Welcome to the latest digital digest, where we delve into the heady world of technology, finance, and blockchain. From BlackRock’s impressive leap into blockchain-based finance to the intricate confrontation between artists and AI, and the forging of new pathways in the Web3 realm, we’ve got you covered.

BUIDL Claims Throne as the World’s Largest Tokenized Treasury Fund

The Institutional Digital Liquidity Fund, BlackRock USD, is now the biggest blockchain-based piggy bank out there. It took less than six weeks for BlackRock USD to outshine the tokenized Franklin Templeton fund, which was put together just a year ago.

BlackRock’s six-week wonder, under the catchy ticker BUIDL, ballooned to a market cap of $375 million, leaving in the dust the 12-month-old Franklin OnChain U.S. Government Money Fund (BENJI), which, according to Dune Analytics, is sitting at $368 million.

What’s the scoop? Well, last week, BUIDL snagged $70 million, including $50 million from Ondo Finance’s OUSG token, a company all about tokenizing assets. Meanwhile, BENJI’s assets took a dip of about 3.7% during the same timeframe.

Right now, over $1.2 billion worth of US Treasuries exists on Ethereum, Polygon, Solana, and other blockchains.

Fund’s Tokenization Frontier

Blockchain-based tokenization of real assets is all the rage lately: BlackRock CEO Larry Fink recently said that capital markets could be made more efficient by moving to blockchain.

Treasury bonds are just the tip of the iceberg: stocks, real estate, and a whole heap of other assets can get the token treatment too.

But, according to 21.co’s research strategist Tom Wan, investors aren’t exactly beating down the door for these tokenized goodies right now, citing “thin liquidity” as one of the main reasons.

Turns out there’s already demand for U.S. Treasury bonds from the deep pockets playing in the $140 billion stablecoin market. So, “finding end investors to switch to will be easier,” when demand ramps up, Wan explained.

He’s also banking on other ETF emperors taking a leaf out of BlackRock and Franklin Templeton’s playbook and tokenizing RWA (Real World Assets) on the network.

By Boston Consulting Group’s estimates, blockchain-based tokenization is set to be a $16 trillion market by 2030.

Artists Ahead of Generative AI Deepfakes

Artificial intelligence is back in the spotlight in Washington, D.C., as members of the Senate’s Legal Committee heard testimony from representatives of the music industry, unions, and academia about the risks associated with generative AI. The session largely focused on digital replicas and AI-generated deepfakes, with one musician sharing her own experience working with this technology.

British actress and musician FKA Twigs, whose real name is Tahliah Debrett Barnett, gave firsthand insight into how AI could impact artists.

We dedicate our entire lives to hard work and sacrifice in pursuit of perfection — not just for commercial success and critical acclaim, but also in the hope of creating a body of work and a reputation that will become our legacy.

FKA Twigs then revealed to the committee that she had created her own digital clone.

“Over the past year, I’ve developed my fake version of myself, which not only captures my personality but can also use my exact vocal tone to speak multiple languages,” she said, noting that this could help her reach a more global fan base and refine her marketing while still focusing on her craft.

Consent and fair compensation were key factors in the SAG-AFTRA strike. Earlier this month, the actors’ union reached an agreement with major players in the music industry, limiting the use of AI for voice actors by recording companies.

What’s unacceptable is when my art and my identity can be simply hijacked and misused for someone else’s gain without my consent due to a lack of appropriate legislative controls and restrictions. However, this is all under my control, and I can grant or deny consent in any reasonable way.

For FKA Twigs, safeguarding the legacy she has spent years building through her music is paramount.

Web3 Partnership Progress

In a strategic move to level up the Web3 sector, Animoca Brands, the Hong Kong-based gaming software and venture capital company, has announced a partnership with Opal Foundation and Saakuru Labs. The aim is to nudge Animoca into the Bitcoin ecosystem and pump up the expansion of Web3 games.

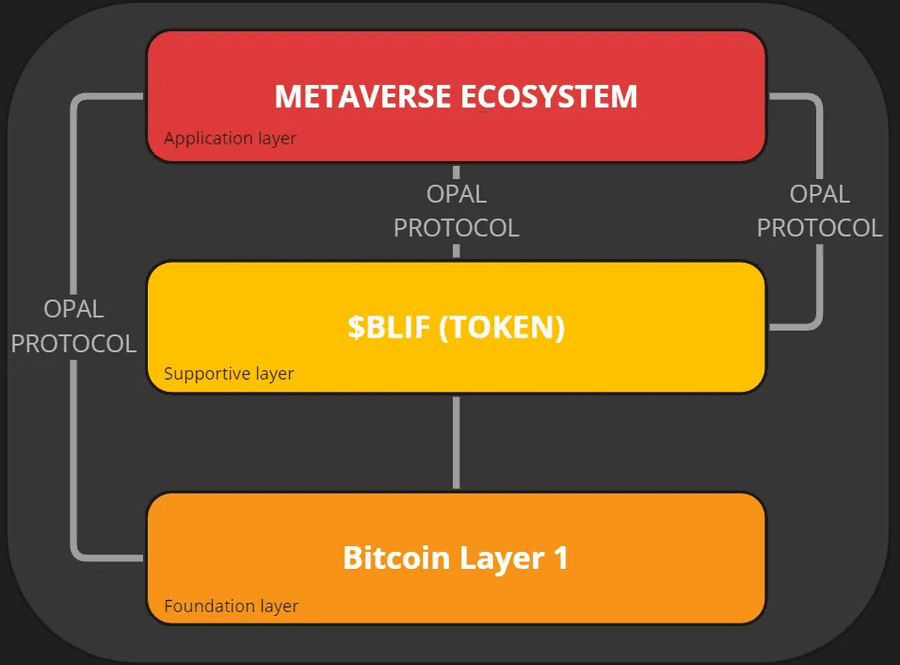

Teaming up with Opal Foundation, Animoca Brands is tapping into the potential of Bitcoin by integrating BLIF tokens, the core essence of the OPAL protocol.

