Economic Uncertainty in 2025

Trump's tariffs have exposed the systemic weakness of markets—unpredictable U.S. policy can wreak havoc globally with remarkable ease. The President's announcements of widespread tariffs in April 2025time saw markets tailspin into turmoil. As traditional safe havens show concerning signs of weakness, many investors are questioning whether cryptocurrency—particularly Bitcoin—might offer protection when the economy falters.

This comprehensive guide explores the case for Bitcoin as a potential safe haven during a U.S. recession, examining its unique properties alongside historical context, regulatory considerations, and practical strategies for investors.

Safe Havens in Economic Downturns

What Defines a Safe Haven?

A recession is a significant decline in economic activity, particularly over an extended time. Some telltale signs include widespread bankruptcies, unemployment, and reduced discretionary spending.

Today many people seek ways to preserve their purchasing power through safe havens—assets that either maintain or increase their value during times of currency depreciation, market volatility, or economic uncertainty over a period of time.

The Evolution of Safe Havens Throughout History

What investors consider safe havens has changed dramatically over time:

- Prehistoric to Pre-Modern Era: Precious metals (gold and silver), jewelry, property, land, grain, and silverware served as stores of value

- 18th Century Onwards: Certain types of debt (government and private) began gaining utility as safe assets globally

- Post-Great Depression: Government-insured demand deposits emerged after massive bank failures

- Late 20th Century: Short-term wholesale funding markets grew in importance until the 2008 crisis exposed their fragility

As Gary Gorton noted: "The financial crisis of 2007–2008 showed, once again, that privately produced safe assets [i.e., short-term debt like sale and repurchase agreements (repo)] are not always safe. Short-term safe debt is subject to runs, threatening systemic collapse of the financial system."

Traditional Safe Havens Under Pressure

The threat of sweeping tariffs in 2025 has sparked unprecedented market reactions. The U.S. 10-year Treasury yields spiked while the DXY (U.S. Dollar Index) dropped sharply—highly unusual movements to occur simultaneously. Typically, Treasuries and the dollar strengthen during crises; this time, both faltered.

This rare dynamic reflects a deeper shift: growing loss of confidence in the traditional pillars of financial safety. Investors are questioning whether today's safe assets—sovereign bonds or the U.S. dollar—can still offer the protection they once promised.

The Case for Bitcoin as a Recession-Proof Asset

As Mike Maloney observed, "Wealth is never destroyed. It is merely transferred. And that means that on the opposite side of every crisis, there is an opportunity."

Satoshi Nakamoto created Bitcoin in the aftermath of the 2008 financial crisis as an alternative to centralized monetary systems. Here's why it might serve as a safe haven during economic turbulence:

1. "Deflationary" Properties

In economics, deflation refers to a sustained decrease in the general price level of goods and services. What crypto users typically mean when they call Bitcoin "deflationary" is that its supply decreases over time relative to demand.

Bitcoin's key supply characteristics:

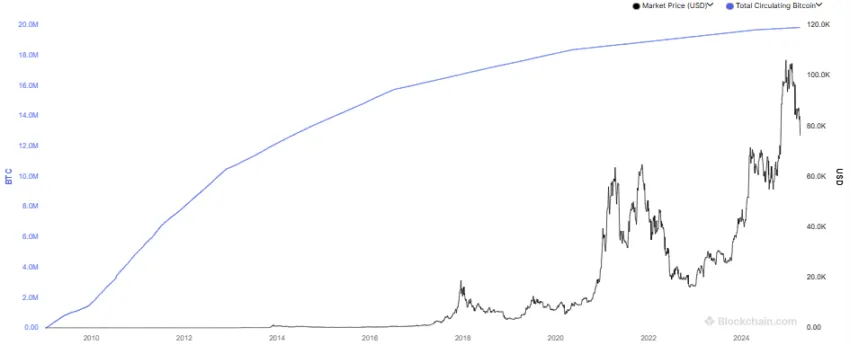

- Total supply cap: 21 million BTC, after which no new coins will be created

- Halving mechanism: The Bitcoin protocol issues 50% fewer Bitcoins every halving event

- Lost coins: Some portion of Bitcoin becomes permanently inaccessible as owners lose private keys

The chart showing Bitcoin in circulation compared to its price demonstrates a clear long-term upward trajectory despite volatility—a key criterion for a safe haven asset.

