Hello, dear reader! If you’re reading these lines, it must be the end of the week as usual, and we’ve brewed up a fresh batch of news for you. Today, we’re diving into the murky waters of quantum economics (yes, we’re scratching our heads too), exploring hefty donations against crypto-unfriendly politicians in the US, figuring out why MATIC is lagging behind in the grand race, and uncovering the latest AI powerhouse poised to outshine ChatGPT. Stick around, folks, it will be interesting!

Is the Future in Crunching Numbers, Not Bitcoin?

David Orrell, a mathematician and renowned writer, claims that the future of the economy doesn’t lie in trendy cryptocurrencies like Bitcoin. Instead, it’s all about quantum mechanics. He emphasizes the potential of quantum models in social sciences and decision-making processes, challenging the assumptions of classical economics.

Classical economic theories have long been the bedrock of financial analysis and forecasting, largely relying on equilibrium models to predict market behavior. While foundational, these models often fall short, ignoring the complexities and uncertainties inherent in real economic systems. Despite their innovative approach to decentralization and security, Bitcoin and similar cryptocurrencies still operate within these classical frameworks, thereby inheriting their limitations.

However, quantum economics takes these complexities into account, drawing parallels with the particle-wave duality of quantum particles to model economic phenomena.

Orrell emphasized that quantum economics harnesses quantum models as mathematical tools for a more efficient analysis and prediction of economic behavior. According to him, just as quantum probability plays a crucial role in understanding physical processes, it can also shed light on economics.

I’ve found that people use quantum models in social sciences for things like decision-making – in other words, how to use a quantum model to account for the decision-making process. Just like in regular economics, instead of consistently making perfectly rational decisions, we find that all these other things are happening in the background that disrupts our thought processes.

Therefore, quantum models can explain irrational behavior that influences economic decisions. This approach offers a more comprehensive foundation for understanding the flow of money and information in the financial system. Thus, it challenges the traditionally rational assumptions of classical economics.

He also pondered the analogy between the binary nature of traditional computing and the capabilities of qubits in quantum computing. This paradigm shift, as Orrell speculated, could revolutionize economic modeling and decision-making by taking into account uncertainty and complexity.

A qubit can be likened to a spectrum of colors, offering various shades and complexities. It’s not just a zero or a one. Qubits are entangled; they interact with each other, introducing uncertainty when measured. That’s a fundamental difference and what sets it apart. And, as I’ve mentioned, the key point is demonstrating that models based on this principle can be profitable and effective.

While Bitcoin has revolutionized the concept of decentralized finance, it remains confined by the paradigms of classical economic theories. They often fail to capture the full spectrum of human behavior and market fluctuations. Orrell believes that a deeper understanding of quantum principles could lead to the creation of innovative economic models and strategies that will benefit the global financial system.

Very tangled and unclear, isn’t it? Well, let’s take the words of our favorite writer on faith and await breakthroughs in quantum mechanics, or whatever it is!

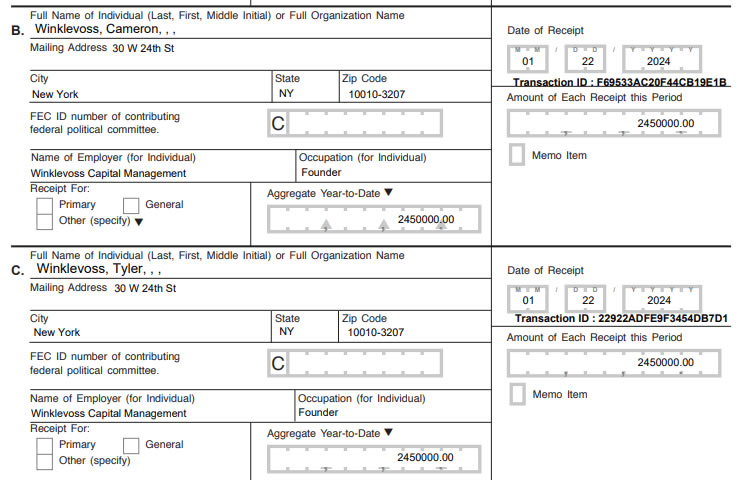

The Winklevoss twins donated $4.9 million to an anti-political organization

Dear readers, those who keep up with our digest will remember that last time we wrote about this fund orchestrating an anti-political campaign against a well-known American senator. Tyler and Cameron Winklevoss donated $4.9 million to the Fairshake Super Political Action Committee (PAC), focused on cryptocurrency, to support crypto-friendly candidates in the upcoming U.S. elections.

Among other recent donors to the crypto-super PAC is the venture company Blockchain Capital, which donated $100,000 in January.

According to OpenSecrets, in December 2023, Fairshake received a total of $14 million from crypto venture capitalists Mark Andreessen and Ben Horowitz of Andreessen Horowitz, $5 million from Jump Crypto, $15.5 million from Coinbase, and $20 million from Ripple Labs.

About Fairshake

Fairshake describes itself as backing candidates “aiming to make the United States home to innovators creating the next generation of the Internet.”

Many in the crypto industry view Fairshake as a major player in the 2024 US elections, as the crypto sector faces increased scrutiny from lawmakers and regulators following a string of high-profile crashes over the past 18 months.

