Hey there, dear readers! If you’re tired of constantly refreshing our page for the latest digest, hoping for a new release, fear not! We’re back to soothe your worries and delight you with the hottest news from last week.

The SEC continues to play puppeteer with financial giants, speculating on Ether ETH approval. But hey, not all crypto tricks go smoothly for them. They managed to rub a fair judge the wrong way, who noticed their biased attitude toward crypto firms. Meta rolled out a nifty new feature for Threads. Hooray, said the three people who still use it. Meanwhile, in the altcoin market, it’s prime time for accumulation. Which coin exactly? Read on to find out.

Hope for Ether ETF Approval Decreases

The U.S. Securities and Exchange Commission (SEC) has delayed its decision on proposed spot ETF funds by Hashdex and ARK 21Shares. The SEC’s decision to postpone from March 19 came just a few days before the agency’s “third ultimate deadline” – the final decision on both Ether ETF applications will be made by the end of May. May 24 will mark the SEC’s final decision on ARK 21Shares, while Hashdex’s application will face the regulator’s ultimatum by May 30.

The Securities and Exchange Commission (SEC) continues procrastinating its decision on spot ETH ETFs, while analysts have become more pessimistic about approvals.

Analysts’ Negative Vibes

Analysts have recently cast doubt on approval for the eight currently proposed Ether ETFs from BlackRock, Grayscale, Fidelity, Invesco Galaxy, VanEck, Hashdex, and Franklin Templeton.

Bloomberg ETF analyst James Seyffart stated in a message X dated March 19 that he is increasingly concerned about the lack of interaction between the SEC and the issuers.

“My cautiously optimistic stance on ETH-ETFs has shifted in recent months. Now, we anticipate a flat-out denial in this round come May 23rd,” Seyffart wrote.

Last week, Bloomberg ETF analyst Eric Balchunas slashed the odds of an Ether ETF approval from 50% to 35%. Balchunas shared that the ETF process for Ether feels “reverse” compared to what he experienced during the Bitcoin ETF frenzy, citing the SEC’s silence.

Public sentiments, it seems, have also dived: Polymarket’s odds for ETFs approved by the end of May plummeted to 32% compared to January’s 77%. Polymarket, a decentralized betting platform, saw around $2.2 million wagered on the ETF outcome.

If we had a dollar for every time the SEC delayed their decision, we could probably start our own cryptocurrency. HoDLCoin, or something like that.

SEC Lands Under Court Sanctions Due to Prejudice Against Crypto Firms

While the Securities and Exchange Commission (SEC) flexes its muscles in crypto circles, pulling strings with ETF approvals and keeping America’s biggest investment firms on their toes, a U.S. District Court has sanctioned the SEC after one of its many enforcement actions against the crypto industry resulted in serious reverse consequences.

In a ruling, Judge Robert J. Shelby accused the SEC of “bad faith” as it forced the court to obtain a temporary restraining order (TRO) against Debt Box following its complaint against the company in July.

SEC’s Mistake

The SEC initially accused the firm of defrauding investors after allegedly raising $50 million in cash, Bitcoins, and Ethereum and spending the money on luxury cars and lavish vacations instead of a legitimate business.

At the time, the Securities and Exchange Commission opposed providing advance notice of the TRO, claiming that Debt Box executives might flee to the United Arab Emirates (UAE), asserting that the firm had already transferred $720,000 overseas.

Utah District Court initially heeded the agency’s request but dissolved the TRO several months later after a counter-motion from the defendants, who argued that the restraining order was issued recklessly. Upon review, the judge found evidence that the $720,000 referenced by the agency was indeed sent within the U.S. borders.

In response, the court issued a “show cause order” to the SEC, demanding evidence of the regulator’s initial claims under the threat of sanctions. Instead of providing it, the Securities and Exchange Commission acknowledged that its attorneys were not “responsive” to the court but moved for a complete dismissal of the case without prejudice, stating that sanctions were unwarranted.

Indignant Judge

However, Judge Shelby wasn’t as forgiving:

The court cannot write off these issues as unintentional, inadvertent mistakes. The Commission’s acknowledgment and attempt to rationalize… demonstrate that the Commission’s efforts to obtain and defend the ex parte TRO were permeated with bad faith.

