Welcome, dear readers, to our exciting weekly cryptocurrency market update. In this article, we will delve into social media analysis and uncover why retail investors remain skeptical of the cryptocurrency frenzy. Additionally, we will reveal a cautionary tale about unwise partnerships, featuring the misadventures of crypto influencer Brian Jung.

We will also discuss how the Solana network ingeniously closed a loophole for cunning validators. And finally, we will immerse ourselves in the euphoria of the crypto market through in-depth Glassnode analysis. Join us and stay informed about the latest happenings in the world of cryptocurrencies.

Social Media Analysis: Retail Investors Still Skeptical of Crypto Hype

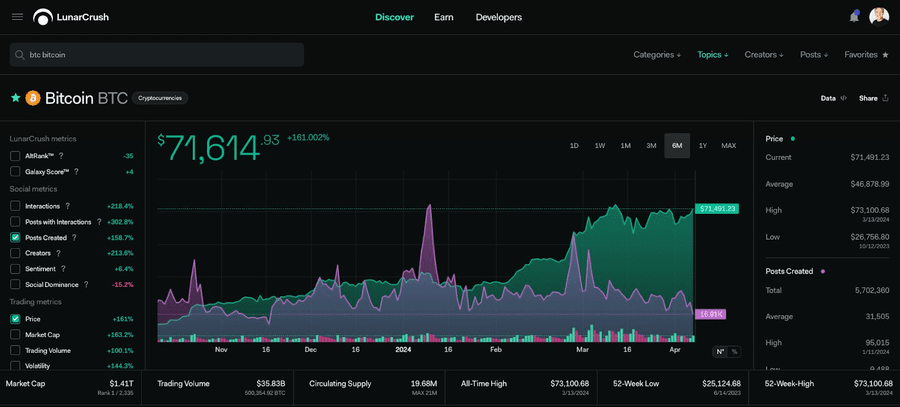

According to Joe Vezzani, CEO of the social media analytics platform LunarCrush, social interaction and overall interest from retail traders are “still pretty low” compared to the last major surge. Over the past six months, mentions of Bitcoin showed spikes in activity in January and March.

The January mentions may be linked to the excitement surrounding spot Bitcoin exchange-traded funds (ETFs). On January 10, the SEC approved spot Bitcoin ETF applications.

In March, there was also a spike in posts when Bitcoin hit a new all-time high. However, the volume of posts remained steady despite Bitcoin reaching $73,737 on March 14.

Mentions of Ethereum keywords on social media have remained relatively stable over the past six months. However, data shows a downward trend in these keywords since the beginning of March.

Halving Hype Might Not Be on the Horizon

Vezzani’s perspective is that the upcoming Bitcoin halving may not lead to significant changes in retail trading. While Bitcoin and other digital assets are on the rise, retail investors aren’t quite “buying into the buzz” just yet.

He pointed out that if you filter out the spam and bots, there might be a decrease in social media activity within the crypto space.

“When it comes to the number of authors and influencers posting daily, we’ve seen growth. However, a noticeable change we’re not observing is the level of engagement with these creators.”

Even with major upcoming events like the Bitcoin halving, Vezzani doesn’t think there will be a significant shift in retail trading. He argues that the halving event is “typically perceived as insider knowledge.”

Bitcoin is already complex for newcomers, and when we introduce concepts like halving, we risk alienating the public and reducing their interest in this discourse.

When asked why it’s crucial to look at social activity data, Vezzani replied that cryptocurrency markets continue to fragment, with new coins and exchanges emerging. For this reason, the executive believes that analyzing social activity gives traders an edge.

A Cautionary Tale of Unwise Partnerships

We still shudder at the FTX scandal, a stark reminder to tread carefully with crypto influencers and their endorsements. Crypto-influencer Brian Jung learned this lesson the hard way through personal experience, realizing that not all partnerships with crypto firms are worth it.

“I’ve turned down sponsorship deals with more zeros than I can count and even partnerships with KOLs [Key Opinion Leaders], which many influencers do. Since FTX, we’ve learned our lesson and are very cautious when working with any company,” Jung says.

Brian Jung admits he’s been declining offers from crypto companies ever since he got caught with his pants down during the FTX fallout. He even said “no” to Coinbase, a cryptocurrency exchange that, in his view, is “quite different” from FTX as it’s a publicly traded company on the US stock market.

Jung also found himself embroiled in a massive billion-dollar class-action lawsuit along with a group of other celebrities and influencers who had endorsement deals with FTX before its bankruptcy.

Quite a nerve-wracking experience for a guy who was only 25 at the time. Essentially, he played the entire FTX influencer gig for free.

In the end, we settled with them. So we’re one of the few who agreed with them, and it just means we returned the sponsorship money we received from FTX.

He’s unsure how many he convinced to join FTX, and while he settled with the plaintiffs, he believes the biggest beneficiaries are the lawyers.

“In the end, the ones making money off this are the lawyers representing the so-called victims,” he says.

Despite coming “dangerously close to losing everything” with FTX, Jung managed to take care of his parents’ mortgage and continue providing them with a monthly allowance.

This is a cautionary tale for any influencer because, when FTX was at its peak, it seemed safe to jump on board.

Predictions from Jung

Despite having a relatively modest following of 61,400 users, most of his audience tunes into his YouTube channel for insightful cryptocurrency tips. There, he boasts 1.78 million subscribers.

Young spends roughly two-thirds of each week diving into cryptocurrency tokens, so the Hall of Flame is eagerly awaiting to hear what alpha he can offer.

