Looks like Canadians are giving crypto the cold shoulder. According to the latest Bank of Canada survey, our northern neighbors are about as interested in Bitcoin as they are in giving up hockey and maple syrup.

Related: Best Сrypto Wallets in Canada

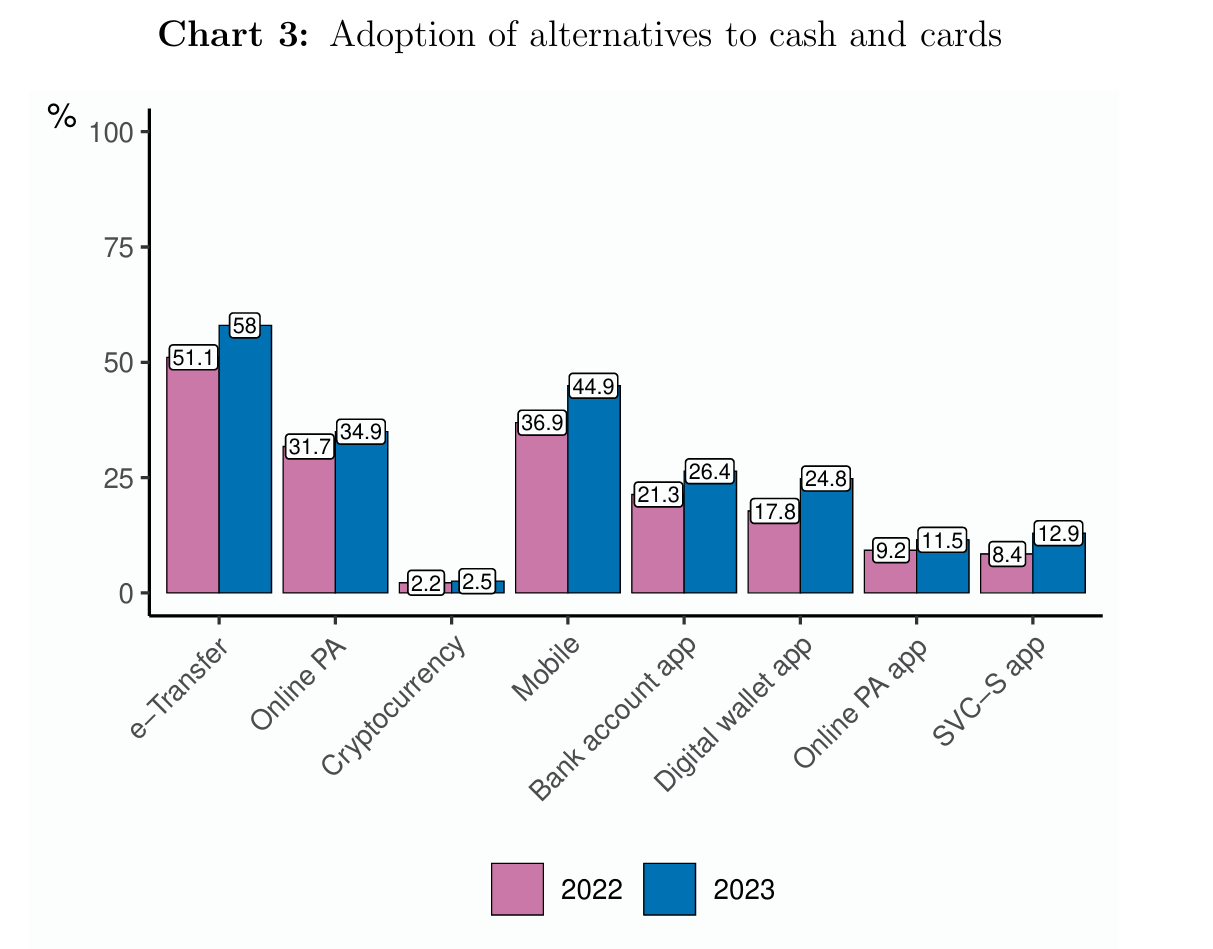

For two years straight, less than 3% of Canadians have used cryptocurrencies for day-to-day payments. That's fewer people than those who think moose make great house pets.

