On October 30, Ethereum’s price surged to $2,700, marking its highest point in ten days. But a strong pullback on October 31 took it down to $2,550. However, the bear days for this altcoin may be nearing their end, as a technical analyst suggests Ethereum's final drop is behind us and greener days are ahead. The charts are hinting at an incoming rally up to $2,800.

Independent trader Poseidon believes Ethereum has already weathered its "final dip" over the past weekend. He explained that ETH regained its 200-day EMA on the 8-hour chart, and the weekend’s drop was merely a "bear trap/fake-out."

$ETH

— Poseidon (@CryptoPoseidonn) October 29, 2024

A beautiful impulse move during the night. I told you not to hesitate below $2500 and that this would be the final dip, though I'm sure most didn't listen. I’ve moved the stop up to the latest higher low, around $2350, and the target remains the same.

The price has… https://t.co/HZxBTqzzyx pic.twitter.com/BbYBngLpdE

What's Weighing Down Ethereum's Price?

A rather lukewarm interest from both retail and institutional investors is adding pressure on Ether. On October 30, the new ETH ETF saw a modest inflow of $4.4 million, a fraction compared to the $893 million inflow into Bitcoin ETFs, just about 0.49% of its larger rival.

🎉 BTC #ETF saw an inflow of $893.3M today, with BlackRock contributing a massive $872M in a single day.

— Spot On Chain (@spotonchain) October 31, 2024

Similar to yesterday's inflow, this marks one of the largest inflows since launch, with BlackRock setting a new record for the highest inflow ever.

BTC's price has remained… pic.twitter.com/2a3XgVrm1I

Joe Consorti, a Bitcoin advocate and creator at Theya Inc., pointed out that Ethereum ETFs in the U.S. haven’t garnered much investor enthusiasm. In stark contrast, Bitcoin-based funds attracted $3.3 billion in a single week!

Spot Ethereum ETFs since July launch:

— Joe Consorti ⚡️ (@JoeConsorti) October 29, 2024

-$3.3 billion

Spot Bitcoin ETFs since last week:

+$3.3 billion

Wall Street wants nothing to do with ETH and everything to do with BTC. pic.twitter.com/Jgu6PdsTAg

As for what it’ll take to see Ether hit $2,800, or maybe even retake $3,000, the answer likely lies in a combo of reduced transaction fees, wider institutional acceptance, and juicier staking incentives for ETH holders.

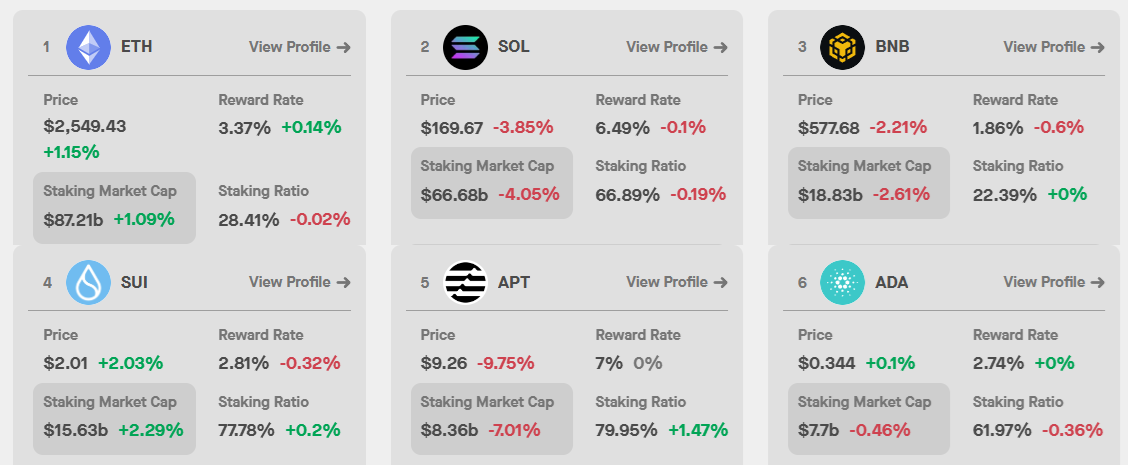

The ongoing debate centers around balancing the demand for low-cost transactions with ensuring attractive staking rewards for Ethereum. Currently, Ethereum’s transaction fees remain static. According to StakingRewards, ETH staking rewards sit at 3.4%, compared to Solana’s 6.5% and Tron’s 4.5%.

Ethereum’s path to $3,000 leans heavily on institutional uptake, which is partly blocked by the SEC’s stance, halting spot Ethereum ETF applications that could rely on staking strategies.

Additionally, Ethereum now faces issues with rising supply and a bit of “layer-2 over-optimization,” which, while useful for scaling, could compromise security sustainability. So, ETH’s stable growth may require significant adjustments in network structure.

Could the Reddit Selloff Put Pressure on Ethereum?

One of the more unexpected players in Ethereum's price woes might just be Reddit, which recently decided to part ways with most of its crypto holdings in Q3. According to an SEC filing, Reddit sold off its stash of Bitcoin and Ether, assets that were once kept "for treasury purposes."

This crypto sell-off marks a shift for Reddit, distancing itself from a digital asset market it once viewed as promising. Offloading around $6.9 million in cryptocurrency, including Ethereum and Bitcoin, suggests Reddit is adopting a more conservative balance sheet strategy.

Interestingly, the sale wrapped up in Q3, meaning Reddit completely missed out on the infamous “Uptober” — that time of year when crypto tends to rally, and Bitcoin reached its monthly high.

This cautious move hints at a waning interest in crypto investments, possibly signaling risks or volatility to the broader market. Such a step by a major player like Reddit undoubtedly piles on more pressure for Ethereum, which is already grappling with its own market struggles. Reddit’s retreat may just be one more weight holding back ETH’s potential growth.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL FM strongly recommends contacting a qualified industry professional.