Would you be interested in getting a financial education at the "Harvard of Trading"? If you think, yes, sure, think again. You may be better off sticking with less ambitious trading schools. Because the really ambitious ones are also often the really fake ones. Here is the fascinating story of IM Academy, AKA the Harvard of Trading, by Bloomberg.

Related: Crypto in Cinematography: Crypto-Themed Movies You Cannot Miss

Founded by the controversial Chris Terry, IM Academy promised to teach young investors how to brave the financial markets; options, crypto, stocks, foreign currencies, you name it.

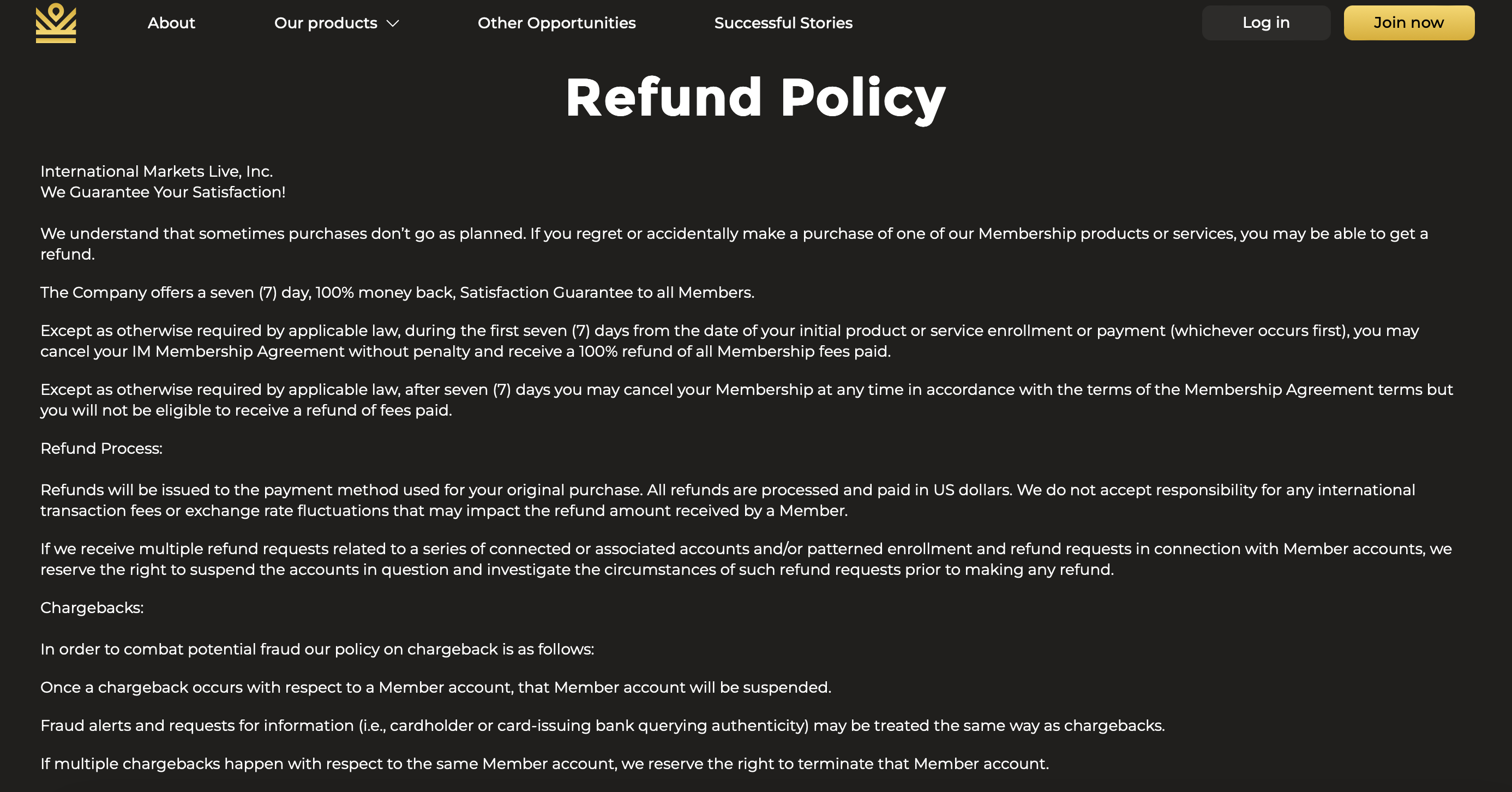

It billed itself as a top-tier trading school, but the reality was dark. IM Academy proved to be nothing but a one-way ticket to financial ruin. For $275 upfront and $250 a month, young investors were promised Wall Street-level trading skills but found themselves in a financial black hole.

