Get ready, crypto-curious minds and blockchain enthusiasts, because we’re about to take a wild ride into the world of Bitcoin! Bitcoin, the GOAT of all cryptocurrencies, has flipped the script on how we view and handle money. Bitcoin has become the talk of the town. Picture this: the potential for sky-high returns, the power to be your own bank, and technology so cooler than an ice cream truck on a scorching summer day.

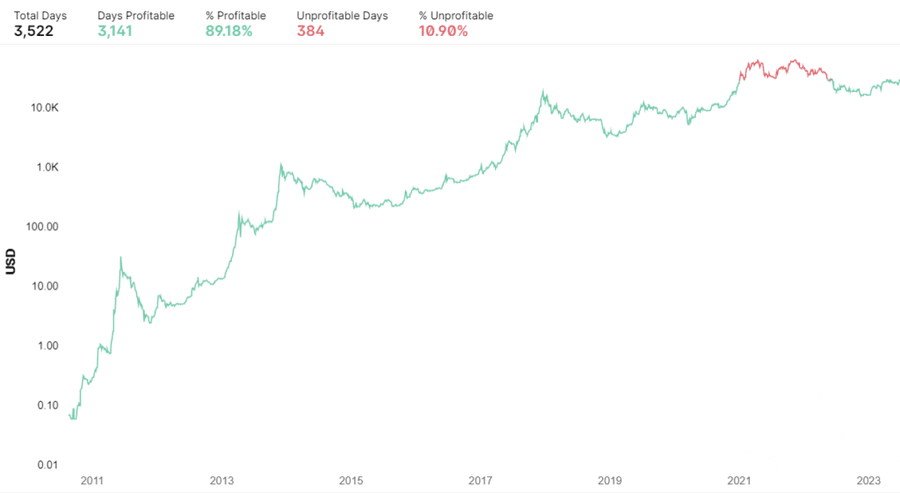

It’s clear that this whole cryptocurrency thing is not just a passing fad. Bitcoin’s growth has been so insane that it could put a rollercoaster ride to shame. We’re talking about a whopping 3,141 days of profitable trading out of a total of 3,522 days.

But hold on, because there are also challenges and risks lurking around the corner. So, let’s take a moment to explore the impact and functionality of Bitcoin, and maybe even peek into the dangers it brings to the table. We’re going to dive deep into Bitcoin’s historical journey, uncover its secrets, and shine a light on the hurdles it faces.

Historical Overview of Bitcoin

Imagine a mysterious figure, shrouded in secrecy and equipped with a magical pseudonym like Satoshi Nakamoto, making a grand entrance in 2009. Well, my friends, that’s exactly what happened when Bitcoin burst onto the scene. A manifesto called “Bitcoin: A Peer-to-Peer Electronic Cash System” was like the blueprint for a whole new financial order, and it came from the depths of Nakamoto’s enigmatic mind. The funny thing is, we still have no clue who this Nakamoto character really is.

Blockchain Technology Explaining in simple words

So, what the heck is blockchain? Well, imagine a digital ledger that keeps track of every single transaction, and get this—it’s not controlled by any single authority. Nope, it’s like a team effort, with a network of computers working together to make sure everything is legit and transparent. This blockchain thingamajig is the backbone of the Bitcoin network, ensuring that everything runs smoothly and securely.

Read more: Cryptocurrency: Key Terms and Concepts

Major Milestones in Bitcoin’s History

Now, let’s take a stroll down Bitcoin’s memory lane and uncover some major milestones:

January 3, 2009 — the day that changed everything. It was like the birth of a new era when the first Bitcoin transaction took place.

Bitcoin Pizza Day – remember when someone bought a pizza with a mind-boggling 10,000 bitcoins back on 24 May 2010? I mean, seriously, that’s one expensive slice of heaven!

And let’s not forget about the halving events, my friends. We’ve had some epic halving parties in 2012, 2016, and 2020, and rumor has it that the next one is coming in April or May 2024.

El Salvador, June 2021. It became the first country to adopt Bitcoin as a legal tender. That’s right, my friends, a whole country embracing the magic of Bitcoin.