The agency’s conduct “constitutes a gross abuse of the authority granted to it by Congress and has substantially undermined the integrity of these proceedings and the judicial process,” the judge said.

The court ordered the SEC to cover the legal and court costs incurred by Debt Box, a crypto firm offering investors “node software licenses” to earn income through cryptocurrency mining.

Debt Box hailed the court’s decision as a “monumental victory” on Х:

This landmark case underscores the need for regulatory reform and confirms the importance of honesty in legal proceedings. The court’s decision to compel the SEC to cover Debt Box’s legal expenses marks a critical stance on transparency and ethical conduct in regulatory bodies.

Cardano (ADA) Price Might Fall by 26%

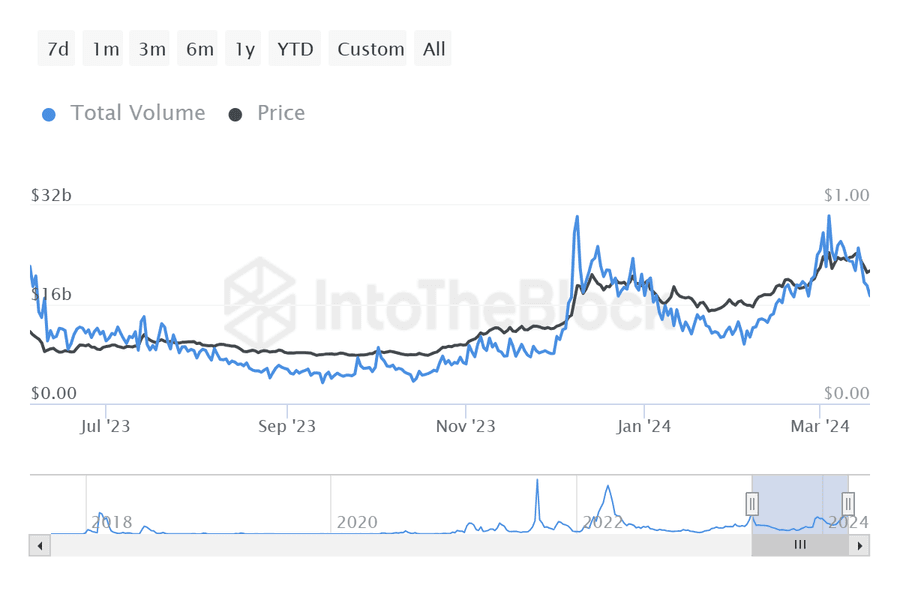

Whales are one of the most important and influential cohorts for any cryptocurrency – what they do sends ripples through the price charts. And Cardano is no exception. The price of Cardano (ADA) is showing signs of a bearish reversal pattern, suggesting that the altcoin might be in for a larger-than-expected correction.

Whales on the Move

Despite owning less than 20% of the circulating supply, these “whales” hold serious sway. Out of the whopping $17.7 billion traded, these whales splashed around about $17.4 billion worth of transactions.

However, that’s a far cry from their transactions five days ago, when they shuffled around ADA worth about $23 billion. This drop showcases a weakening bullish sentiment among the whales, which in turn will negatively impact price action.

A Window for Accumulation

While the forecast is bearish, the Cardano price dip has created quite the bargain bin. According to the Market Value to Realized Value (MVRV) ratio, ADA is in the accumulation zone.

MVRV compares the current market cap to its realized cap, indicating whether a cryptocurrency is overvalued or undervalued compared to its historical price. A 30-day MVRV of -13.45% means that investors who bought ADA in the past month are currently experiencing losses of 13.45%.

This also means that the indicator is in the “opportunity zone” ranging from -8% to -18%. Historically, this zone has seen price reversals, making it prime real estate for accumulating ADA.

Meta Just Showed off Fediverse Threads Feature

During the FediForum conference, Meta showcased what sharing and posting across multiple platforms could look like. FediForum is like the Comic-Con for developers, where they get to flaunt their creations in the Fediverse.