This article will be a lighter, and hopefully, a bit more engaging recap of the original story, which can be found on Bloomberg.

“Harvard of Trading” and Its Allure

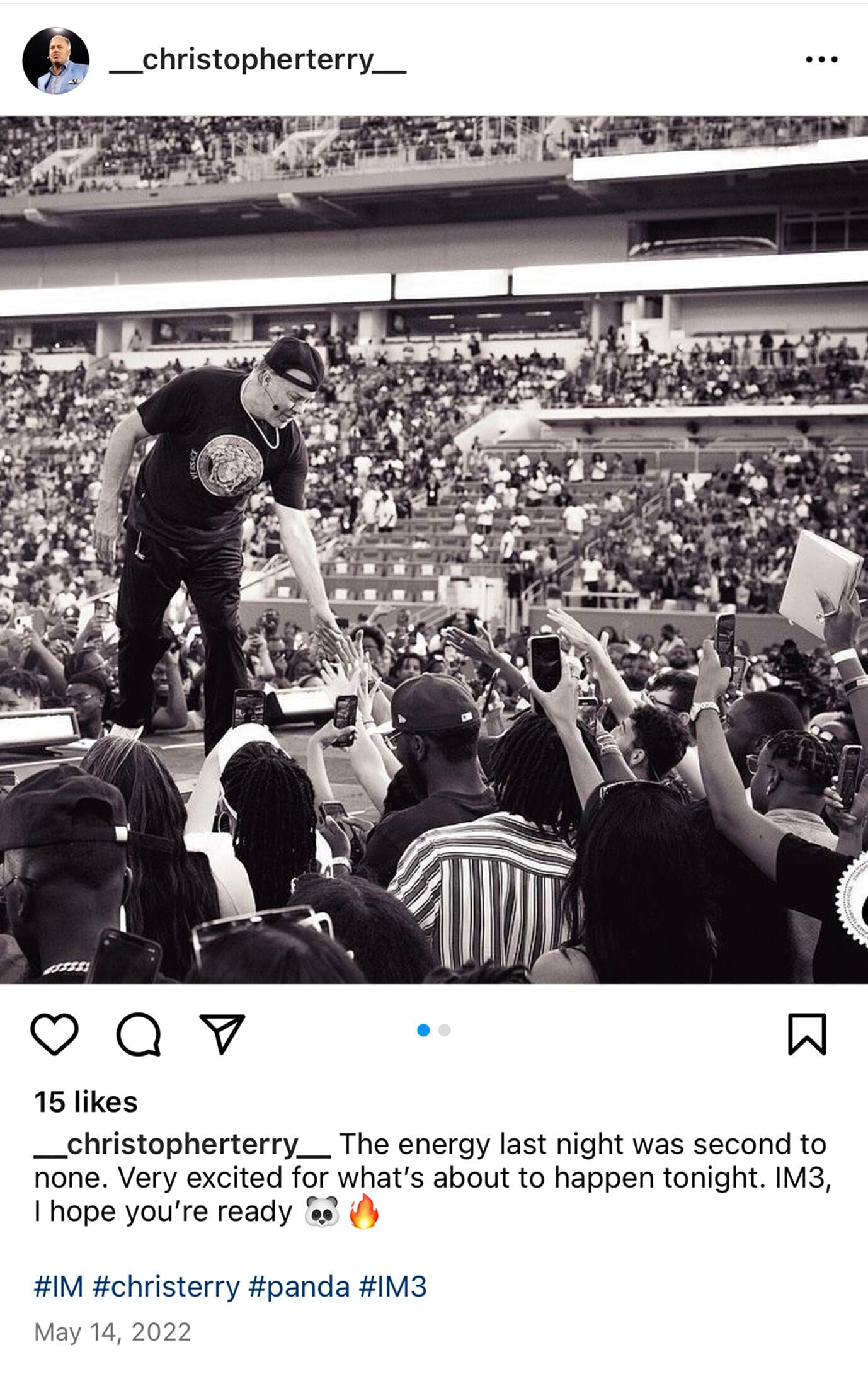

For some, the pandemic was an inspiring period. One such person was the infamous Chris Terry, the founder of the IM Academy. Terry expanded his academy from a small New York-based operation into a global sensation. IM Academy was marketed as an educational platform that could turn anyone into a savvy retail investor.

The target was teens and young adults. What they had in common was a lack of life experience and an appetite for financial freedom. That’s where IM Academy’s allure was, which leveraged it well and grew rapidly. The company utilized a multilevel marketing (MLM) structure and encouraged its members– or students, to recruit new ones, promising huge commissions and rewards. Sounds a bit like a pyramid scheme, or any investment scam you’ve ever heard, right? Well, because it almost is.