Fairshake aims to combat excessive industry regulation by supporting crypto-friendly candidates from both sides of the political aisle in the United States.

On February 13, a political ad tracker showed that Fairshake spent $3.6 million opposing California Senate candidate Katie Porter, who is against cryptocurrency, making it the largest expenditure to influence the elections so far.

Why are traders giving MATIC the cold shoulder?

Polygon’s own ecosystem token (MATIC), the darling of the market during the bull run in 2021, saw less attention from crypto traders last year, missing out on significant cryptocurrency growth.

The cryptocurrency dropped by about 32% over 12 months, significantly trailing competing second-tier coins like OP and SKL, which, according to CoinDesk Indices, grew by 216%, 46%, and 50% respectively. Arbitrum’s ARB token, existing for less than a year, achieved more significant growth in six months than MATIC.

Bitcoin (BTC), the largest cryptocurrency by market capitalization, more than doubled over the year to $51,700, and the CoinDesk 20 index, a broader market indicator, grew by 70%. Ethereum’s native token, Ether (ETH), rose by 76%.

MATIC’s dismal performance contrasts with 2021 when the token was on a tear, providing staggering market price growth measured in triple digits, even during correction phases of the bull run.

Indeed, the frenzy back then could have been fueled by the project’s then-leader status as a leading Ethereum sidechain.

Polygon`s achievements

But since then, the technological race has shifted: investors and developers now prefer a different type of scalable networks, known as “collapsars.”

Polygon pivoted, rolling out Polygon zkEVM, using ZK-rollup technology, bundling and processing transactions off the Ethereum main chain. The biggest competitors to Polygon, Arbitrum, and Optimism, are other popular Ethereum scaling solutions, based on a slightly different but equally popular technology known as “optimistic rollups.”

But Polygon still clings to its outdated chain, known as Polygon PoS, which utilizes the Plasma platform with a “proof of stake” (PoS) consensus mechanism.

Currently, Polygon is pushing Polygon CDK, the “chain development kit,” built on ZK technology, which other developers can use to deploy their own layer-two networks. Last week, Polygon made a technological breakthrough, releasing “proof of type 1,” a new component enabling any network compatible with the Ethereum EVM standard to become a second-layer network based on zero-knowledge proofs. Polygon representatives declined to comment on this story.

Well, it seems the multi-month detox strategy might finally be paying off. Over the last month, MATIC gained 24%, compared to a 14% growth in the benchmark CoinDesk 20 index of top digital assets during the same period. Looks like MATIC is getting its groove back!

New Artificial Intelligence Outsmarts ChatGPT and Elon Musk

Groq, the latest Artificial Intelligence (AI) tool to hit the scene, is taking social media by storm with its lightning-fast responsiveness and new technologies that can bypass graphics processors.

Related: ELVIS Act: Protecting Musicians from AI

Groq’s LPU inference engine became an overnight sensation after its publicly available performance tests went viral on the X social media platform, demonstrating that its computing and response speed surpasses that of the popular AI chatbot ChatGPT.

This is because the Groq team has developed its own specialized Application-Specific Integrated Circuit (ASIC) chip for Large Language Models (LLMs), enabling it to generate roughly 500 tokens per second. By comparison, ChatGPT-3.5, the publicly available version of the model, can churn out about 40 tokens per second.

Groq Inc, the brains behind this model, claims to have created the first Language Processing Unit (LPU), with which it powers its model, rather than relying on scarce and expensive Graphics Processing Units (GPUs) typically used to run artificial intelligence models.

Groq`s background

However, the company behind Groq isn’t new. It was founded in 2016 when it registered the trademark Groq. Last November, as Elon Musk’s own AI model, also known as Grok (but spelled with a “k”), was gaining traction, the original Groq developers published a blog post urging Musk to choose a different name:

We get why you might want to take our name. You’re into fast things (rockets, hyperloops, single-letter company names), and our product, the Groq LPU Inference Engine, is the fastest way to power Large Language Models (LLMs) and other AI generative applications. However, we must ask you, kindly, to pick another name and do it fast.

Since Groq went viral on social media, neither Musk nor the Grok page on X has made any comments regarding the similarity of the two tools’ names.

More HODL FM Digests:

- Metaco’s CEO Departure, US Crypto-Political Battles, 1.3 Million Token Rewards, and Celebrity Scam Scandal

- Million-Dollar NFT Loans, Bukele’s Bitcoin Boost, Hong Kong Ultimatum & Buterin’s Social Network Rave

- Bitcoin’s $170,000 Forecast, Binance’s Swiss Vault, Luxury Watches Losing the Race, and Green Energy Bitcoin Mining Boom

From the potential of quantum economics to the evolving landscape of cryptocurrency donations in politics, and from the resurgence of MATIC to the advancements in artificial intelligence, the world of finance and technology is dynamic and ever-changing. One thing is clear: innovation and adaptation will continue to shape the future of finance and technology, whether we’re crunching numbers, navigating political landscapes, or exploring the frontiers of artificial intelligence.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL FM strongly recommends contacting a qualified industry professional.