Functionality and Key Features of Bitcoin

Bitcoin, my friends, is all about cutting out the middleman and embracing the power of peer-to-peer transactions. But how does it all work, you ask? Well, let me introduce you to the marvelous process of mining. Picture a group of participants, also known as miners, using their super-powered hardware to solve mind-boggling mathematical problems. This whole mining extravaganza ensures the security and integrity of the Bitcoin network.

Key Features

- Decentralization and Peer-to-Peer Network. We have decentralization and a fancy-schmancy peer-to-peer network. Say goodbye to those old-fashioned intermediaries and hello to direct transactions between you and your crypto-pals.

- Transactions and Wallets. Picture a public blockchain recording all the Bitcoin transactions for the world to see. But don’t worry, my privacy-loving friends, because you need a digital wallet to send and receive funds securely.

- Cryptography and Secure Transactions. Bitcoin uses fancy encryption techniques to keep your transactions super safe and secure. It’s like having a fortress of digital locks that make it nearly impossible for unauthorized parties to mess with your hard-earned bitcoins.

- Limited Supply. We’re talking about a grand total of 21 million bitcoins. That’s it, my friends. This scarcity adds a sprinkle of potential long-term value appreciation to the mix.

Impact on the Financial World

By operating outside centralized control and relying on decentralized consensus, Bitcoin is like a rebel with a cause. It offers an alternative to reshape various aspects of the financial system, including banking, remittances, and cross-border transactions store of value.

Bitcoin Advantages

- Accessibility and Inclusion. Bitcoin opens the doors to the global economy for those who have been left out in the cold. It’s like a golden ticket to the global economy, allowing anyone with an internet connection to participate.

- Fast and Low-Cost Transactions. Near-instantaneous transfers that won’t break the bank, especially when it comes to international remittances. Say goodbye to those pesky middlemen taking a chunk out of your hard-earned cash.

- Transparency and Security. Bitcoin transactions are like open books, thanks to the public blockchain. It’s like having your financial life on display, but don’t worry, my friends, because it’s all protected by fancy cryptography.

- Financial Sovereignty. Bitcoin is like a superhero cape, giving you full control over your funds. Say goodbye to those pesky banks and hello to the era of personal empowerment!

Challenges and Risks of Bitcoin

- Price Volatility. Bitcoin’s value is highly volatile, impacting its use as a medium of exchange and a store of value.

- Regulatory Concerns. Evolving regulations pose challenges and opportunities for Bitcoin adoption.

- Security Risks. Users must secure their private keys and wallets to protect against theft and unauthorized access.

- Scalability. Bitcoin’s scalability is a topic of discussion, with solutions like the Lightning Network being developed to address this challenge.

Adoption and Mainstream Recognition

Let’s take a spin through the Bitcoin revolution and see how it’s making its mark on the world. It’s like watching a magic trick unfold, where skepticism fades away and credibility takes the stage. Major companies, institutions, and even governments are starting to give Bitcoin a big thumbs-up. Just look at Microsoft, PayPal, and Tesla—they’re all hopping on the Bitcoin train.

Cryptocurrency Exchanges and Investment Vehicles

Cryptocurrency exchanges and investment vehicles are like the gateways to the Bitcoin universe. They make buying, selling, and trading your digital treasures easy. In addition, the introduction of Bitcoin ETFs has brought in the big guns — institutional investors. It’s like inviting the Wall Street big shots to join the party and see what Bitcoin has to offer.

Integration into Everyday Life

Platforms like Overstock, Newegg, and Shopify are like the pioneers, accepting Bitcoin as payment for all your online shopping needs. But hold on tight, my friends, because Bitcoin’s influence doesn’t stop at e-commerce and remittances. It’s like a ripple effect, spreading its magic to gaming, travel, and even charitable donations.

Future Outlook and Potential Developments

Alright, let’s take a peek into the crystal ball and see what the future holds for our beloved Bitcoin.

- Institutional Adoption. Big shot investors are giving Bitcoin a serious nod of approval. They’re like the cool kids on Wall Street, realizing that Bitcoin can be a mighty store of value and a shield against pesky inflation.

- Regulatory Frameworks. Governments are rolling up their sleeves and getting down to business. They want to set some ground rules for this crypto-craze, and that includes Bitcoin. Clearer regulations are on the horizon, and that will shape how Bitcoin is accepted in different parts of the world.

- Environmental Concerns. Environmental concerns are making waves, and it’s time for Bitcoin mining to go green. We’re talking about more sustainable practices and exploring greener energy sources for those energy-hungry mining operations.