Chris Terry's past was full of controversy. He started as a construction worker in the Bronx and later found himself committing crimes with gangs. He ultimately pleaded guilty to theft. His journey took a turn when he entered the world of multilevel marketing with Amway, a multinational company known for its direct selling of health, beauty, and home care products. It operates kind of like missionaries knocking on your door to ask if you are interested in a conversation about the Lord and Savior. It employed a multilevel marketing model. See where Terry got the idea?

Terry’s lack of formal education didn't stop him from becoming a self-proclaimed financial guru. He then created IM Academy to share his wisdom with the masses.

The Promises

Terry's pitch was simple: Pay your dues, learn the secrets of the market, and get rich. The reality was more like paying, praying, and watching your savings evaporate. Young investors flocked to IM Academy. For a fee of $275 upfront and $250 monthly, members were given access to online courses, live trading sessions, and guidance, all marketed as the ultimate "Harvard of trading."

Anyone who promises you "spectacular returns" is likely going to cause more pain than gains.

— Markets & Mayhem (@Mayhem4Markets) May 19, 2024

This Bloomberg article titled How the ‘Harvard of Trading’ Ruined Thousands of Young People’s Lives is illuminating.

I suggest giving it a read and being VERY careful who you trust. 👇 pic.twitter.com/qvA1Z9h2AO

The academy claimed that its unique blend of education and mentorship could make anyone a savvy trader capable of achieving financial independence and wealth. The allure was further strengthened by endorsements from celebrities and influencers.

Such an aggressive marketing strategy quickly paid off. IM Academy saw explosive growth. By June 2021, membership had jumped from 68,000 in 2018 to 225,000 and eventually reached half a million in 2022. The influx of recruits helped IM Academy rake in at least a billion dollars in annual sales. The meteoric rise painted a picture of success, hence the constant new recruits.

The Harsh Reality

The reality for many IM Academy members was far from the promised financial success. The trading advice offered was nothing new and ineffective and led to poor trading outcomes for most participants.

Monique Jones, a poor member who had invested her savings into IM Academy at the age of 17, found herself facing severe financial and emotional consequences, like other thousands of members. Jones strictly followed the provided advice and signals, but she incurred loss after loss and received little to no support or effective guidance from her so-called mentors.

Instead of becoming skilled traders, many members were tricked into taking the role of recruiters, who kept bringing in new members rather than improving their own trading skills. In this environment, success was measured by the number of recruits rather than trading proficiency. Members were encouraged to prioritize their IM Academy network over personal connections.

Sleepless nights, skipped meals, and mounting debts were common among the members. The promise of financial independence turned into a cycle of financial dependency, as members struggled to cover the ongoing subscription fees and recover their initial investments.

The Fallout

IM Academy's fraudulent practices left an of economic devastation behind. Thousands of investors found themselves not just penniless, but also burdened with debt and their career prospects shattered. The financial strain extended beyond individual bank accounts and affected families who had supported their young traders.

Of course, regulatory bodies around the world took notice of the widespread impact of IM Academy. The US Commodity Futures Trading Commission imposed brutal fines on the company, and the Federal Trade Commission launched an investigation into its practices and methods of unfair competition. International authorities joined the party, leading to coordinated police raids and high-profile arrests of IM leaders across Europe.

Chris Terry chose to maintain a low profile while facing increasing legal pressures and attempted to deflect responsibility onto other individuals within his empire of fake dreams.

The damage to the company's reputation and its members was already extensive. Disillusioned former members began to flood social media platforms with their horror stories, sharing detailed accounts of financial loss, and ruined lives.

Yet, despite the cracks in Terry’s empire, the multilevel marketing machine kept on going. The allure of quick wealth and financial freedom continued to attract new recruits. Terry's seasoned veterans of the MLM game continued to flaunt their luxurious lifestyles on social media, flexing their expensive cars, vacations, and luxury homes. They managed to lure in another wave of traders.

IM Academy also attempted a rebranding strategy, but these efforts failed, as the damage to its reputation was too extensive to recover from. The company’s online presence was drastically bad, and the once thriving social media accounts fell into silence. By 2023, IM Academy had scaled back its operations. Many of its offices closed and its digital footprint reduced.

You’d think IM Academy isn’t fooling any more minds, but the Bloomberg story concludes with this: “With the income I get from recruiting others, I’ll be able to trade using that residual income rather than my earnings from Volvo. Soon we’ll be rich.” That’s a quote from a new recruit.

More: What’s Behind the Memecoins Mania?

Apparently, the Harvard of Trading is not yet dead and as the young generations continue struggling with increasingly harsh economic conditions including student debt and rental prices, IM Academy will never run out of people to trick. Sad, but true, just like the promises vs. reality.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL FM strongly recommends contacting a qualified industry professional.