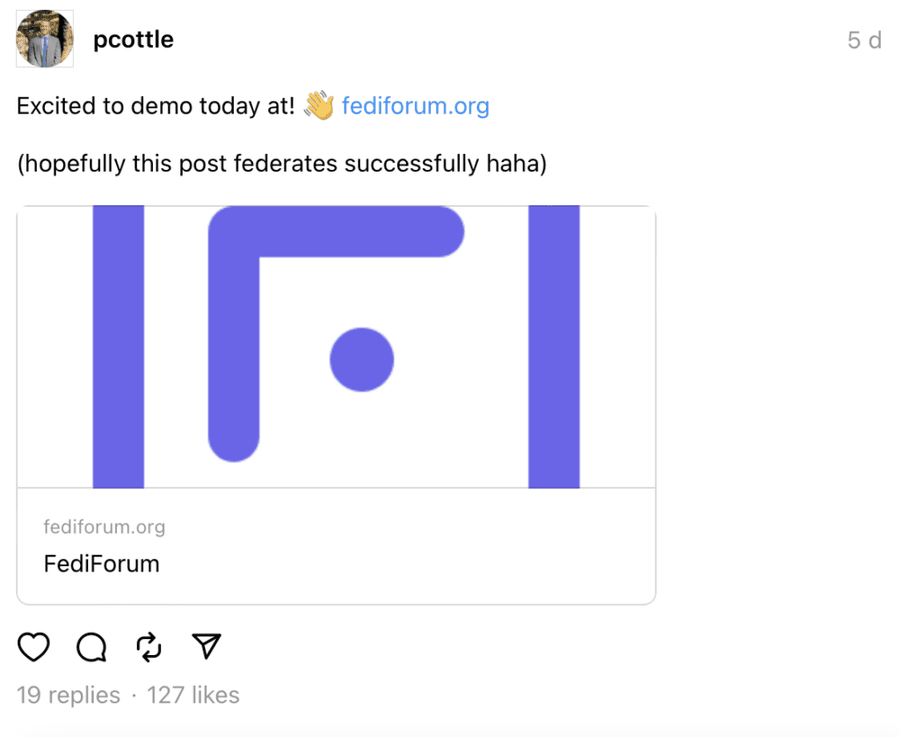

Threads are about to conquer the Fediverse – and we’ve just been treated to the first official sneak peek of how it might work on Meta itself. At the FediForum conference on Tuesday, Peter Cottle from Meta gave a quick demo of how users will eventually be able to link their accounts and posts to the Fediverse.

This integration will let users spread their messages across different platforms through Threads, allowing them to reach multiple audiences simultaneously. Meta is just one of the many platforms trying to join the Fediverse, a group of decentralized social networks all trying to play nice with each other.

How Integration Works

Cottle can head to his Threads account settings and turn on the option called “Fediverse Sharing.” Then, Meta will pop up a window explaining what the Fediverse is, along with some disclaimers that Meta will slap on users so they know what they’re getting into.

Once the shared access via Fediverse is activated, users can start posting messages on other services that interact through ActivityPub. Cottle says Threads will “wait five minutes” before sending messages to the Fediverse, during which users have the chance to edit or delete their posts. If a Threads user has shared access to Fediverse enabled, their profiles will show a “pill icon,” which other users can click to copy their Fediverse usernames.

Meta notes that users will need to have a public profile to enable this feature. Current alpha testers also can’t view responses to their posts and only see the likes they receive. Cottle says Meta is “working very diligently” to change this situation.

Threads also plans to allow users to subscribe to Fediverse accounts not affiliated with Threads, and for creators to take their followers with them to another platform.

More on Our Digests:

- EuroParl’s AI Legislation, MicroStrategy’s $500M Bitcoin Bet, and Meme Coins’ Network Bond

- Meta Tech Troubles, China’s Blockchain Push, US Election Deepfakes & Crypto for Bigwigs in Germany

So we bid adieu to another week in the world of crypto. As we witness the SEC’s struggles with ETF approvals and legal troubles, we’re reminded of the importance of transparency and integrity in regulatory bodies. Meanwhile, Cardano’s price forecast warns of potential dips. But fear not, adventurous investors, for every dip in the market, is just another opportunity to buy the dip and hope for a moonshot. And let’s not forget Meta’s grand entrance into the Fediverse Threads scene, a feature that offers a glimpse into a more interconnected social media landscape.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL FM strongly recommends contacting a qualified industry professional.