“Right now, I’m averaging about 14-16 hours a day researching coins, talking to founders, and chatting with my team,” he explains.

Jung is particularly bullish on Aerodrome Finance (AERO), an automated market maker (AMM) set to become the liquidity hub of Base. This DEX has skyrocketed its TVL by over 380% in just two months, reaching $580 million.

But remember, dear reader, what we told you at the beginning of the article, and don’t rush to invest your nest egg in the first advertised token you come across! Invest wisely!

Solana Found How to Fix a Loophole for Sneaky Validators

The Solana network has been experiencing high levels of network congestion lately. According to Coinbase’s status report, sending SOL is taking longer than a tortoise in a marathon — over 24 hours! And to top it off, last week Unchained reported that 75% of non-voting transactions on Solana failed as bots dominated the swap count on the network.

According to Fantom Foundation’s founder, Andre Cronje, Solana has become a victim of its own success. Fixing these bottlenecks is just an engineering hiccup, not some wild consensus blunder or blockchain doomsday.

Up until now, validators were gaming the system, timing their votes just right to see which fork had the juiciest odds. This voting delay has resulted in slower confirmation and finalization, putting the brakes on Solana’s transaction processing speed.

Fixing Solana’s Validator Shortcut

Solana validators’ loophole for snagging extra credits without the hassle of consensus is about to get a reboot thanks to Timely Vote Credits (TVC). This function will award votes with variable scores, where the quicker the vote, the heftier the points.

The Solana community gave the green light to activate Timely Vote Credits (TVC) — a mechanism that can mitigate latency in voting system delays among validators, ultimately dialing down network overload and turbocharging transaction speeds.

This fresh rewards setup, doling out major credits to validators for turbocharging transaction processing, could speed up block confirmations on Solana.

According to Dune, the proposal scored a whopping 98.4% approval rating from voters and is set to kick in after a few weeks of comprehensive network testing by the developers and community discussions.

These engineering hurdles are apparently under development. Solana Labs founder Anatoly Yakovenko noted that a quick delivery of the patch to address these congestion issues would be “impossible,” but it will happen once the fix undergoes thorough verification, release, and conveyor testing.

Crypto Market Euphoria: Glassnode Analysis

According to analysts at Glassnode, the volume of spot trading is equivalent to levels seen during the bull market of 2020-2021. Bitcoin has surged by 145% over the past year and is currently trading at around $69,300. Glassnode claimed that much of this price movement over the last 12 months was driven by both spot trading volume and exchange deposits and withdrawals.

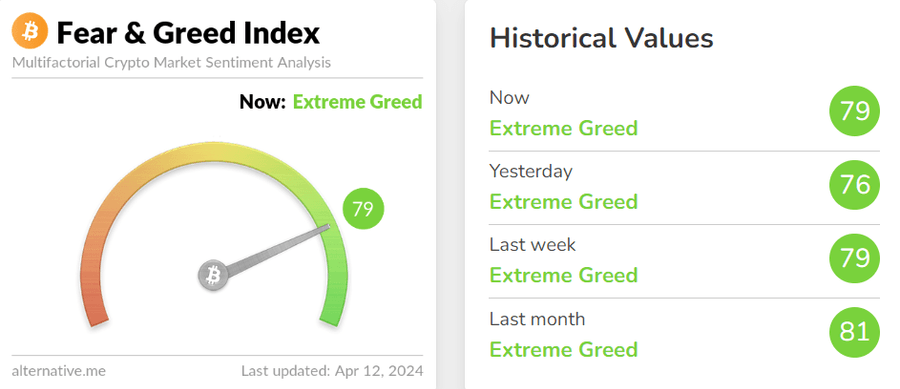

In their latest weekly cryptocurrency market report, Glassnode noted that the market has entered a phase of euphoria, and profit-taking has accordingly increased.

The surge in Bitcoin trading volumes largely followed the approval of Bitcoin spot exchange-traded funds (ETFs), launched in January, with daily trading volumes hitting a peak of $14.1 billion around mid-March when Bitcoin reached a new all-time high of $73,000.

According to Glassnode’s analysis, spot trading volume saw a significant increase as early as October 2023, with faster moving averages significantly outpacing slower ones. Glassnode uses a fast/slow moving average model to assess overall market dynamics.

Profit-taking among long-term holders significantly increased during periods when Bitcoin was trading near a new all-time high (ATH).

“Comparing the ATH breakout in previous cycles, we can argue that the current Euphoria phase (the market price discovery phase) is still relatively young,” say Glassnode analysts.

“In previous euphoric stages, there were numerous price drops exceeding -10%, with many much deeper, and 25%+ corrections were common. In the current market, there have only been two corrections of ~10%+ since the ATH breakout.”

The notion that the market is in a “euphoria phase” is further supported by the fear and greed index, currently at 79 or “extreme greed.”

Previous Digests:

- Digest 52: Solana’s 24M Locked Protocol, Bitcoin’s Bull Run, Paradigm’s Fundraising, and iOS App Market Challenges

- Digest 51: Coinbase’s Base Expansion, Nvidia’s AI Reign’s End, Hacker’s $63M Return & Near Protocol’s Chain Signatures

- Digest 50: Ether ETF Expectations Fade, SEC Faces Sanctions, Cardano Price Forecast & Meta Introduces Fediverse Threads

In conclusion to our digest, it’s important to remember a few key takeaways. Don’t forget to invest wisely, stay informed by reading our column, and above all, approach the hype with a healthy dose of skepticism and humor. Until next time, happy hodling, and may your trades always be in your favor!

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL FM strongly recommends contacting a qualified industry professional.