Welcome to the blockchain boxing match! In the left corner, sporting blue shorts, we have Solana. And in the right corner donning red shorts, its opponent – Ethereum. The second is a true heavyweight, confidently ruling the ring since 2015 under the stern guidance of Vitalik Buterin. The first contender, a bit younger in ring years, only made a name for itself in 2017. Nevertheless, that hasn’t stopped it from feeling at home in the ring and taking on seasoned players with gusto!

Hold off on betting solely on the more experienced fighter just yet, because there are surprises hidden in their gloves that could snag the win in this match. We’ll peek into what they’re made of, how they keep things safe, explore the hurdles they face, and how they tackle them. Plus, we’ll check out how much each of them loves their fans and sneak a peek at their post-match plans. Get ready for the legendary blockchain comparison!

Background

Let the showdown begin! In this first round, our contenders are all revved up, eager to flaunt their strongest suits.

Solana’s Key Features and Strengths:

- Scalability. Solana can handle up to 65,000 transactions per second, leaving Ethereum’s current 15-30 TPS in the dust.

- Fees. We’re talking pennies here, making it super friendly for regular users and those small transactions that often get sidelined.

- Unique Consensus Mechanism. Solana’s got a cool mix with its Proof of History (PoH) and Proof of Stake (PoS).

- Dev-friendly vibes. SOL blockchain rolls out the red carpet for developers, offering a slick, user-friendly environment powered by the Rust programming language.

Read More: Solana’s DEX Faces Million-Dollar Exploit

Ethereum’s Key Features and Strengths:

- Ecosystem. Ethereum’s got this whole mature and diverse ecosystem with a bunch of dApps, DeFi setups, and established standards.

- Smart Contract Simplicity. Blockchain speaks the language of Solidity, and it’s all about flexibility. This PL is super adaptable and ready for complex applications.

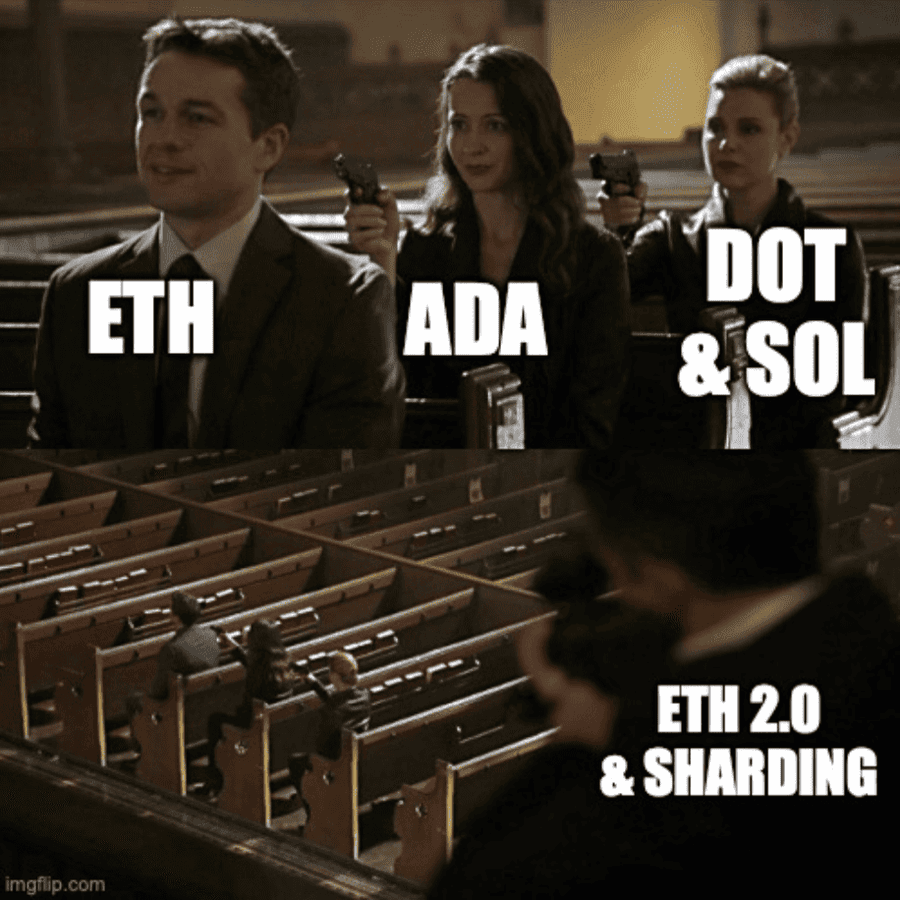

- Updateability. Ethereum 2.0 is already in action, tackling scalability and energy worries.

Technology and Architecture

Round one’s done, and here comes a cutie parading around the ring with a sign that says “Round Two.” Let’s take a closer peek at their endurance and muscularity.

Solana’s architecture

Hybrid Consensus Mechanism, as we mentioned above, is a combo of Proof of History (PoH) and Proof of Stake (PoS). PoH’s like the timekeeper without the energy drain, ensuring lightning-fast transactions. Meanwhile, PoS rewards those validators flexing their SOL tokens.

Tower BFT is the peacekeeper, making sure validators see eye-to-eye on transactions even if a few nodes decide to take a break. It is letting a whole bunch of transactions cruise through different parts of the network simultaneously, all for that need for speed!

Ethereum’s architecture

Ah, Ethereum’s got its own computer, the Ethereum Virtual Machine (EVM). It is running those smart contracts and giving developers a playground with Solidity.

But here’s the deal: all transactions on Ethereum mess with this one huge global state. This might slow things down when a lot is happening on the network.

Scalability

Watch out as these heavyweights strut around the arena, gearing up for the next round. Ready yourself for an in-depth glimpse at cryptocurrency scalability and agility.

