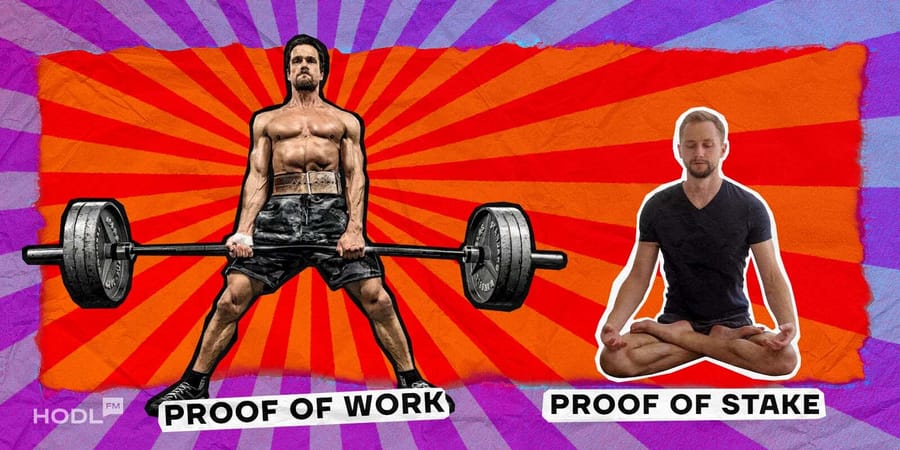

Proof of Work and Proof of Stake are arguably the two biggest consensus mechanisms in the crypto world. The pair have been tussling and trading blows with one another since Peercoin proposed it back in 2012. Today, some of the biggest blockchains around are using Proof of Stake. But in a battle of proof of work vs proof of stake, which protocol would take the gold and which would go home a sore loser?

Let’s find out!

More: What is the Bitcoin Halving and How Bitcoin’s Supply Is Limited

What is Proof of Work?

Proof of Work (PoW) is a consensus mechanism that various cryptocurrencies use in order to secure their blockchains and process transactions by adding new blocks. It works by causing network participants, known as miners, to take a batch of transactions and run complex mathematical equations to create a SHA-256 hash of the total value. However, it cannot be any old hash, it must be completely unique and fit certain criteria set out by the current difficulty rate. The more miners there are competing to find the next hash, the higher the difficulty rate, so the more hashes one needs to try per second.

Now, running these equations requires you to run a computer or dedicated hashing machine, known as an ASIC – it’s too complicated to do this profitably by hand. The more powerful these machines are, the more power it will consume. Some miners even have massive mining farms, consuming tens of thousands of dollars’ worth of electricity daily, all in a bid to win the race and mine the next block to earn the block rewards.

Without going into too much detail, that’s PoW. It’s energy intensive, but allows anyone with a computer to take part – in an ideal world. While you cannot mine Bitcoin using your computer anymore due to the current difficulty rate, there are still other cryptocurrencies like Digibyte that you can mine using your PC!

Proof of Work Pros & Cons

We’ve already covered a couple of these pros and cons while explaining PoW, but let’s dive into more so you can get a solid feel for this consensus mechanism!

Proof of Work Pros

Nobody likes a negative Nelly, so let’s kick off with the pros of PoW.

| Pro | Reason |

| No Censorship | With a PoW mechanism, OFAC censorship cannot be applied, meaning that no matter who you are or where you’re from, your transaction will be processed without prejudice. |

| Enhanced Privacy | PoW boasts more flexibility when it comes to making privacy and obfuscated transactions, keeping your wallets safe, secure, and hidden from prying eyes |

| Anyone Can Mine | There’s no minimum to what you can use for mining. You can get involved using your home PC, or even a Raspberry PI |

| Simply Secure | For a bad actor to take over a PoW blockchain, they’d need to spend more money on equipment than would be gained from taking control, making most PoW blockchains secure by design. |

| Makes Greta Thumberg Cry | PoW consumes a whole lot of energy, something that Greta Thumberg claims is killing the planet, which causes her to cry. The reality is traditional banking consumes more power and trees. |

Let’s just expand on a few of those.

