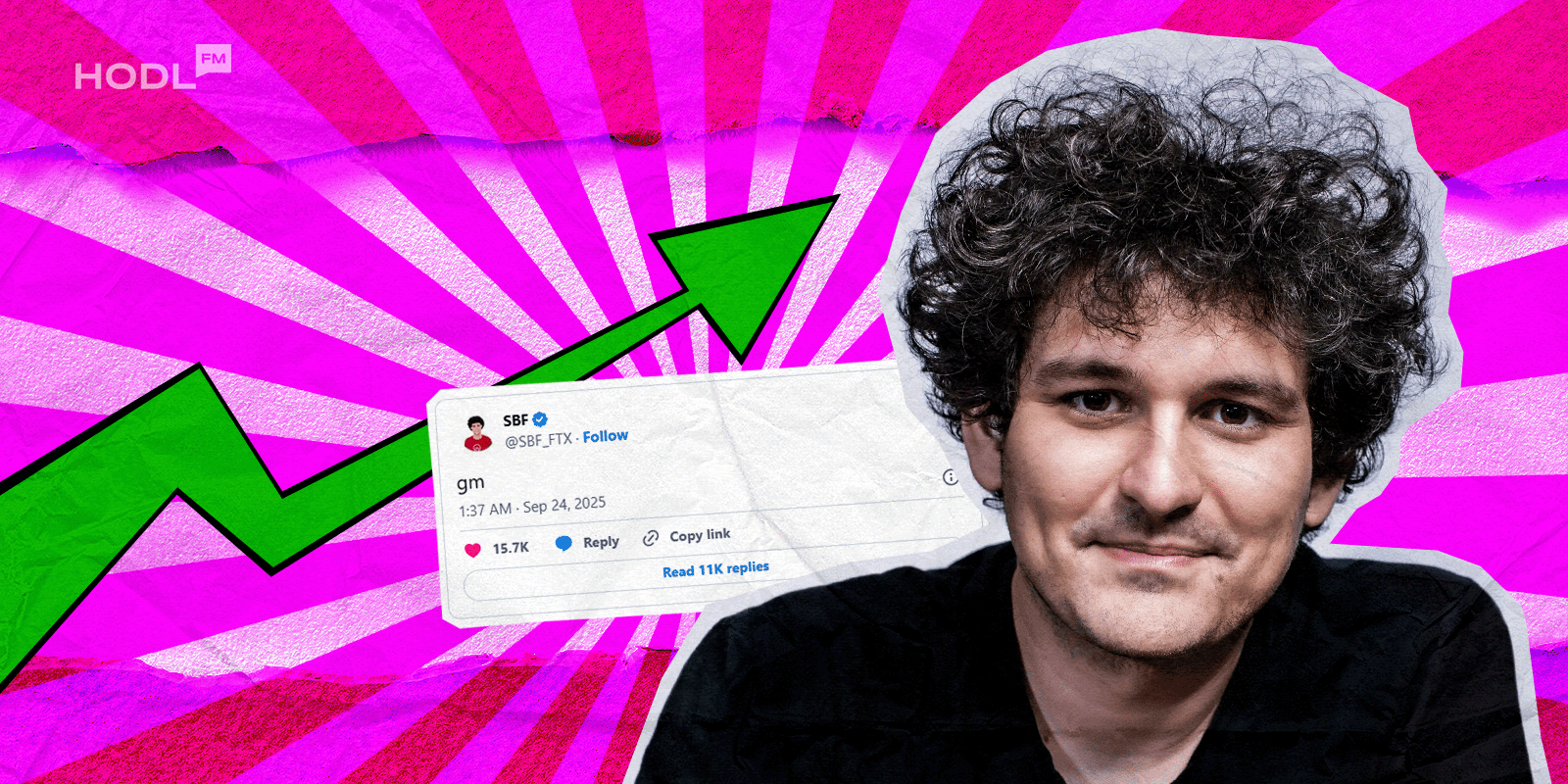

The embattled FTX token FTT staged a sharp rally this week, briefly jumping more than 30% after a single word appeared on Sam Bankman-Fried’s verified X account.

“gm” post triggers trading flurry

On Sept. 23, Bankman-Fried’s account posted the brief message "gm", shorthand for "good morning." The account later clarified that the post was made by a friend managing the account, as Bankman-Fried remains in prison serving a 25-year sentence at FCI Terminal Island.

[No, SBF is not posting himself from prison. I'm a friend posting on his behalf.]

— SBF (@SBF_FTX) September 24, 2025

Despite the clarification, the token surged. FTT climbed to an intraday peak between $1.20 and $1.23, before easing back near $0.97-$1.05 as traders locked in gains.

Trading volumes spike sharply

The move came with a major uptick in trading activity:

- Spot trading volume increased 281% to $49.6M in 24 hours (CoinGecko).

- Derivatives open interest rose 38% to $3.3M (Coinglass).

- Futures volume jumped more than 1,300%, hitting $30.3M (Coinglass).

These numbers highlight significant speculative inflows, often associated with higher volatility in both directions.

Technical analysis

- FTT briefly broke above the upper Bollinger Band at $1.05 before retreating.

- The RSI cooled to 54.7, shifting back into neutral territory.

- Short‑term EMAs (10, 20, 50‑day) sit below the current price, providing near‑term support.

- The 100‑day EMA stands at $0.92, with the 200‑day EMA at $1.10 acting as overhead resistance.

Support levels: $0.90, $0.80, and $0.70.

Resistance levels: $1.05 and $1.20.

Momentum indicators gave mixed signals, with the MACD showing a buy pattern, while the momentum oscillator and CCI suggested exhaustion.

Market sentiment remains divided

Reactions within crypto communities varied widely, including memes referring to "pumping from prison" and criticism from those who lost funds in the FTX collapse. Many highlighted that FTT no longer has practical utility since the exchange’s 2022 bankruptcy and functions now only as a speculative asset tied to headlines.

Context: Ongoing FTX bankruptcy

The price jump coincided with developments in the FTX legal process. On the same day, the FTX Recovery Trust filed a $1.1B lawsuit against Genesis Digital Assets. Creditors also expect the third major payout by Sept. 30, valued at $1.6B.

Court filings show legal and advisory fees related to FTX bankruptcy proceedings are nearing $1B, making it one of the costliest crypto insolvencies on record.

Outlook and risks

Despite being up more than 20% over the past week, FTT remains down 99% from its $84.19 all‑time high in 2021. Current trading is highly sensitive to social signals around Bankman-Fried rather than fundamentals.

Disclosure & Risk Warning: Sources are from CoinGecko (spot data), Coinglass (derivatives), TradingView (charts), CoinMarketCap (price history), posts from Bankman-Fried’s verified X account (Sept. 23, 2025). The author holds no position in FTT. FTT has no functional role since FTX’s collapse and is considered a highly speculative asset. Price moves remain driven by sentiment and social media activity, not fundamentals. Investors risk total loss of capital. Trading volatile crypto tokens with leverage involves heightened risk. This article is informational and not investment advice.