Solana’s Approach to Scalability

Sealevel (Parallel Processing Engine) batching transactions and hustling them through validator graphics processing units (GPU) all at once. Imagine a factory assembly line where each step occurs simultaneously.

Then there’s PoH, the timekeeper without the power drain. Validators use this slick clock to timestamp transactions, speeding up the validation without needing everyone to nod in agreement.

Solana’s got this distributed ledger called “Verifiable Delay Function (VDF).” Think of it as the secret vault spread across validator nodes, securing transaction data while keeping storage stress at bay.

Ethereum’s Scalability Challenges

Ethereum’s block size is capped, kind of like fitting Tetris blocks into a predetermined space, limiting the transactions that can hustle through in a set time. Besides, every move on Ethereum updates this one grand state, creating a traffic jam for scalability.

But Ethereum has a game plan!

This mega Ethereum 2.0 upgrade that happened last year is a facelift with a transition to Proof-of-Stake (PoS), a more scalable consensus mechanism than the previous PoW setup. Plus, Ethereum’s toying with sharding to spread the workload across validator shards, a move aimed at turbocharging transaction throughput.

Decentralization and Security

Fighters both aim for decentralization and security in blockchain, but each has its unique kick.

Solana’s Decentralization Model

Check out Solana’s Delegated Proof-of-Stake (DPoS). Token holders handing over their voting power to a posse of validators, currently about 2,050 strong. These chosen ones, based on their stake size, handle transactions and keep the network in check.

Limited validators mean smooth sailing for transaction processing and network expansion. Fewer expenses mean cheaper transactions for users. It’s like getting a luxury service at bargain-bin prices. And DPoS means quicker confirmations than Ethereum’s Proof-of-Work (PoW) model.

Ethereum’s Decentralization Model

With PoS strutting its stuff, Ethereum’s opened its doors wider. More folks get to play validator, theoretically beefing up the decentralization in blockchain technology.

Yet, there’s drama in the wings about the distribution of ETH and potential centralization among large token holders. Initiatives like “staking pools” and liquid staking derivatives aim to democratize access to staking and dodge this centralization bullet.

Use Cases and Adoption

Round fifth’s in the books, and here they come strutting into the arena for the next fight. Prepare for an up-close look at their prowess in adoption and use cases.

Solana Use Cases:

- DeFi on Solana. Swift loans and trading, like a flash sale for money matter.

- NFT Express. Minting and trading NFTs at lightning speed, attracting artists and collectors.

- Gaming Speedster. Instant in-game buys and low-cost fun, leveling up the gaming world.

Ethereum’s Dominant Use Cases:

- dApp Central. It’s the hotspot for diverse dApps – DeFi, social hubs, NFTs on Ethereum – you name it.

- Smart Contract Hub. Ethereum’s Solidity language is the place for fancy contract action and complex financial tools.

- Corporate Attraction. Big shots love Ethereum for secure business plays—supply chains, IDs, you name it.

- ETH Bling. Ether is not just a coin, it’s a swanky store of value, drawing in investors and hype.

Community and Ecosystem

The bell rang for round six, and now, here they are, back in the ring, ready for the next round.

Solana’s Growing Community

Solana’s like that popular party spot for developers—it’s all about the speedy transactions and roomy scalability. Picture a bustling hangout with DeFi hotspots, NFT art galleries, and gaming arenas.

Now, here’s the backstage crew, the Solana Foundation, for paving the way for growth and innovation. Grants, funding, and all sorts of support go toward leveling up Solana’s speed, security, and user-friendliness.

Ethereum Community

Ethereum’s got this tight-knit community that’s been hanging around since way back when. They practically wrote the book on smart contracts and now boast a colossal ecosystem. It has become a DApps with lending, market-making, and even some farming (the yield kind, not the hay kind).

Big shots like Uniswap and Aave rose up in this Ethereum hood, adding major street cred to its name in the Web3 scene. Also Ethereum’s collaborations with the big leagues ConsenSys, Chainlink, and Ethereum Enterprise Alliance (EEA) drive its fame and growth.

Future Developments

Solana’s got some big plans and fancy upgrades in the works:

Token-22 is stealing the spotlight, making way for secure payments and slick ownership transfers. Then there’s Anchor, playing the smart contract maestro using Rust on Solana. Also, they’re cooking up a fresh consensus algorithm to turbocharge the network. Updates will make it Fort Knox-level secure and faster. And finally, Solana trying to be everyone’s friend by mingling with other platforms like Ethereum and Polygon.

According to Ethereum’s blockchain roadmap, they’re constantly eyeing improvements in four key areas:

- Wallet-Friendly Transactions. No more pricey deals. Rollups, although snazzy, can burn a hole in your pocket.

- Extra Security. They’re beefing up the defenses, making it ready to take on anything the future of blockchain throws its way.

- Better User Vibes. Think smart contract wallets and light-weight nodes swooping using as easy and safe as ordering pizza.

- Future-Proofing. Solving tomorrow’s problems today to set up the stage for the next generations.

Conclusion

In the ring, Solana and Ethereum bring unique moves and strengths. Solana boasts blazing transaction speed and minimal gas fees in cryptocurrency, while Ethereum flexes its established ecosystem and smart contract prowess. The boxer in blue shorts taps into scalability with its hybrid consensus, while the red shorts’ player evolves with upgrades like Ethereum 2.0 and sharding.

In the showdown Solana vs. Ethereum, the winner comes down to your needs. Need speed? Solana’s your fighter. But if you crave a mature ecosystem and potential future upgrades, Ethereum might be your jam. It’s a toss-up – speed or stability, your call!

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL FM strongly recommends contacting a qualified industry professional.