Here's the scoop on Canada's stubborn love affair with cash and cards:

- Over 80% of Canadians have no plans to stop using cash in the future

- E-transfer is the most popular alternative to cash and cards

- Canada hosts the second-largest network of crypto ATMs globally, with 2,941 active Bitcoin ATMs

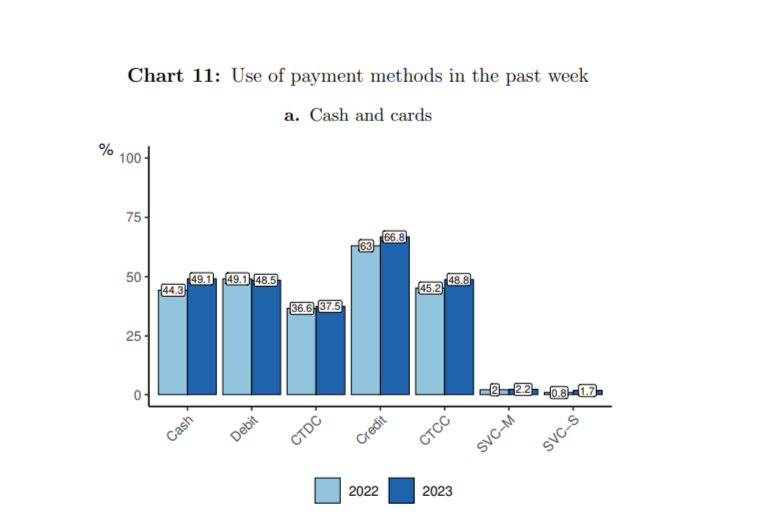

The survey found that good old-fashioned cash and bank cards remain the go-to payment methods for most Canadians. In 2023, a whopping 49% of Canadians used cash for purchases in the past week, up from 44% in 2022.

Credit cards are the real MVPs of Canadian wallets, with 66.8% of folks swiping or tapping their plastic for purchases.

Now, you might be thinking, "Surely the tech-savvy youngsters are all about that crypto life?" Well, not so much. Across all age groups, the use of cryptocurrencies for everyday transactions remains lower than the chances of seeing a moose riding a bicycle down Yonge Street.