PoW means that you have to invest in equipment to run the algorithm to create the hashes. The more valuable the cryptocurrency, the more hardware and power is required. This means that the more popular a coin is and the more people that are mining, the more secure these networks are from being attacked by a group looking to cause trouble. The rewards just simply aren’t worth the investment for bad actors.

PoW blockchains also run objectively, which means that if for some reason a bunch of nodes go offline for say a widespread power outage, when they reboot, they’ll automatically sync with the chain that has the most successful blocks. This continuity helps PoW stand out as one of the best blockchains for uptime and reliability.

Proof of Work Cons

| Con | Reason |

| Energy Intensive | PoW requires a lot of hardware to run if you’re going to be a top miner. This consumes a lot of energy and is often seen as not good to the planet. |

| Hefty Transaction Fees | PoW blockchains aren’t as scalable as Proof of Stake, meaning the transaction fees during peak times can get rather hefty. You’ll need to pay more to get your transactions passed in a reasonable timeframe. |

| Slow Transactions | Unfortunately, PoW blockchains often have block size limits placed on them, in a bid to help keep the network decentralized. Unfortunately, this creates a bottleneck and transactions can take a long time to process |

Most of PoW’s cons are down to transaction throughput as most blockchains aim to be decentralized. This means that their communities want to be able to host a copy of the blockchain locally, but in order to make this possible, blocks can’t get too large. By capping block size, you cap the number of transactions that fit into a single block. So during peak times, that transaction limit jams up the network, causes fees to spike and users get frustrated.

But that’s where Proof of Stakes comes to play!

What is Proof of Stake?

Proof of Stake (PoS) is another consensus mechanism that allows you to stake your coins in order to possible be the next validator node that publishes a block full of transactions. The more coins you stake, the better your chances are of winning the next block as well as the rewards and transaction fees that come with it. It’s significantly more friendly for the environment as it doesn’t require thousands of computers running 24/7 to solve equations, which wins it a place in the heart of eco warriors across the globe.

Anyone can run a validator node to take part in staking, but some blockchains have a minimum requirement for you to launch a validator node. As a work around, centralized exchanges (CEXs) and staking pools have popped up that offer you the chance to stake with a fraction of the amount of funds – now that’s revolutionary.

There’s also a feature called a bonding and unbonding period where you have to wait for your coins to fully stake or unstake, which can cause your investments into staking to be tied up for a period of days to months, depending on the network. There’s also something called Slashing whereby if you’re detected to be trying to abuse the network the network will remove your validator from the network and drain your funds. But more on this in the next patch!

Proof of Stake Pros & Cons

Ok, as you can tell, there are some mighty pros and some mighty cons to the PoS world. So let’s explore some of these, kicking off with the Pros!

Proof of Stake Pros

| Pros | Reason |

| Highly Scalable | Since nobody is fighting to create the perfect hash, transactions can be approved and validated significantly faster, meaning that when network activity peaks, the network can step up to easily handle the queue, meaning no waiting in line! |

| Energy Efficient | PoS still requires energy to run, but it requires a LOT less than PoW does, meaning that any time you’re using PoS blockchains, you’re helping the planet consume less energy – that’s great news! |

| Everyone Can Participate | Thanks to liquid staking and pooled staking, anyone can Stake and take part in consensus with as little as $1 in equity, giving you real control over the blockchain |

Thanks to the likes of liquid staking and pooled staking, everyone can get involved with staking, which is more than can be said for the heft upfront investment into PoW mining. While some of this pooled and liquid staking is done in the form of custodial staking, meaning you don’t hold your coins while they’re staked, and you will get offered lower payout rates for liquid staking, it lowers the barrier to entry, meaning that everyone can take part in consensus – a core part of blockchain.