Sitting here feeling like Michael Burry, and waiting for everyone else to realize that $BTC was made for exactly this purpose and times like these. Like, this is the ultimate bull case for $BTC. China can sell usd and their US bonds, but they can’t sell $BTC.

— Oryx | α | (@SimplyOryx) April 9, 2025

2. Store of Value Characteristics

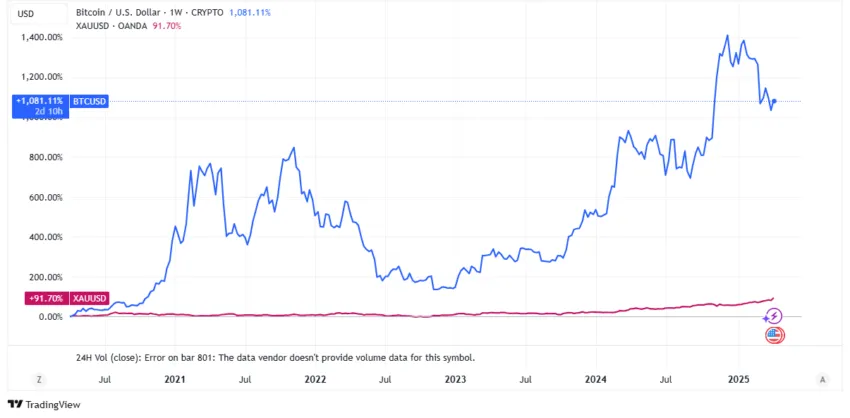

While Bitcoin began as a peer-to-peer payment system, it has evolved primarily into a store of value (SoV), drawing comparisons to gold. Here's how they compare:

| Feature | Bitcoin | Gold |

|---|---|---|

| History | Less than two decades | Centuries of use as a store of value |

| 2022-2023 interest rates/tightening | Fell hard, traded like a tech stock | Virtually flat |

| Covid recession (2020) | Crashed during Covid but rallied in 2021 | Hit an ATH during Covid |

| Counterparty risk | None | None |

| Adoption | Growing, but limited | Wide |

| Supply | Limited to 21 million | Unknown |

Since its inception in January 2009, Bitcoin has risen from essentially $0 (technically 0.0008 when it first traded in 2010) to over $100,000 in 2025—an increase of over 8,000,000,000%!

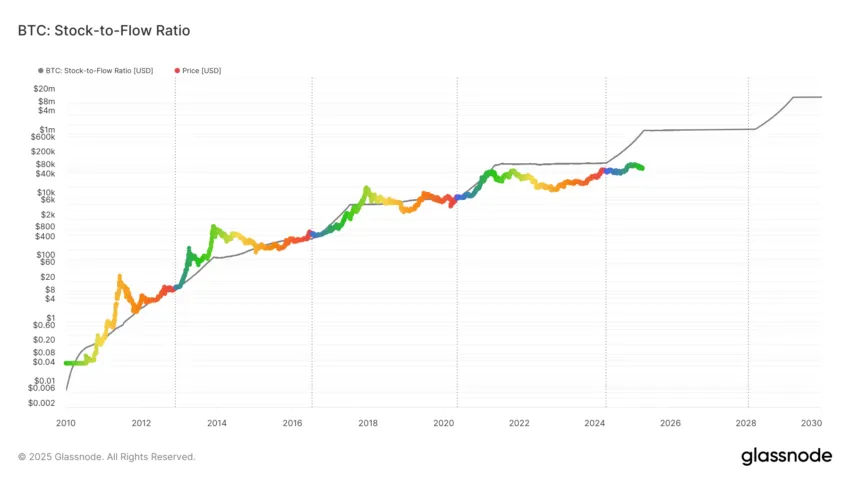

Bitcoin's stock-to-flow (S2F) ratio—a measure comparing existing supply to new production—continuously increases due to its programmed halving events. This makes it technically an even more rigid monetary asset than gold, though still early in its adoption as a global hedge.