“Opal isn’t just about hitching non-native Bitcoin apps onto the Bitcoin community bandwagon. It’s also about turbocharging our own Bitcoin Web3 apps for prosperity. BLIF serves as the universal kickstarter, fostering collaboration and innovation across the entire ecosystem,” explained Vincent Marty, Product Director at Darewise.

BLIF tokens offer a comprehensive digital life experience, transcending the bounds of traditional gaming and entertainment. According to the official document, Opal elucidated that BLIF is “rooted in the foundational layer, providing access to higher levels of the ecosystem.”

Industry heavyweights like Magic Eden, Xverse, ALEX, and HorizenLabs have already thrown their hats into the ring. In the coming days, Opal will unveil additional members of the main cast.

Growth Gateway

Meanwhile, Animoca Brands has fortified its strategic partnership with Saakuru Labs, the brains behind the L2 Saakuru protocol. This alliance aims to catapult the adoption of Web3 games by integrating Saakuru’s blockchain technology. Additionally, the company seeks to bolster Animoca Brands’ influence in Southeast Asia.

Yat Siu, co-founder and executive chairman of Animoca Brands, underscored the strategic importance of this collaboration.

“Southeast Asia’s market, with its burgeoning tech-savvy audience, is poised to spearhead the Web3 revolution. Our partnership with Saakuru Labs plays a pivotal role in accelerating this change, turning the open metaverse into reality through gaming,” Siu remarked.

This move also aligns with the sharp expansion of the Web3 market. According to a report by Research and Markets, the value of the Web3 market is projected to soar from $3.19 billion in 2023 to $4.43 billion in 2024, representing an average annual growth rate of 38.8%. The potential for further growth is immense: by 2028, the market is expected to reach $16.3 billion.

Furthermore, the report emphasizes that this growth will be driven by increased adoption, scalability of solutions, and the evolution of token economies.

XRP Market Insights

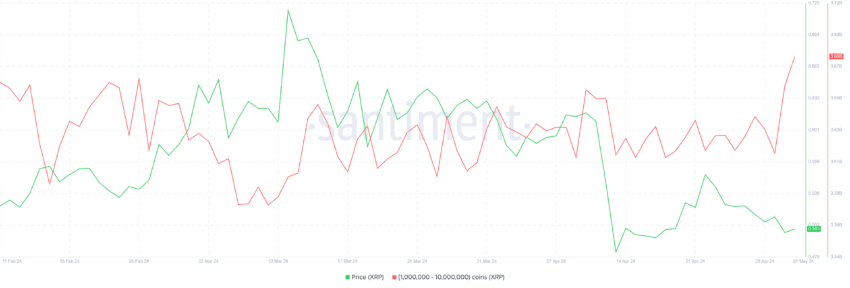

Ripple (XRP) is trading around the $0.50 mark, just below the $0.51 resistance. The rebound at this support level is likely fueled by whale enthusiasm, and it could pave the way for further price recovery.

XRP is holding above a critical psychological support level that hasn’t been breached for nearly 11 months — talk about stubborn resilience. It seems the whales are making a concerted effort to keep it that way. This could be the key to shaking off the bearish vibes that have been dogging XRP.

The drop saw the altcoin lose its support level at $0.51, which corresponds to the 23.6% Fibonacci retracement level stretching from the $0.82 high to the $0.42 low. However, the whales seem to have become aware of this problem and will likely jump to prevent this. Over the last two days, addresses holding between 1 and 10 million XRP have added over 70 million XRP into their wallets.

Another reason for this accumulation is the whales’ intention to reel in profits. The odds of XRP dipping below $0.50 are slim, and the altcoin is poised for a rebound. The whales could milk this situation for all it’s worth, buying low and potentially cashing out later.

More Info:

- Digest 53: Retail Investor Skepticism, Unwise Partnerships, Solana Validator Loophole Fixes & Market Euphoria

- Digest 54: Sweden’s $90M Mining Tax, Binance’s India Return, Omni Network Token Scam & Magic Eden’s NFT Triumph

- Digest 55: Cosmos Protocol Fix, AI Safety Measures for Children, Argentina’s Crypto Adoption and Bitcoin Advances

Typically, market peaks are formed when over 95% of circulating assets are on the upswing. This means there’s still room for growth for XRP, which could serve as a solid incentive for investors to stash this token in their wallets.

And there you have it, as we bid adieu to today’s digest. From BlackRock’s bold foray into blockchain finance to the fascinating interplay between artistry and artificial intelligence, and the groundbreaking partnerships forging the way in the Web3 world, the stage is set for a revolution. Until next time, folks, keep innovating!

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL FM strongly recommends contacting a qualified industry professional.