The crypto market has been flashing signs of recovery over the past few months, reigniting the age-old question: are we entering a new altcoin season? Historically, capital tends to flow into altcoins after Bitcoin's bull run, often resulting in their prices outpacing the leading cryptocurrency. So, is there still a chance we won’t miss this altcoin season?

Total3 Index – A Signal for Altseason?

The Total3 index, which tracks the market cap of all cryptocurrencies except Bitcoin and Ethereum, has recently hit levels not seen since April 2021, rising by an impressive 23.2%. This surge often signals the dawn of an altcoin season, and right now, it’s making quite the case for itself.

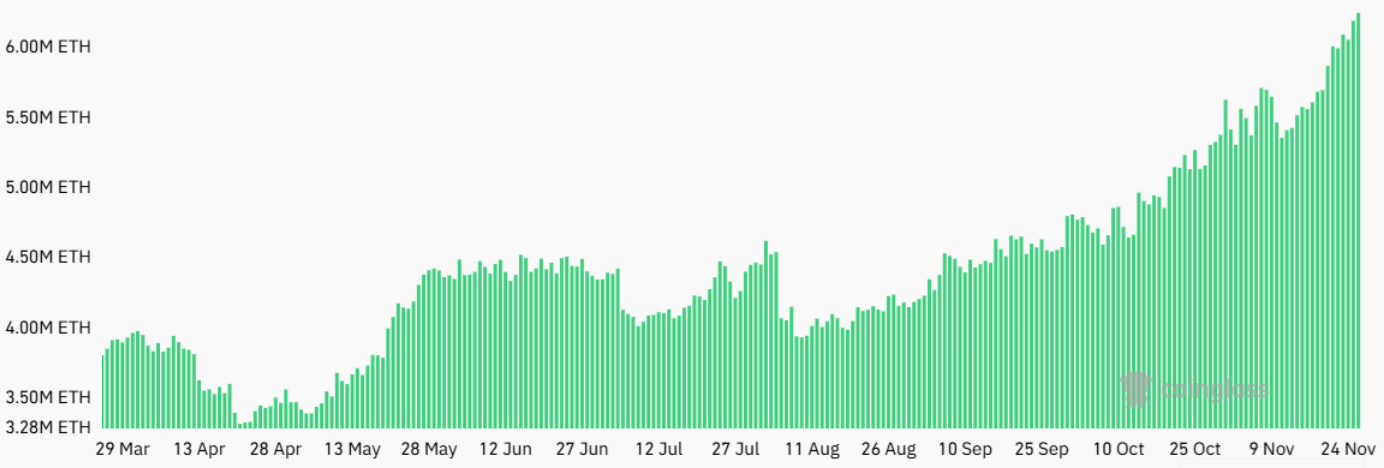

The resurgence of FOMO among retail investors remains a key driver for altcoins, especially the low-cap variety. Signs of this are already emerging: the aggregate open interest in Ether futures jumped 23% over 30 days leading up to November 27, reaching $22 billion, which could push other crypto assets higher.

The altcoin market cap is inching closer to its all-time high of $984 billion, set in May 2021. Big hitters like Solana particularly notable, with SOL reaching fresh all-time highs. This surge points to speculative capital flowing out of Bitcoin and into altcoins, accompanied by increased interest from retail traders.

However, BitFinex experts warn that high activity in large altcoins often comes with heightened volatility and a higher likelihood of corrections.

Along with them, CryptoQuant Founder and CEO Ki Young Ju warns that “not every altcoin will hit its previous ATH.”

Don't get me wrong, I'm bullish on altcoins. Just pointing out that only a select few attract fresh capital. Altcoin season will come, but it’ll be for a few, not every altcoin will hit its previous ATH.

— Ki Young Ju (@ki_young_ju) November 27, 2024

The Issue of New Capital Inflows

Despite positive indicators, Ki Young Ju points out a key problem: altcoins lack fresh capital. Institutional funds are focused on Bitcoin ETFs and other instruments, while new retail investors are not yet showing significant interest.

Altcoins need to focus on developing independent strategies to attract new capital rather than relying on Bitcoin’s momentum.

The lack of liquidity from new users keeps altcoin market capitalization below its all-time high. The unstable economic situation in the U.S., including rising inflation expectations and reduced activity in certain sectors, could also affect investor sentiment.

Experts Divided on the Current Altcoin Season

Optimists, to which we can hardly, but can include Ki Young Ju, highlight increased market activity, new highs, and retail investor interest as signs of renewed growth.

Skeptics, such as popular trader Willy Woo, argue that the new altcoin season differs from previous ones. While past cycles were driven by innovations like DeFi and NFTs, the market now resembles a meme-fueled casino bubble, far from technological revolutions.

I haven’t talked about altcoins in years, I quit my interest in them after the “shit rolls downhill chart” mapping the performance of 10,000 of them. But someone asked me specifically and this is how I see altcoin market cap…

— Willy Woo (@woonomic) October 26, 2024

This cycle has been markedly different from others.…

Each new cycle is weaker than the last, and expecting an altcoin season like 2017 is unrealistic. Retail investors are beginning to understand the nature of these assets, but risks remain high.

Woo notes that altcoins are “an insider’s game where the house always wins,” with their market capitalization often misleading, based only on successful projects. Trading them is one thing, but holding them long-term is extremely risky.

Altcoin season is not just a time of price growth but also a period of heightened risks. Success requires support from retail traders and independent growth strategies from individual projects.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL FM strongly recommends contacting a qualified industry professional.