3. Structural Independence

Bitcoin operates outside traditional financial systems with:

- No central issuer

- No monetary policy

- No national allegiance

This independence allows Bitcoin to behave in unique ways during recessions, potentially uncorrelated with typical downturn dynamics. While it remains volatile and influenced by broader liquidity cycles, its fixed supply and decentralized nature position it as a potential hedge—especially in recessions marked by monetary instability or systemic distrust.

Why Bitcoin Isn't a Perfect Safe Haven

Despite its promise, Bitcoin has significant limitations as a safe haven asset:

Problem 1: Accessibility and Cost Barriers

Bitcoin, like gold, can be expensive, volatile, and not especially accessible to people with limited income. If you can only afford a small fraction of Bitcoin, high network fees can make even moving or spending it impractical.

This limitation affects different investors differently:

- Wealthy investors: Can afford to hold, ignore volatility, and weather downturns

- Limited-income investors: May face liquidity challenges if they bought near peak prices and need funds

In this sense, Bitcoin might function better as a theoretical than practical safe haven for those who cannot afford to wait out market cycles or absorb transaction costs.

Problem 2: Correlation with Risk Assets

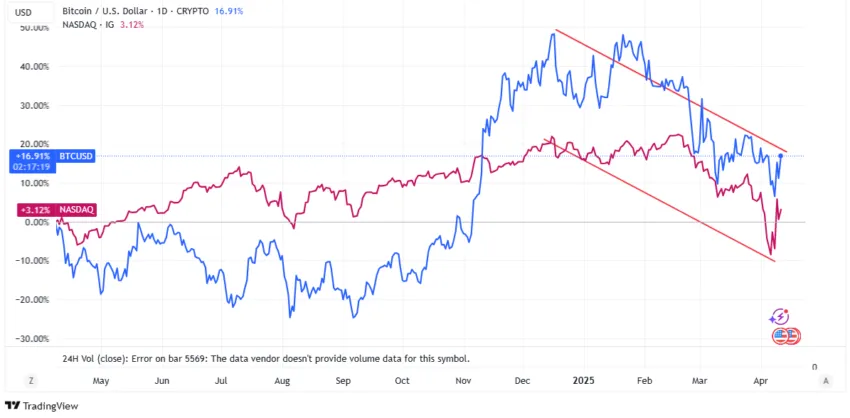

Bitcoin doesn't always behave like a hedge; it often trades like a tech stock. During liquidity crunches or Fed tightening cycles, Bitcoin has shown high correlation to equity markets, particularly the Nasdaq.

This correlation undermines its value as a true safe haven—when traditional finance takes a hit, Bitcoin often follows suit rather than providing protection. For Bitcoin to optimize into a reliable safe haven, it needs to more consistently decouple from risk assets, especially during systemic stress.

Regulatory Environment During Recessions

Historical Regulatory Changes During U.S. Recessions

The National Bureau of Economic Research (NBER) has documented roughly 15 recessions in the U.S. since the 1920s stock market crash. Each sparked significant policy changes:

The Great Depression

Triggered by the 1929 stock market crash and exacerbated by:

- Over-speculation and excessive stock market exposure

- High leverage

- Poor regulation

- Wealth inequality and overproduction

- Widespread bank runs

Policy responses included austerity measures, protectionism, and tight monetary policy—all of which deepened the crisis. Eventually, this led to the New Deal programs that established modern social welfare policies.

OPEC Embargo (1973)

When OPEC imposed an oil embargo on the U.S. and allies, it created a unique "stagflation" scenario:

- Sharp rise in oil prices

- High inflation coinciding with economic stagnation

- Unemployment alongside rising prices

This challenged economic orthodoxy, as recessions typically feature deflation. Paul Volcker eventually tamed inflation through aggressive interest rate hikes, triggering a deep but necessary recession in the early 1980s.

