The world of cryptocurrencies never ceases to amaze us with its surprises, predictions, and innovations. As we inch closer to 2024, whispers circulate about Bitcoin potentially reclaiming its former peak price. Yet, amid these anticipations and achievements, cautious voices of JPMorgan reflect skepticism about the current rally. We’re here to either confirm these rumors or debunk them. Additionally, blockchain evolution keeps on evolving, bringing new concepts like “Intents.” It’s time to dive into these aspects together, exploring Bitcoin’s potential, skeptical perspectives, and the emergence of “Intents” in the blockchain sphere.

Bitcoin’s Price Prospects: A Journey to $69,000

Let’s kick off our digest with some uplifting news. By mid-2024, Bitcoin might reclaim its former glory at $69,000. We don’t ask you to take our word for it. We’ve got Cory Mitchell, an analyst at Trading.biz, backing us up on this. He reckons that Bitcoin is going through a familiar phase of acceleration.

“Trends in Bitcoin growth tend to unfold rapidly once they kick off, often moving hundreds of percent in less than a year,” says Cory.

Recalling Bitcoin’s past rallies:

2013:

Starting price: $120

Ending price: $1440

Increase: 1200%

2017:

Starting price: $966

Ending price: $18,390

Increase: 1900%

2020:

Starting price: $11,000

Ending price: $58,000

Increase: 400%

Cory Mitchell is pretty sure Bitcoin’s now entering its fourth phase of growth acceleration.

Amidst the recent positive shifts in the main cryptocurrency’s price and the altcoin rally, a big shout-out goes to the filings for Bitcoin exchange-traded funds (ETFs) in the US. Everyone’s gearing up, expecting these regulated offerings to unlock the floodgates for institutional investor demand.

As proof, futures trading at the Chicago Mercantile Exchange (CME) hit record-breaking volumes at $4.07 billion worldwide. That’s outstripping even the bigwig in this space, Binance, whose open interest clocked in at $3.8 billion, down by 7.8%.

Considering CME is where serious Wall Street whales swim, it just goes to show the immense interest this crowd has in crypto. We wouldn’t dare doubt their moves, after all, these financial wizards make billion-dollar deals over lunch. We’re watching and taking notes from the masters.

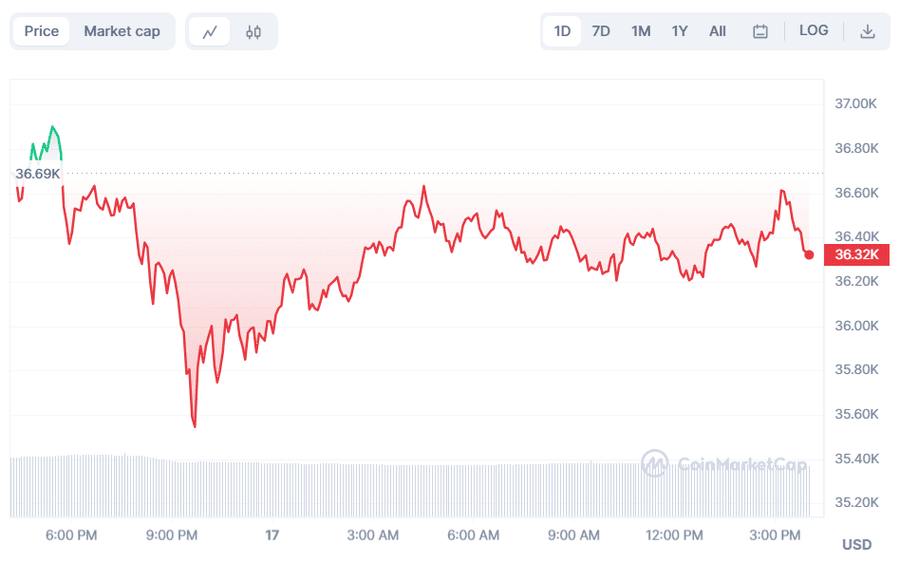

A New Growth Catalyst for Bitcoin Price

As we’ve mentioned before, the anticipation for the approval of a Bitcoin exchange-traded fund (ETF) set off a Bitcoin rally. But you won’t be satisfied with just waiting, and the price stopped showing positive growth rates, hovering around $36,500.

Now, the next catalyst in the price rodeo that the bulls are eyeing is the impending report on the US Consumer Price Index (CPI), and apparently, it’s supposed to shake things up for Bitcoin. Let’s break down why investors are pinning their hopes on this:

- Economists are predicting a slowdown in the monthly Consumer Price Index for October, down to 0.1% from September’s 0.4%.

- The annual Consumer Price Index is expected to drop to 3.3% from 3.7%.

- The Core Consumer Price Index (excluding food and energy expenses) is anticipated to remain steady at 0.3% monthly and 4.1% annually.

- Both Consumer Price Index indicators remain above the U.S. Federal Reserve’s target of 2%.

As a result:

- Higher interest rates might play tug-of-war with risky assets (like bitcoins) for investor funds.

- A landscape with lower interest rates could favor Bitcoin.

In a nutshell, here’s the gist: folks are eyeing this Consumer Price Index report to gauge its impact on inflation, which, in turn, might sway the Fed’s interest rate decisions, eventually affecting Bitcoin’s price in the market.