Now, let’s look at the dark side of PoS!

Proof of Stake Cons

| Cons | Reason |

| Whales Can Control Networks | PoS is a case of the rich get richer, in that the more coins you stake, the more chance you have of being chosen as the next validator. So if you drop a billion dollars into staking, you’re obviously going to win more blocks than someone with 50 dollars. |

| Forking isn’t discouraged | With PoS validators will earn their fees whether the chain goes one way, another or both ways. There’s no built-in feature to prevent forks occurring on a daily basis. This also opens up the chance for double spend attacks on smaller blockchains with a small handful of stakers. |

| OFAC Compliance | Entities that are required to abide by OFAC sanctions, such as CEXs, can opt to avoid transactions and validators that are based in an OFAC sanctioned country or region. This creates all sorts of ethical problems and situations when it comes to censorship. |

When Ethereum swapped to PoS, it added an update that saw it follow OFAC compliance. This means that validators and blocks are more likely to be those abiding by OFAC sanctions. This has a huge impact on censorship and freedom. During November 2022, OFAC compliant blocks reached an all-time high of 79%. This means that people from sanctioned regions were having issues making transactions on Ethereum, and poses all sorts of moral dilemmas.

What is Better, Proof of Work or Proof of Stake?

Both PoW and PoS have their pros and cons, each suited to their own realms. If you want a blockchain that just runs until the end of time with little interruption and maintenance needed, then PoW is your guy. But if you want more scalability for payments and apps with a low barrier to entry for consensus participants, then PoS stands out as the clear winner.

Both are fantastic at what they do, but aren’t suited to every single type of transaction. The best way to go is to pick the consensus mechanism that suits your needs, rather than saying that one is better than the other full stop.

Let’s break this down in a table for you to make it a bit more clear!

| Proof of Work | Proof of Stake | |

| Mining/Validating Requirements | The amount of computing requirements that you have determines your performance | You can solo stake with a minimum amount of money, or pool stake with as little as $1 |

| Competition | The more miners taking part, the harder it becomes | Algorithm picks a winning validator based on stake size |

| Equipment Required | Bigger blockchains like Bitcoin requires farms of specialized equipment, while some chains still work with home PCs | A server-grade device or virtual machine |

| Scalability | Limited by block size and transaction fees | Fluid scalability that can handle thousands of transactions per second |

| Security | Cost to attack networks isn’t worth the investment | Whale can flash loan enough to take over a network |

| Efficiency | Consumes large amounts of electricity to run mining farms | Minimal electricity required to run virtual machine or server |

| Forking | Economic incentive with systems in place to prevent it accidentally happening | Not automatically discouraged |

There we have it. On paper, Proof of Stake probably just nudges out Proof of Work in terms of all-round performance and features. It’s more scalable and has way more features available. But, if you prefer true blockchain and you want something that’s going to keep you safe, Proof of Work is the way to go. As always, there’s not a one size fits all solution, and the same goes for the old Proof of Work vs Proof of Stake debate!

Does Bitcoin use Proof of Work or Proof of Stake?

Bitcoin uses Proof of Work because it’s a real man’s blockchain that doesn’t care about the environment or Greta Thumberg. There are legends that some miners can supercharge their ASIC rigs using the tears of ecowarriors!

Why is PoS better than PoW?

Proof of Stake is generally regarded as better than PoW due to its superior scalability and lower transaction fees.

What are the main issues associated with Proof of Work?

Proof of Work consumes a lot of power, isn’t scalable as it’s limited by block sizes. This causes fees to go up and wait times for transactions to skyrocket.

Is Ethereum Proof of Work or Stake?

Ethereum started out life as Proof of Work but transitioned to Proof of Stake in 2022 during “The Merge”. There is still a Proof of Work fork of Ethereum, but it’s not widely supported or used.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL FM strongly recommends contacting a qualified industry professional.