COVID-19 Pandemic (2020)

The pandemic triggered:

- Large-scale lockdowns causing unprecedented supply and demand shocks

- Massive government interventions including stimulus checks and PPP loans

- Interest rates cut to near zero

- Extensive quantitative easing

- Emergency lending facilities

Unlike previous recessions, the policy response was swift and enormous, leading to all-time highs in equities and crypto while also contributing to sustained inflation years later.

Possible Regulatory Changes in a Future Recession

Three key policy areas could significantly impact crypto during a recession:

Crypto Regulation

The current Trump administration has established a pro-crypto stance:

- Halted most Biden-era crypto regulations and lawsuits

- Nullified IRS rules expanding the definition of brokers to include DEXs

- Adopted a more cooperative SEC approach

- Likely stablecoin regulation ahead

During a recession, we might see continued rescinding of "anti-crypto" policies, moderate enforcement, and potentially pro-crypto measures like favorable stablecoin regulation—potentially bullish for the sector.

Tariff Policy

The mere mention of Trump tariffs in April 2025 was enough to cause market uncertainty. While not directly tied to crypto, tariff announcements have historically suppressed cryptocurrency prices, while rollbacks or pauses have coincided with brief rallies.

Given that tariffs exacerbated the Great Depression, they could further suppress markets during a U.S. recession. President Trump's unpredictable nature makes future tariff policies difficult to forecast.

Federal Reserve Policy

The Fed's dual mandate—maintaining full employment and stable prices—guides its monetary policy through interest rates and money supply management:

- Lower interest rates: Encourage borrowing and risk-taking, signal economic slowdown

- Higher interest rates: Cool inflation and speculation, discourage risk-taking

During the COVID era (2020-2021), abruptly lowered rates and surging liquidity fueled a historic crypto bull run. In a future recession, Fed responses would significantly impact crypto:

- Rate hikes to combat inflation would likely suppress crypto prices

- Rate cuts to stimulate growth could eventually rally markets, though not immediately

Preparing for a Recession as a Crypto Investor

Reduce Exposure to Lending Markets

Crypto lending markets pose specific risks during recessions:

- For borrowers: Asset price drops can trigger rapid liquidations

- For lenders: Automatic liquidation systems depend on sufficient liquidity and functioning oracles

- System risks: Low-liquidity or high-volatility environments can compromise even "safe" lending strategies

Prudent investors should consider reducing leverage, limiting exposure to lending protocols, and monitoring liquidity conditions during economic stress.

Rotate into Safe Havens

As risk appetite wanes, consider shifting portions of your portfolio to:

- Digital dollars: USD-pegged stablecoins (USDC, USDT)

- Digital gold: Bitcoin

- Protocol-level staking: As a crypto-equivalent to sovereign bonds, offering predictable yield and potential stability

Unlike traditional bonds, however, staking carries slashing and protocol risks that should be carefully assessed.

Diversify Across Jurisdictions and Platforms

Prepare for regulatory uncertainty by:

- Staying diversified across centralized and decentralized platforms

- Maintaining good transaction records in case reporting rules change

- Establishing multiple fiat on/off ramps while access remains fluid

- Adopting self-custody where possible to reduce dependence on centralized platforms

Bitcoin's Rising Role in Economic Crises

Due to its "deflationary" properties, store-of-value characteristics, and structural independence from traditional systems, Bitcoin has credible potential as a safe haven during a U.S. recession—particularly as confidence in traditional safe assets wavers.

However, significant hurdles remain, including volatility, accessibility barriers, and its tendency to correlate with risk assets during liquidity crises. Bitcoin's role as a genuine safe haven is still evolving, not established.

As the regulatory market shifts and recession risks loom, investors should remain vigilant about both the opportunities and limitations of crypto assets. While Bitcoin may not perfectly mirror gold or Treasuries as a safe haven, its unique properties could provide meaningful portfolio protection—especially in scenarios where traditional financial systems face unprecedented challenges.

The world of finance continues to transform, and with it, our understanding of what constitutes true safety in uncertain times. Only time will tell whether Bitcoin becomes the definitive digital safe haven many of its proponents claim it will be.