Hi there, my crypto enthusiasts, in our weekly digest. The crypto industry is bubbling with events, and as always, we’re keeping our finger on the pulse to bring you the hottest news. This time around, we’ll talk about how the world’s largest crypto exchanges are spreading their influence across the Asian and Middle Eastern markets.

Meanwhile, a crypto-friendly presidential candidate is bowing out of the race, which might seem to depress all the crypto followers out there. However, don’t hang your heads just yet, because rumors are floating around that a law regulating stablecoins might just be passed later this year.

OKX and Binance Spreading their Tentacles Worldwide

OKX, one of the biggest exchanges in the world, just received a regulatory license in Dubai, marking its strategic expansion into the United Arab Emirates (UAE). Meanwhile, Binance, is on a raid through Southeast Asia, unleashing a digital asset exchange in Thailand. But let’s break it down step by step.

OKX getting a regulatory approval in Dubai aligns perfectly with the UAE’s grand ambitions to become a global crypto hub. This vision is further cemented by the creation of the Dubai Virtual Assets Regulation Authority (Vara) back in March 2022.

This development for OKX is a reflection of a broader trend. A bunch of Indian crypto firms are pulling up stakes and making the move to Dubai. The reason for this is the regulatory landscape, which is about as different from India’s strict crypto rules and hefty taxes.

Rifad Mahasneh, the MENA region’s CEO of OKX, underscored the significance of this expansion. Mahasneh chimed in, saying:

We see this as a game-changer because now we can cater to both retail and institutional clients in the UAE, allowing them to deposit and withdraw funds in the local currency.

He also threw in a shout-out to the ongoing partnership with Vara, making sure all are in a row for the imminent launch.

Sumit Gupta, CEO of CoinDCX, weighed in on this trend:

Many Web3 founders prefer Dubai or Singapore as their hub because they have clarity and certainty about the rules and substantial community support.

So, it seems like Dubai is the new cool crypto hub – clear rules, community love, and probably some sunny weather to boot.

Binance Launches in Thailand

Presenting Binance TH – currently the exclusive, invite-only platform. It’s slated to make its grand debut to the public in early 2024, brought in partnership with Gulf Energy Development. The Thai Securities and Exchange Commission gave it the approval, signaling Binance’s grand global expansion plans.

However, opening up in Thailand is not without its challenges. Crypto shenanigans have the country on edge, with Binance teaming up with Thai law enforcement to combat the crypto underworld.

The exchange played a starring role in two operations, including “Operation Trust No One”. A scam that led to the confiscation of assets worth a cool $277 million.

As OKX preps for its UAE debut and Binance gears up for the Thai adventure, these moves are shaping up to be the turning point in the Asian crypto industry.

HashKey Crypto Exchange Hits the Jackpot with $100 Million Investment Round

Last year, HashKey Exchange became one of the first crypto exchanges to be licensed under Hong Kong’s new licensing regime, allowing crypto trading platforms to dish out retail services. And now, it’s raking in almost $100 million in a Series A funding round, with a pre-money valuation north of $1.2 billion.

As of now, the exchange boasts 155,000 registered users, with a daily trading volume reaching $630 million over the last 30 days, the company said in a statement.

In the announcement, HashKey revealed plans to use their freshly bagged treasure (aka capital) to spruce up their Web3 ecosystem, improve compliance, and expand their product lineup for the licensed business in Hong Kong. It’s like they’re giving their crypto business a makeover – new year, new blockchain bling!

The exchange is also in discussions with some asset managers, cooking up the idea of launching potential spot exchange-traded funds (ETFs). They’re eyeing the possibility of jumping into the crypto-ETF scene in Hong Kong, participating in crypto transactions linked to ETFs, and offering cryptocurrency storage services.

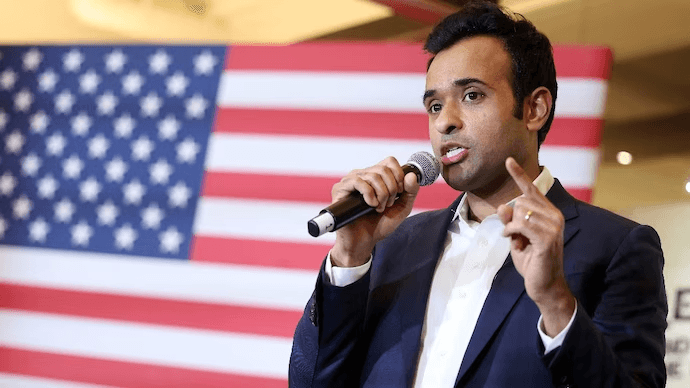

Crypto-Friendly Candidate Drops Out of U.S. Presidential Race

Vivek Ramaswamy, the Republican candidate has officially hit the brakes on his almost year-long presidential campaign.

