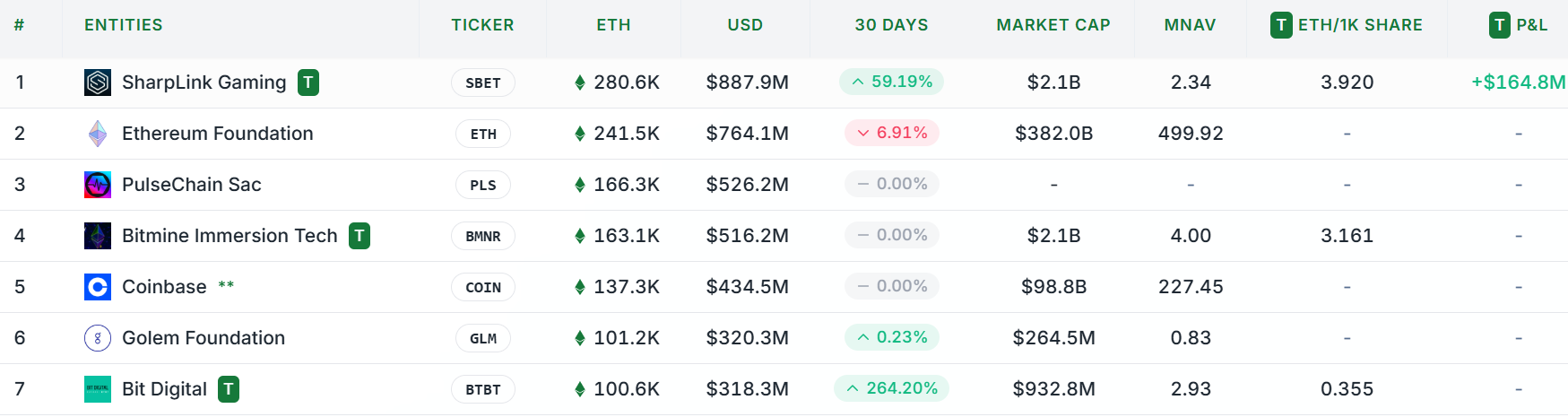

SharpLink Gaming is now officially the biggest corporate holder of Ethereum, outpacing the Ethereum Foundation, because why not go big or go home, right?

On July 15, SharpLink revealed it owns a jaw-dropping 280,706 ETH, which is worth a cool $867 million. And that’s not all, between July 7 and July 13, the company scooped up a staggering 74,656 ETH for $213 million at an average price of $2,852 per coin. Now that’s some serious crypto shopping!

Here’s the kicker: 99.7% of these Ethereum holdings are staked, earning an extra 415 ETH since June 2. So, while most of us are still trying to figure out how to stake, SharpLink’s ETH stash grew by a solid 23% since June 13. Looks like they’ve figured it out.

Joseph Lubin, Chairman of SharpLink, couldn’t resist calling this a moment of “collective capitalism,” where businesses aren’t just making bank, but are also building for the community. He made it clear that Ethereum’s decentralized, permissionless nature is key to creating free markets.

He proudly declared:

“Collective capitalism is built on the foundations of radically free markets only possible on a permissionless, uncensorable, rigorously decentralized Layer 1 blockchain.”

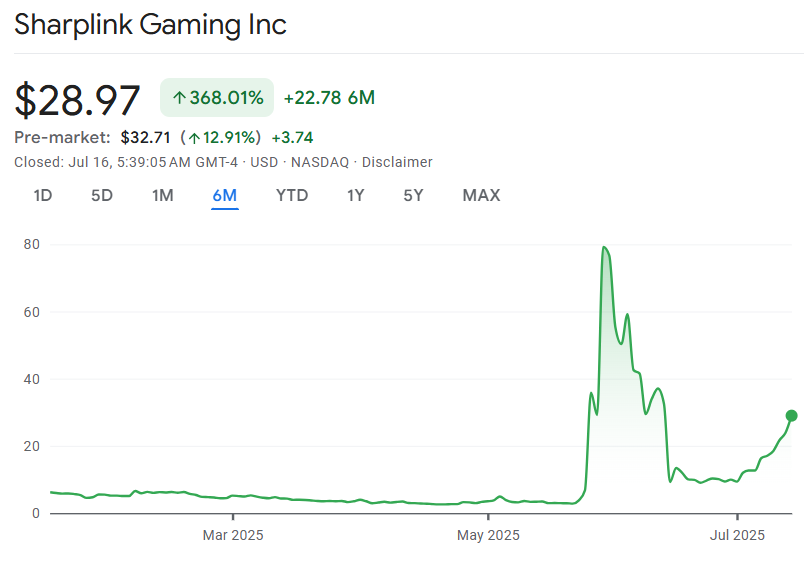

Sounds pretty lofty, doesn’t it? And guess what? SharpLink’s stock shot up by 20%, hitting $28 after this big reveal. Looks like the market likes what they’re selling.

The Ethereum Treasury Strategy Gains Momentum

SharpLink’s move isn’t just a solo act. It’s part of a bigger trend of companies adopting the Ethereum Treasury Strategy. Over the past 30 days, about 10 companies (including SharpLink) have bought more than 550,000 ETH, totaling $1.65 billion in acquisitions. Not too shabby.

Some of these companies were Bitcoin miners, like Bitmine Immersion Technologies, who’ve now decided Ethereum is the better digital asset. Smart move, honestly.

Kyle Reidhead, co-owner of Milk Road, predicts this trend is just getting started. Firms might drop up to $2 billion on ETH in the next month and $3 billion the month after. With stablecoins growing and favorable regulations on the horizon, Ethereum could soon become the star of the show.

The demand for $ETH right now is insane@SharpLinkGaming alone has bought more than 75k $ETH ($225m USD) in the last 5 days 🤯

— Kyle Reidhead | Milk Road (@KyleReidhead) July 14, 2025

In the last 30 days, 10 ETH treasury companies have bought more than 550,000 $ETH ($1.65 BILLION USD)

And these numbers are accelerating!

This means… pic.twitter.com/VGmf5JWDul

As of now, about 1,520,715 ETH (worth over $4.5 billion) is locked up in Ethereum reserves belonging to 52 companies. These holdings represent 1.31% of the total ETH supply. So, get ready for an ETH supply shock, it’s coming!

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource, and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice. HODL FM strongly recommends contacting a qualified industry professional.