This is HODL FM, where we break down tough market insights and put them in a cookie jar for you to snag one-by-one.

Uptober is here but before that, let’s look how it’s going for ETH.

More: Ethereum ETFs took More ETH than Their Debut

Uptober is just 8 days away. pic.twitter.com/ChWwSnF0He

— Ash Crypto (@Ashcryptoreal) September 22, 2024

This is what could happen to ETH in the upcoming days:

- Bullish Theory: A breakout above $2,850 suggests defeating the bears and triggering a climb to $3,400.

- Bearish Theory: There is alot of selling near the overhead resistance of $2,850, which is likely to trigger indecision at the current level of $2,622.

It turned out whales on Ethereum have been dumping ETH like a fashion sense that just went out of style.

Over the past week, these big players have been selling off their spot positions but this hasnt scared Ether’s price which is still flexing its bullish muscles at $2,622.

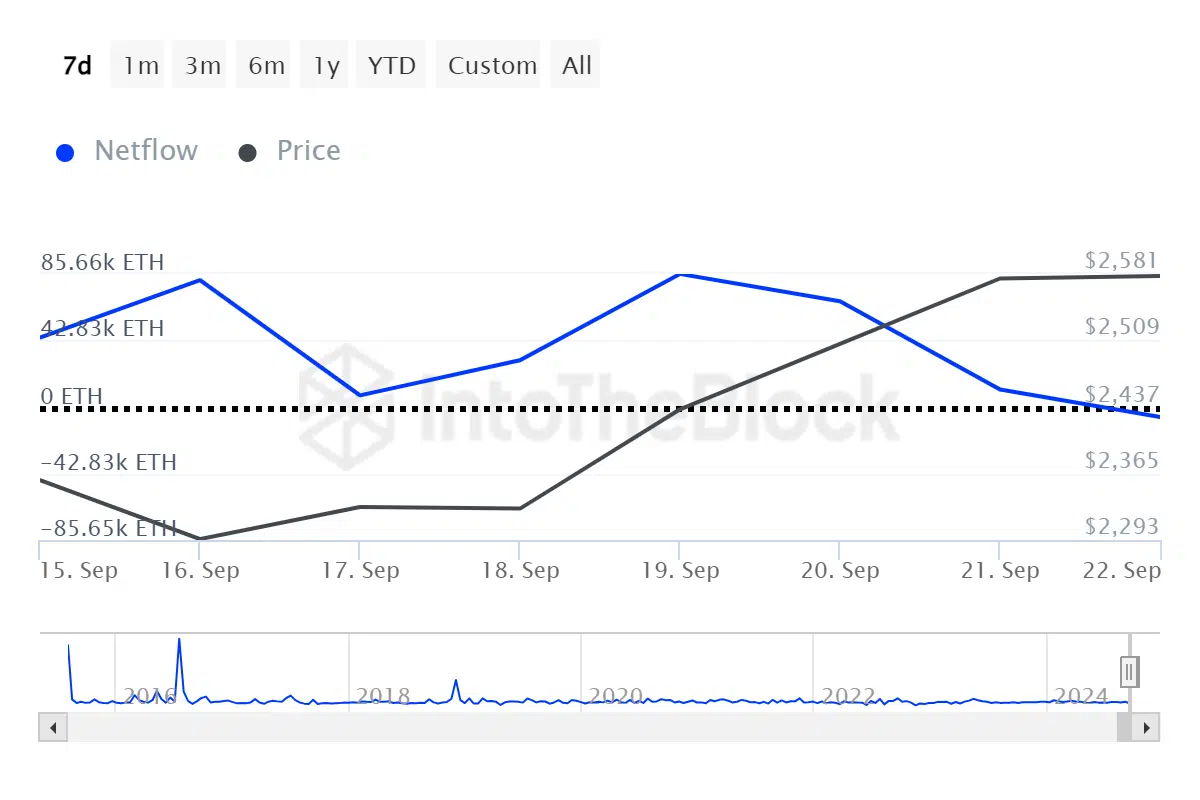

On-chain detectives at IntoTheBlock suggest these whales went from throwing 85,650 ETH (inflows) into the market on September 19 to yeeting 6,420 ETH (outflows) back out by September 23.

The data indicates a notable sell-off from Ethereum whales just as the asset's price rebounded from $2,300 to $2,400 on September 19.

Interestingly, the recent bullish momentum seems to be driven more by retail traders rather than large holders.

According to data from IntoTheBlock (ITB), Ethereum experienced a significant net inflow of 150,690 ETH into centralized exchanges on September 19. However, this influx quickly tapered off.

Over the past week, a total of approximately $480 million in ETH has flowed into centralized exchanges, signaling a shift in market behavior.

The large holder to exchange net inflow ratio indicates that retail traders have been leading the charge over the weekend, pushing Ethereum’s price higher.

Despite the whales offloading their holdings, ETH still managed to climb an impressive 15% over the past seven days.

In the last 24 hours alone, the leading altcoin is up 2.2%, now trading at $2,640.

Earlier today, Ethereum hit a local high of $2,685, its highest level in a month, as on-chain signals continue to flash bullish momentum. It’s clear that retail traders are holding their own in this rally as they solidify their position in readiness for ‘Uptober.’

God, please give me a sign pic.twitter.com/NKA6BmU3G4

— naiive (@naiivememe) September 25, 2024

Uptober For Bulls

Historic price data shows September has always been a bears month with majority of the crypto markets trading at lower levels.

On the other hand, the months between October and March have always brought in fever-pitch bullish momentum with past data showing it’s the time when all the bull markets started.

For Ethereum, Julien Bittel who heads Macro Research says it could reach $20,000 in the next bull market considering its present technical structure which resembles previous trends in 2023.

As per Bittel, ETH has exhibited consistent accumulation which is likely to trigger a strong breakout and rally towards staggering levels.

Short-Term Price Predictions

In the short-term, ETH/USDT pair could dip toward the moving averages—a level traders will be keeping a close eye on.

If the price bounces back from those moving averages with some real momentum, we could be looking at a potential breakout above $2,850. In case of such a breakout, it would signal that the downtrend might finally be over, with a chance for the pair to climb up to $3,400.

However, if the price drops and breaks below the moving averages, it could point to the formation of a symmetrical triangle pattern.

This would suggest some serious indecision between the bulls and bears, meaning the market could stay in a wait-and-see mode for a bit longer.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL FM strongly recommends contacting a qualified industry professional.