Ramaswamy burst onto the presidential scene as a bit of an underdog but quickly became the superhero of the crypto community with his outspoken political proposals regarding bitcoins and other digital assets.

He was the lone candidate in the presidential race who presented a crypto-policy blueprint. On November 16, Ramaswamy unveiled “The Three Freedoms of Crypto,” promising to liberate cryptocurrency developers from any blame for the actions of the folks using their code.

In his grand plan, he also declared that the policy would toss out crystal-clear regulatory suggestions for the new cryptocurrencies on the blockchain and wouldn’t let any federal agency play dictator with rules that cramp the style of independent wallets.

Then, on December 6, 2023, Ramaswamy sharply criticized the U.S. Securities and Exchange Commission and its chairman, Gary Gensler, for not keeping up with cryptocurrency regulations. He even threw in a “just a shame” for Gensler’s failure to admit to Congress that Ether should be considered a commodity.

The crypto community doffed their virtual hats to the departing candidate, with Nick Carter, the general partner at Castle Island Ventures, dubbing Ramaswamy the “most talented” Republican candidate in the last generation.

Ramaswamy Now Jumps on the Trump Train

In a performance on January 16 at a press conference in Des Moines, Iowa, Ramaswamy told his followers that he was done playing the presidential game, declaring, “From this moment on, we’re putting the brakes on this presidential campaign.”

“I can’t become the next president if this country doesn’t do the thing we don’t want it to do,” he added.

“In this race, America needs its number one candidate,” declared Ramaswamy, announcing that in the upcoming elections, he’s throwing his weight behind none other than the ex-president extraordinaire, Donald Trump.

“He’ll be getting my full endorsement for the presidential gig down the road. We just couldn’t pull off the surprise we wanted to unveil tonight,” said the former candidate.

Legalizing Stablecoins in the U.S. Could Happen This Year

The Clarity for Payment Stablecoins Act brought by U.S. Representative Patrick McHenry, is one of the prominent bills on stablecoins gracing the halls of both the House and the Senate. Its mission is to give stablecoin issuers a regulatory framework similar to the traditional financial. Senator Bill Hagerty also joined the stablecoin legislative movement by presenting the “Stablecoin Transparency Act” to Congress on March 31, 2022.

Meanwhile, for the past few years, Circle has been the stablecoin defender, actively pushing for stablecoin legislation. Jeremy Allaire, Circle’s CEO, is optimistic that the U.S. will finally adopt the long-awaited stablecoin law in 2023.

As digital dollars pop up all around the globe, other countries’ governments are regulating digital dollar currencies before the United States. So, I think there’s a very strong desire to act, assert U.S. leadership, and ensure proper consumer protection.

Allaire made the comments in a CNBC interview on January 15 at the annual shindig – the World Economic Forum in Davos, Switzerland.

I sense momentum. I mean, we’ve got some pretty good chances of seeing this law go through this year.

Allaire, who managing stablecoin firm USD Coin, said that he’s witnessed recent strides from lawmakers, courts, and regulatory bodies in the good ol’ U.S.

His comrade-in-arms, Dante Disparte, the firm’s Director of Strategy and Global Head of State Policy, chimed in on CNBC, saying:

“I’m keeping the faith that stablecoin payment policies will be possible early in the new year. And it’s starting to feel like a bipartisan reality, too!”

According to ProPublica, Circle began lobbying strategy with the help of the consulting firm Invariant back in late 2021. And rumor has it, they’ve dished out a cool $860,000 on lobbying efforts since then.

What could prevent the law’s passage?

Nevertheless, Disparte pointed out that lawmakers might still have concerns about stablecoins being used to facilitate criminal activity

“In the Middle East conflict, we’ve seen the use of certain digital assets in the space as a financing tool for terrorism… Within the United States, you might spot certain assets in the space funding illegal fentanyl trade,” he said.

“If this issue isn’t sorted out, it could go against the country’s [and] the economy’s interests.”

From the global expansion moves of major exchanges like OKX and Binance, reaching into Dubai and Thailand, to HashKey’s spectacular $100 million investment jackpot, and the unexpected exit of a crypto-friendly candidate from the U.S. presidential race – it’s been a week full of unexpectable events. And of course, we’re eagerly anticipating the potential legalization of stablecoins in the U.S. Stay tuned for more stories from the crypto industry!

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL FM strongly recommends contacting a qualified industry professional.