Greetings, dear reader, in our latest Digest installment! While the Bitcoin ETF hype train keeps on, we’ll keep the ink flowing. There are folks standing on Mount Crypto, gazing down from a different angle, confidently assuring us that the ETF will indeed get the nod. Meanwhile, a globally renowned newspaper has decided to fight with artificial intelligence in the courtroom, and North Korean hackers are moon-walking their ill-gotten Bitcoins away from our prying eyes (thankfully, no nuclear warheads are involved). Dive into the juicy details in our latest issue.

OpenAI and NYT scandal

The New York Times has taken OpenAI to court, claiming that the use of their content without explicit permission undermines the value of original journalism, highlighting the potential negative impact on the production of independent journalism and its societal worth.

In response to the lawsuit from The New York Times, OpenAI has presented its receipts. The leading developer of artificial intelligence reiterated its often-stated commitment to the news industry, stating, “We support journalism, collaborate with news organizations, and believe that The New York Times’ lawsuit is unwarranted.”

The company suggests that the examples used by the newspaper were taken from old articles widely available on third-party websites. They also hinted that The New York Times might have developed AI prompts to craft the most convincing evidence.

“It seems like they intentionally played with prompts, often including lengthy excerpts from articles to make our model regurgitate,” stated OpenAI, implying that The New York Times acted deviously by providing unnatural prompts as evidence.

Playing with prompts is a common trick where folks sneakily get an AI model to do things it wasn’t programmed for. They use specific prompts that trigger ultra-specific responses, like eliciting an answer you’d never get under regular circumstances.

OpenAI’s Apologies

OpenAI is keen to highlight its friendship with the news industry. “We’re diligently working on cooking up tech to support news organizations,” the company wrote, emphasizing the deployment of AI tools that assist reporters and editors. They’re all about mutual growth, nurturing both artificial intelligence and journalism.

OpenAI recently joined forces with Axel Springer, the publisher of Rolling Stone Magazine, to serve up more accurate news digests.

The mystery remains why The New York Times isn’t handing out reading assignments, dictating who can and cannot read their articles. But they’re up in arms against letting artificial intelligence learn from the wisdom within their pages. After all, a person can make use of their content without the help of AI. It seems that this legal skirmish could shape the future of artificial intelligence, copyright laws, and journalism.

Bitcoin at $200,000 in 2025 – Fact or Fiction?

While the financial world is on the edge of its seat, waiting to see which spot Bitcoin ETF applications will get the approval, Standard Chartered Bank predicted on Monday that the price of Bitcoin will exceed $200,000 by the end of 2025.

Geoffrey Kendrick, Head of Financial Research at Standard Chartered Bank, boldly declared this prophecy. Meanwhile, Bloomberg’s ETF guru, Eric Balchunas, tweeted on a Saturday that the chances of a Bitcoin ETF getting the SEC’s nod in January are a whopping 95%.

“At the moment, I’d probably go with a solid 5%. But hey, for these things, you gotta leave a little window cracked,” said Balchunas.

Bitcoin ETFs, like nosy neighbors, keep a close eye on Bitcoin’s current price and aim to track its wild price swings. They offer investors a backstage pass without having to deal with the hassle of buying and storing the digital coin itself.

As for BlackRock, Grayscale, Ark, iShares, Bitwise, and others, their ETFs are currently in the final approval stage. Kendrick chimed in, saying that their 2025 forecast aligns with their previous bet of $100,000 by the end of 2024.

Kendrick’s proclamation aligns with the wisdom dropped by senior analyst Balchunas, who casually mentioned on Thursday that a Bitcoin ETF could rake in a cool $100 million over a decade.

These statements sure give us hope, especially after that hacker’s message (which turned out to be wishful thinking) claimed the Bitcoin ETF got the approval. Sadly, the explosive growth we dreamed of didn’t quite materialize. Nevertheless, we’re holding out for a steady and reliable ascent throughout 2024, of course, post-approval of the Bitcoin ETF.

Jay Clayton’s Confident in Bitcoin ETF Approval

Wondering who this Jay Clayton is and why his opinion is stealing the spotlight in our digest? Well, we will not disappoint you guys! Jay is none other than the former chair of the U.S. Securities and Exchange Commission (SEC), and he’s got the scoop that a spot Bitcoin ETF will be approved “inevitably.”

“I think approval is inevitable. There’s nothing left to decide.”

On January 8th, Jay Clayton took center stage in a CNBC interview, stating that the SEC is now locked and loaded to greenlight the first-ever spot Bitcoin ETF for trading in the United States. The first-ever U.S. spot Bitcoin ETF eventually happened on January 10, 2024, so we might say Jay Clayton is very clever man.

