on gains exceeding 10x.

By contrast, retail buyers who entered the market near its $0.33 peak are currently sitting on losses of around 45%, underscoring the risks of early‑stage speculative tokens. Analysts at Compass Point last week flagged WLFI as “another catalyst that could potentially decimate retail traders.”

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource, and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice. HODL FM strongly recommends contacting a qualified industry professional.