Everything comes to an end, even the good ones, and it seems Ethereum layer-1 networks might be joining that lot very soon. Ethereum’s Layer-1 networks were once all the rage, but recent numbers have shown that the rage has died down—and it has died down by a whole lot.

More: What is Ethereum? Explainer

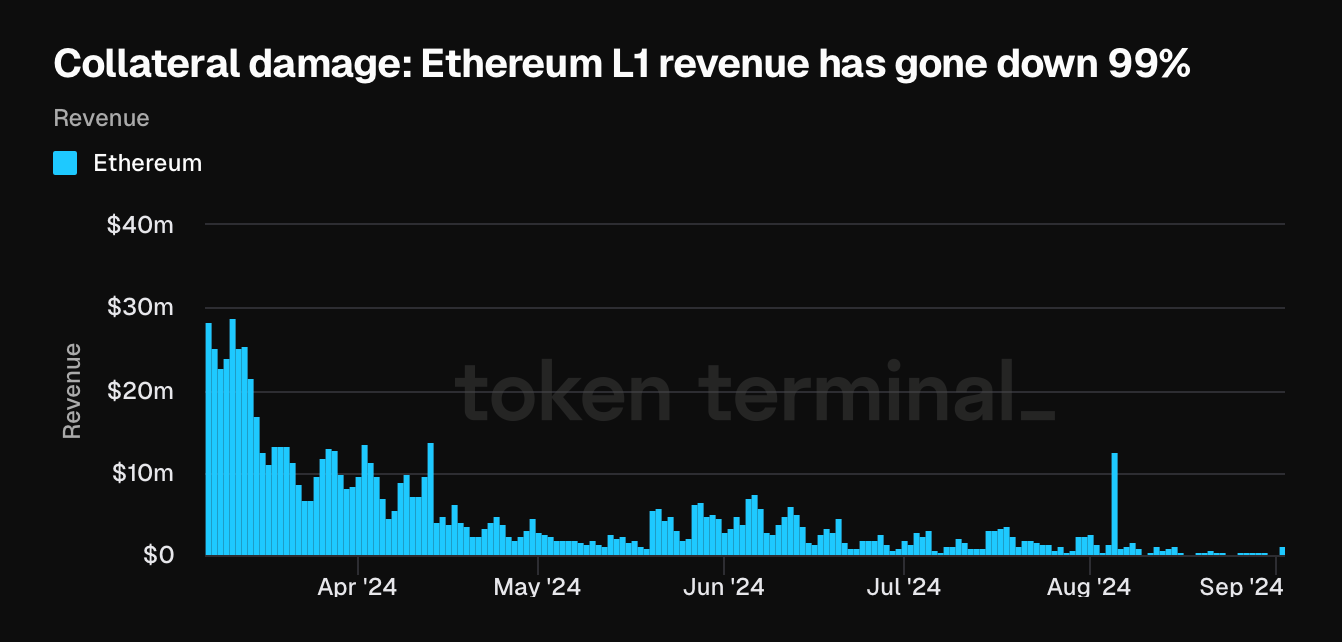

Recent numbers show that the once famous Ethereum layer-1 network revenue has plummeted by an unbelievable 99% since March 2024. This number is shocking enough, but it is even more surprising to see it happen despite the dramatic increase in monthly users on the newer Layer-2 networks.

#Ethereum layer-1 network revenue has dropped by 99% since March 2024 due to the #Dencun upgrade, which significantly reduced transaction fees for layer-2 solutions.

— TOBTC (@_TOBTC) September 3, 2024

The resulting competition among layer-2 networks has driven users away from the Ethereum base layer, further… pic.twitter.com/q6SfB5Fvfk

However, the reason for this speedy switch to L2 networks may not be as far-fetched as one might imagine. Data revealed by Token Terminal has shown that the fees for Ethereum L2 transactions have significantly reduced since the Dencun upgrade went live on March 13, 2024. The upgrade saw fees cut down to $566,000 on Aug. 31, which is significantly low compared to the March 5, 2024 levels of $35.5 million.

This impressive price beatdown of Ethereum L2 fees initiated by the Dencun upgrade was also the key factor behind the sudden explosion of many L2 scaling solutions into the ecosystem. According to data provided by L2Beat, there are now 74 Ethereum L2 scaling projects and 21 Layer-3 projects.

But while competition and choice are good and encouraged in the market, Adrian Brink, CEO of Anoma, has said that the number of L2 scaling solutions available at the moment is way more than the market requires. He believes the market currently has ten times more L2 scaling solutions than it needs.

The obvious disadvantage of so many competing L2 scaling solutions existing in the market at the same time is that demand is greatly reduced. That leaves the service providers with no option but to lower their prices to attract users, which is exactly what happened.

But as good as lowered fees sound, it also has one major drawback for Ethereum. The reduction in fees inevitably translates into lower demand for Ether, the native cryptocurrency required to pay for transactions on the Ethereum blockchain. This has caused the supply of ETH to grow steadily ever since the deployment of the Dencun upgrade went live.

Ethereum fees were down $679m in Q2 (57%), while the network turned inflationary. If you want to understand why, you need to understand this chart.

— Michael Nadeau (@JustDeauIt) August 6, 2024

Here's what's going on:

Ethereum Improvement Proposal (EIP) 4844 was implemented on March 13th. It was the most important network… pic.twitter.com/TQZ16ERVwk

The Dencun deployment and the low trading costs it has caused are so great that analysts have even attributed ETH’s price trading below $3000 to it. So it seems it’s not only Layer-1 networks on Ethereum that are affected by the recent dominance of L-2 networks. Even Ethereum itself is taking a huge hit from it.

Related: Ethereum Analysis - How Ethereum Performed this Week?

So far, so good; it seems things will stay as they are. There has been no mention of reducing the number of scaling solutions available in the market. But at the same time, if things don’t change, Layer-1 networks may not survive this wave of Layer-2 network dominance.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL FM strongly recommends contacting a qualified industry professional.