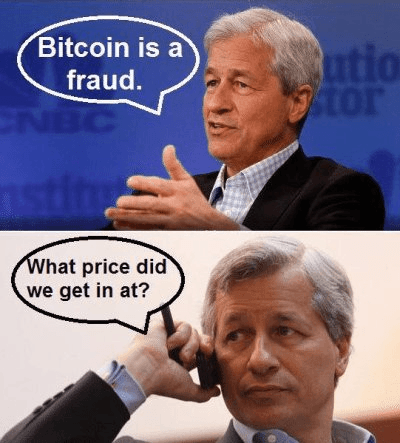

JPMorgan’s Doubts Outlook: Bubbles, ETFs, and Halving

Just as we were kicking back and mentally counting our potentially earned bitcoins, the folks at JPMorgan decided to pour a bucket of cold water over us. They’ve recently released a report suggesting that the recent surge in digital assets might just be a bubble.

The whole month has been on the rise, all thanks to three major factors:

- Firstly, the hype around ETFs. Digital assets shot up in the past month because folks were hyped about this new investment avenue called Bitcoin spot ETFs.

- Then there were Ripple and Grayscale’s legal victories. Crypto enthusiasts believe that the tightening regulation in the crypto industry might ease up in the future, following the success of these cases.

- And lastly, the Bitcoin halving. Some folks think that when the number of new Bitcoins being produced gets halved (reducing the reward for mined Bitcoins by half), it’s going to send prices soaring.

JPMorgan’s Doubts:

- They’re saying that even if these shiny new ETFs get the green light, the cash might not flow in from fresh-faced investors. Nope, it might just shuffle from the existing Bitcoin-related investments into these sparkly new ETFs. JPMorgan points out that similar ETFs exist in Canada and Europe, yet they’ve been about as exciting as watching paint dry for investors since their inception.

- Despite the legal victories in the crypto realm, JPMorgan isn’t expecting a grand overhaul in government regulation. They’re suggesting that the US still has its eye on crypto rules, and recent fraud cases might make lawmakers more cautious.

- As for the price surge following the upcoming halving in April or May 2024, JPMorgan is calling it unconvincing. They believe the impact of cutting production in half is as unpredictable as it’s already factored into the price. According to them, this notion has been chewed over by investors and might not carry the weight it once did.

So, in essence, JPMorgan is saying that the big crypto price surge might not be caused by the reasons everyone’s buzzing about. They’ve got doubts about whether these new ETFs will bring in fresh cash, they’re not convinced recent legal wins will alter how governments regulate cryptocurrencies, and they think the halving will have a minor impact on the price.

Blockchain ‘Intents’: Streamlining Transactions in the Crypto World

Lately, there’s been this influx of newfangled terms popping up in the blockchain. One of them that’s been tickling our brains for weeks is this idea of “Intent.” We’ve wracked our brains, and delved into the deep end of notes, and here’s what we’ve dug up.

So, these ‘Intents’ in the blockchain world are like specific goals that users want to achieve. They get passed on to a service and carried out by a ‘solver’—which could be a person, an AI, or another protocol.

You might wonder, “Why bother with more efficient transactions?” I mean, the blockchain already outsmarts third parties, keeps fees to a minimum, and zips things along as fast as a financier’s dream. But here’s the scoop: the cryptocurrency market has expanded, offering heaps of actions within blockchains, creating millions of possible transactions. Sometimes, it’s like trying to juggle a gazillion tasks, needing to hop from a first-level blockchain to a third, then back to the original network, and only then conduct a transaction on a second-level blockchain.

Traditionally, users used to hand out step-by-step instructions for blockchain transactions. With these ‘Intents,’ users lay out their goals without detailing how to achieve them, letting the protocol handle the nitty-gritty. New services are all about finding the most efficient ways to tackle tasks in blockchains, keeping costs and fees to a minimum for users.

Imagine strolling into a farmers’ market on the hunt for the freshest apples, perfect for Grandma’s pie. There are apple stands as far as the eye can see, offering every variety under the sun. You’re geared up for a day of apple scouting, eyeing the juiciest ones at the best prices. But then, you glance over and spot these ‘solvers’ offering to find the most appetizing ones at the lowest price, for just fifty cents (for example) for their services. Quite the tempting deal, right?

That’s precisely how intention protocols roll in the blockchain world. Users broadcast their intents, and these ‘solvers’ or automatic doers go on to fulfill those intentions for a certain fee.

Seems like an ideal option? But nope, even in this blockchain saga, there are hidden reefs. There are worries that intention-focused systems might brew up monopolies or rent-seeking behavior, bossing around users or charging higher fees.

In conclusion

Thanks for joining us this week; it’s been a bit like a therapy session. One minute it’s soaring to $69,000, the next, those JPMorgan folks step in, demanding to stop the ride and clear the queue. Then, along comes the CPI index, promising to rock Bitcoin even harder. We are completely confused, quietly watching from the sidelines—who’ll come out on top in the end? And just around the corner, these new speculators rushing to navigate tangled transactions across thousands of blockchains for a small fee.

We’ve stocked up on valerian for the entire week, ready to monitor these nerve-wracking updates on your behalf. All you’ve got to do is wait for our next digest. Sign up for our newsletter so you don’t miss a thing.