Right off the bat, there is no such thing as a crypto mine. It’s all in our heads.

So, what is this “mining”?

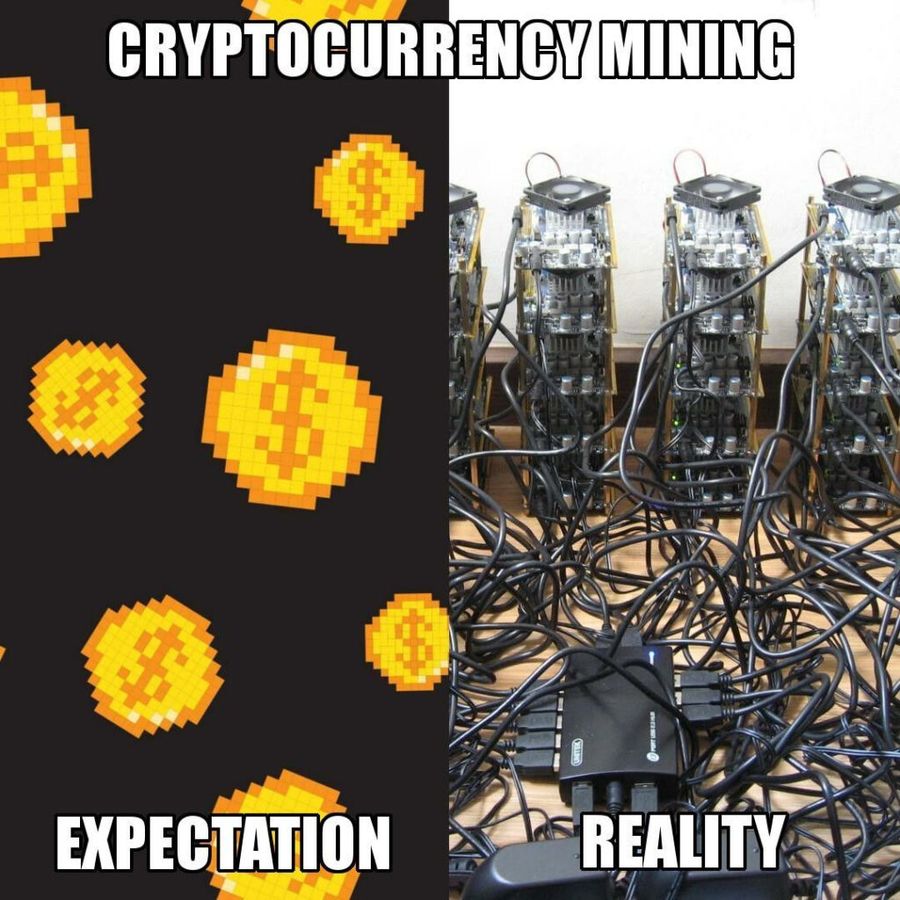

The concept of ‘mining’ holds an undeniable significance in today’s crypto-economy. Not to be mistaken with the subterranean extraction of minerals, crypto mining is a complex computational process happening within millions of machines worldwide, functioning as the beating heart of various cryptocurrencies, most notably Bitcoin. So, a pickaxe is not the tool you are looking for here.

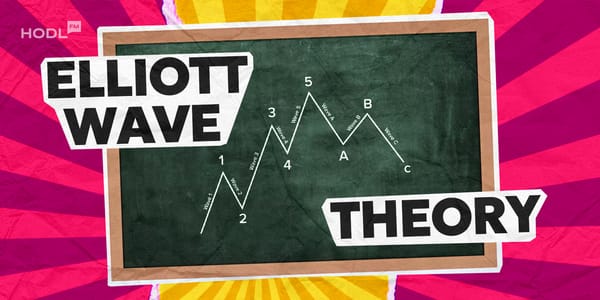

‘Mining’, a clever analogy from traditional gold mining, is the lifeblood of decentralized digital currencies. Mining is fundamentally the process of validating and recording transactions on a public ledger called the blockchain, maintaining the integrity and security of the digital currency network.

Since Bitcoin’s genesis block in 2009, mining has transformed into a global industry. Individual miners and industrial-scale mining farms now compete in this 24/7 global mathematical race. Both are driven by the same prospect: solving complex mathematical problems to ‘mint’ new bitcoins and reaping transaction fees as a reward.

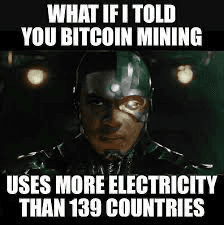

This digital gold rush has not only reshaped the global economy but also spurred technological advancements and instigated discussions on environmental sustainability. So, mining has a larger impact than making the new Nvidia graphics card more scarce. But we’ll come to the environment later, it is not going anywhere, right?