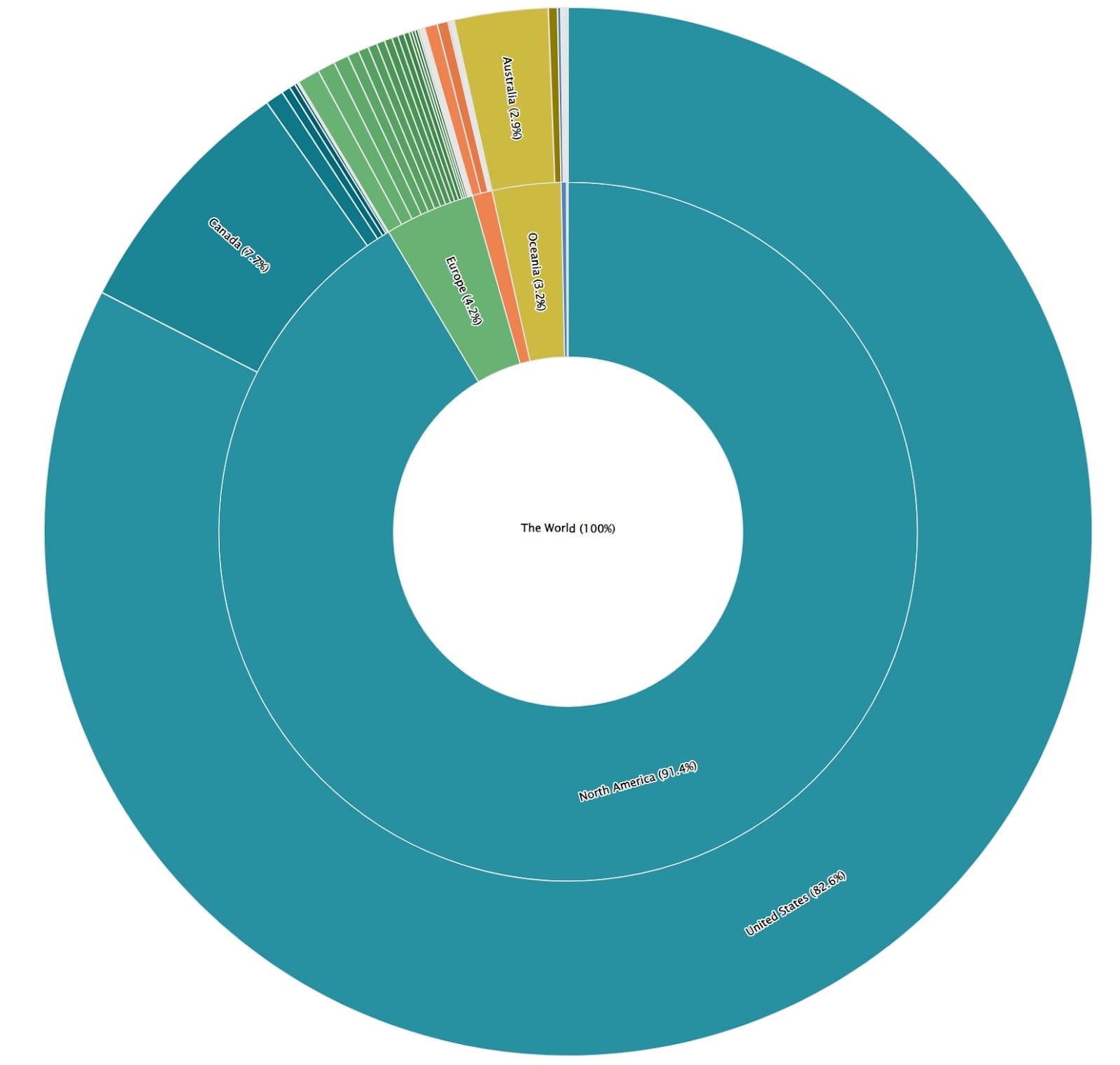

But despite Canadians' apparent aversion to using crypto for their daily runs, the country is home to the second-largest network of Bitcoin ATMs in the world. It's like Canada is the friend who buys a treadmill but uses it as a clothes rack—they've got the crypto infrastructure, but they're not exactly putting it through its paces.

In fact, Canada's crypto ATM game is so strong, it's second only to the United States. With 2,941 active Bitcoin ATMs, that's about one ATM for every 13,000 Canadians.

At this rate, you're more likely to stumble upon a Bitcoin ATM than find a parking spot in downtown Toronto during rush hour.

So, what's behind this crypto-cold shoulder? Well, it seems Canadians are as attached to their cash as they are to their toques in winter. Over 80% of respondents said they have no plans to stop using cash in the future. It's like they're giving a collective "Sorry, not sorry" to the idea of a cashless society.

But let's not write off Canada as a digital payments wasteland just yet. While crypto might be getting the cold shoulder, other digital payment methods are gaining traction.

E-transfer, the method of sending money via email or phone number, is the cool kid on the block. In 2023, 58% of Canadians used e-transfer, up from 51.1% in 2022. Mobile payments are also on the rise, with 45% of Canadians reporting they've used some type of mobile app for payments in 2023, up from 37% in 2022.

More: Canada's Concerns on AI-Generated Deepfake Disinformation Campaigns

Now, this is not to say that Canada's central bank is totally anti-crypto. It actually isn’t… technically. In fact, they're exploring the development of a central bank digital currency (CBDC), affectionately dubbed the "digital loonie" by some.

So, what's a crypto enthusiast to do in the Great White North? Well, you could always use one of those 2,941 Bitcoin ATMs to withdraw some good old-fashioned Canadian dollars and buy yourself a double-double. Or, you could join the 2.5% of Canadians bravely using crypto for payments and feel like a true digital pioneer.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL FM strongly recommends contacting a qualified industry professional.