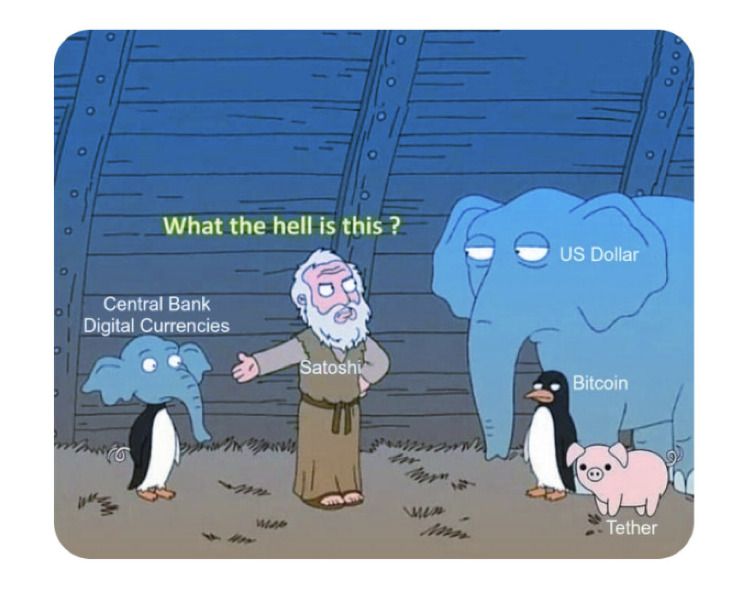

Potential Impact of Central Bank Digital Currencies (CBDCs)

These little fellas are like the cousins of Bitcoin, but with a twist. CBDCs are centralized digital forms of fiat currency controlled by the big boys—the central banks. They offer digital transactions, just like Bitcoin, but they come with a touch of centralization.

CBDCs could impact Bitcoin in the following ways:

- Competition. Well, there’s a chance they could be vying for attention, showing off their digital transaction features. But here’s the thing—Bitcoin has some aces up its sleeve. Its decentralized nature and limited supply make it stand out from the crowd.

- Coexistence. But fear not, my friends, they also can peacefully coexist. Bitcoin’s got its eyes on being a store of value and a champion of financial sovereignty.

- Increased Adoption. CBDCs might bring awareness to the digital currency realm and even drive more people towards decentralized alternatives like Bitcoin.

Potential Applications of Blockchain Technology beyond Bitcoin

- Supply Chain Management. With blockchain, we can revolutionize the way products travel from point A to point B. By creating a decentralized ledger, we can record transactions, verify product origins, and boost efficiency.

- Financial Services. Cross-border payments, identity verification, and smart contracts — it’s like we’re reshaping the way money moves and contracts are sealed. Blockchain has the power to streamline these processes, slashing costs and bolstering security.

- Healthcare. Blockchain can provide a secure and seamless way to share health data, ensuring patient privacy while allowing healthcare providers to collaborate more effectively

- Voting Systems. We all know how important transparent and trustworthy elections are. Blockchain can lend a helping hand by creating immutable and auditable records of votes.

- Decentralized Finance (DeFi). DeFi it’s like a wild west of financial services, where traditional banks are replaced by decentralized alternatives. We’re talking about lending, borrowing, and even decentralized exchanges, all powered by the magic of blockchain.

To Sum Up

This groundbreaking digital currency, born from the genius of Satoshi Nakamoto and blockchain technology, has turned the financial world on its head. Bitcoin’s decentralized nature, peer-to-peer transactions, and limited supply make it a thrilling investment. It disrupts traditional systems, offering inclusivity, borderless transactions, and protection against inflation. Challenges like volatility and regulations exist, but major companies and governments are embracing it.

Looking ahead, Bitcoin’s future involves institutional adoption, regulations, and technological advancements. Blockchain’s potential goes beyond Bitcoin, impacting supply chains, finance, healthcare, and voting systems.

Bitcoin has rocked our world, and the adventure is far from over. Understanding the impact of Bitcoin and blockchain is key to shaping the future of finance. So keep exploring, keep researching, and keep pushing the boundaries of what’s possible. The crypto world is yours for the taking!

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice.Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL FM strongly recommends contacting a qualified industry professional.