The Stages of Mining

Mining is most typically seen within the Proof-of-Work (PoW) consensus algorithm, popularized by Bitcoin, however, PoW isn’t the only consensus model out there. An increasingly popular alternative is the Proof-of-Stake (PoS) model, as employed by Ethereum in its upcoming Ethereum 2.0 update. In this model, rather than ‘mining’ for new coins, participants ‘mint’ or ‘forge’ new blocks based on the number of coins they hold and are willing to ‘stake’ as collateral.

While Bitcoin stands as the most prominent example of a PoW model, there are several other cryptocurrencies like Litecoin and Monero, which use similar PoW systems, but with variations in algorithmic complexity and reward systems. If we’ve established that mining is not the only source for crypto, let’s go deeper into the stages of mining.

Mining isn’t simply a ‘plug-and-play’ process. It’s a sequence of well-coordinated stages. Firstly, when a Bitcoin transaction is initiated, it gets broadcast to the entire network of miners. Each miner then collects these transactions, intending to include them in the next block of the blockchain.

The following stage involves the creation of a cryptographic link between the new block and its predecessor. This is achieved by performing a proof-of-work, a mathematical problem that requires significant computational power to solve but is easy for others to verify. The miner who solves this puzzle first gets the right to add the new block to the blockchain and is rewarded with newly minted bitcoins and transaction fees.

Mining Techniques

As the crypto world has matured, so have the techniques used in mining, transitioning from simple CPUs to powerful, specialized machinery. The evolution of mining techniques in cryptocurrency can be compared to different forms of mineral mining in the real world, each having its own implications and considerations.

CPU Mining

In the early days of Bitcoin, mining was akin to underground mining, using rudimentary tools (CPUs in this case) to dig deeper into the computational strata. Every computer user worldwide had an equal opportunity to mine Bitcoin simply by running software. However, as Bitcoin’s popularity rose, so did the complexity of mining puzzles. Using a CPU became like trying to dig a tunnel with a spoon, incredibly inefficient and slow.

GPU Mining

The inefficiency of CPUs led to the advent of Graphic Processing Units (GPUs) in the mining field. Instead of digging deep, miners discovered they could gather more resources (solve more puzzles) by spreading out over the surface (performing more computations simultaneously). GPUs, initially designed for rendering video game graphics, proved to be perfect for this task due to their parallel processing capabilities. However, as competition grew, this approach also began to lose its profitability.

ASIC Mining

Application-Specific Integrated Circuits (ASICs) are to crypto mining what placer mining is to gold extraction – sifting valuable nuggets from a river of data. ASIC miners are highly specialized devices, designed and optimized for solving specific computational puzzles associated with certain cryptocurrencies. This makes them incredibly efficient at mining but limits their usage to specific cryptocurrencies.

Cloud Mining

Cloud mining allows individuals to rent mining capacity or ‘hash power’ from larger data centers. The actual process of mining takes place in the ‘cloud’, and the individual only needs to manage their account, eliminating the need for expensive hardware and its maintenance.

Pool Mining

In addition to these individual methods, there’s also pooled mining. This is like a cooperative in the mining world, where individual miners contribute their computational power to a group, increasing the group’s overall hashing rate and the chance of mining a block. The rewards are then distributed among the participants based on their contribution, offering a more stable income than solo mining.

Technological Advancements in Mining

The advent of technology has revolutionized the crypto-mining landscape. ASIC miners, though currently the most potent mining hardware, might soon be superseded by quantum computers, capable of solving complex mathematical problems at exponentially faster rates.

However, technological advancements are wider than speed and efficiency. Innovations are increasingly focusing on making mining environmentally sustainable. Miners worldwide are transitioning towards renewable energy sources, and advances in heat recovery are finding ways to reuse the massive heat generated by mining farms.

The Future of Mining: Striking the Balance

The future of mining lies in sustainability. With cryptocurrencies, especially Bitcoin, attracting criticism for their significant energy consumption, the focus is shifting towards ‘ green mining’. Solar and wind-powered mining farms are popping up, while projects involving carbon offsetting and energy reclamation are being piloted.

Governments, too, are stepping in, imposing legislation to curtail the environmental impact of mining. As a result, crypto miners are compelled to rethink their strategies, with many transitioning to more energy-efficient protocols like proof-of-stake.

Mining is a process. As we move forward, the balance between profitability, technology, and sustainability will dictate its trajectory. Despite its challenges, for those willing to venture into its depths, the world of mining offers a dazzling prospect of digital riches. So, pick up your virtual pickaxes and join the digital mining race. Or do the more sensible thing and Hodl onto the crypto that other miners had mined!

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource, and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL FM strongly recommends contacting a qualified industry professional.