But not everything was so sleek from the beginning.

Bitcoin ETF Approval: A Brief History of Failures

Over the past decade, the SEC has been the ultimate buzzkill, swiping left on every attempt to create a spot Bitcoin ETF. It’s all concerned about potential market manipulation and shifty business.

However, Clayton now sees the ETF approval as inevitable, pointing out that Bitcoin’s market dynamics have improved over the past five years. “Five years ago, there were sales, there were stairs, there were all sorts of things you wouldn’t want to make available to the public because of that risk,” he remarked.

Adding, Clayton gave a virtual pat on the back to the regulators, praising them for being “where they are.” According to him, it’s a giant leap for the agency to feel comfy with spilling the beans on Bitcoin ETFs from heavyweights like BlackRock and Fidelity.

Not All Sunshine and Rainbows Ahead of ETFs

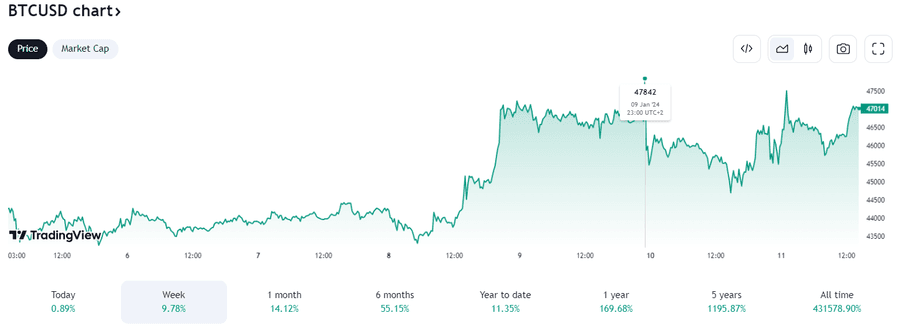

Traders betting against Bitcoin’s rise just got served a financial cold shower, losing over 100 million dollars on January 8th as the much-anticipated approval of a Bitcoin Exchange-Traded Fund (ETF) in the U.S. approaches the finish line.

Their positions were liquidated by the exchanges, a term for saying the exchanges pulled the plug on the traders’ credit-fueled escapade due to a partial or total loss of the trader’s initial margin. Traders on the OKX crypto exchange took the biggest hit – 84 million dollars down the drain. Binance followed suit with a 71 million dollar blow. Ouch, it seems the crypto market is teaching them a lesson.

BTC pulled a 9% growth stunt on Monday, only to moonwalk back a chunk of the profits. Prices soared past $47,000 for the first time since March 2022, leaving traders crying over their misplaced bets. However, open interest (the number of unfinished futures contracts) shot up by more than 8% in the last 24 hours. It seems traders are doubling down on their bets after the liquidation, probably anticipating more volatility.

North Korean Hackers Move Bitcoins

State-sponsored mischief-makers, the Lazarus Group, have hit the Bitcoin blender, siphoning off over 1 million dollars in BTC and casually sending some to an “inactive” wallet.

Post-mixing schemes, blockchain analysts at Arkham spotted a whopping $79 million chillin’ in the Lazarus Group’s piggy bank. While we can’t read minds (especially not those of a cybercriminal gang), these crypto shuffles might suggest they’re gearing up for a more lively performance.

Transfer Details

The Lazarus Group gracefully moved 27,371 BTC – a cool $1.2 million in today’s market – in two transfers that blockchain analysts dubbed the “crypto mixer.” Then sent 3,343 BTC – worth a modest $150,582 – to a previously used inactive address.

Hacker activity

From 2017 to 2023, the Lazarus Group has been on a spending spree, reportedly snatching about 3 billion dollars. Their highlight reel includes the grand Ronin Bridge heist in March 2022 when they stole over $600 million worth of Ether and USD coins from the Axie Infinity game.

Whispers in the digital corridors claim that the Lazarus Group is the favorite project of North Korea’s government, holding the title for one-third of all hacking escapades in 2023. They’ve netted a cool $700 million this year, proving that crime does pay. The group’s bag of tricks includes innovative methods like fake job offers to sneak into their targets and pretending to be famous venture capitalists.

Well, well, these North Korean tricksters certainly had a grand time dipping into the wallets of unsuspecting crypto holders! Note to self: be more cautious with those “get-rich-quick” schemes – they might just be a digital Trojan horse. And with that less-than-cheerful note, we wrap up our weekly saga.

Don’t lose hope; we’ve got our finger on the ETF pulse and will be the first to spill the beans on any updates. Subscribe to our newsletter to stay informed with the latest news.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL FM strongly recommends contacting a qualified industry professional.