The price of Bitcoin has taken an unexpected nosedive, dropping by 3.01% in the last 24 hours and a whopping 10.23% over the past week. The top cryptocurrency hit a monthly low of $53,600 on July 5th, after losing the crucial psychological support level of $60,000. As of this writing, Bitcoin has stabilized somewhat, trading at $55,282 according to TradingView.

Related: Bitcoin Loses Grip of 200-day Trendline for First Time Since August 2023

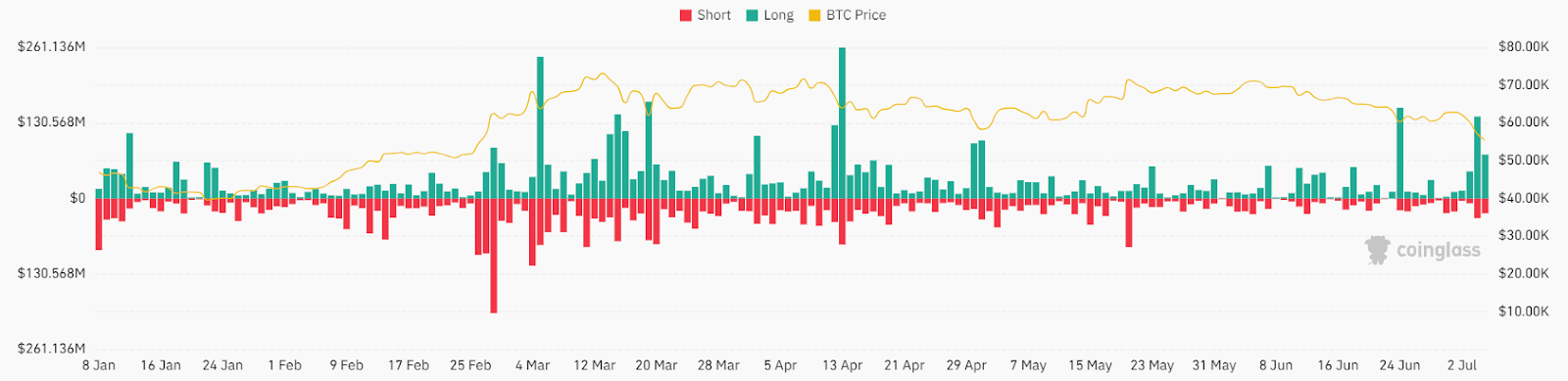

This sudden drop in Bitcoin's value has led to a wave of liquidations across the crypto market. CoinGlass data reveals that in the last 24 hours, long Bitcoin positions worth $98.04 million were liquidated compared to $22.6 million in short liquidations. Approximately $333.1 million in leveraged long positions across cryptocurrencies were wiped out in 24 hours, compared to $50.52 million in short positions.

Analysts Say Bitcoin Could Drop to $50,000

Swyftx analyst Pav Hundal mentioned that the worst might still be ahead for Bitcoin's price action:

A massive Bitcoin wall is about to hit an already apathetic market. While long-term macro conditions remain positive, in the short term we could test $50k or even lower. $52k is the key battleground for bears and bulls right now.

Analysts at 10x Research also predicted a continued decline, which could see Bitcoin's price fall to $50,000 in the coming weeks, warning that "selling could accelerate as support is breached and sellers scramble for liquidity."

eToro market analyst Josh Gilbert said that after the sudden drop to $53,600, he expects Bitcoin's price action to worsen in the coming days. Gilbert attributes much of the sell-off to fears related to creditor payouts from Mt. Gox, which could release around $8 billion worth of BTC into the market in July.

Currently, the news flow is much more bearish than bullish, and the selling activity we've seen is clearly worrying investors, often leading to even more selling. I wouldn't be surprised if the asset tests $50,000 in the next week, but this will be a key psychological level.

Why Bitcoin Bulls Shouldn't Worry

Despite the bearish price movement across the cryptocurrency sector led by Bitcoin, analysts remain optimistic about BTC's potential recovery to higher levels. Investors also have good reasons to maintain a positive outlook in the long term.

Analyst Moustache believes that "the local bottom has been reached," explaining that retesting the 200-day EMA "has always marked the lower range" over the past 18 months.

#Bitcoin

— 𝕄𝕠𝕦𝕤𝕥𝕒𝕔ⓗ𝕖 🧲 (@el_crypto_prof) July 4, 2024

It looks like, we're currently going to experience the true "Spring"-Event in the Wyckoff-Reaccumulation Model. pic.twitter.com/UBBjFf5ukU

"I'm really sensing a bottom for $BTC here," he said.

Strong macroeconomic conditions and an entrenched "buy the dip" mentality can quickly restore BTC's price. Additionally, analysts point to catalysts such as the Federal Reserve lowering interest rates in September, with the possibility of another cut in December, as factors that could boost prices.

#Bitcoin

— 𝕄𝕠𝕦𝕤𝕥𝕒𝕔ⓗ𝕖 🧲 (@el_crypto_prof) July 4, 2024

I'm really getting bottom vibes here for $BTC.

One of my fav. bottom indicators for Bitcoin shows another red dot.

In the last 1.5 years, this signal has ALWAYS marked a bottom range.

-First touch of the 200 EMA (D) in 9 months pic.twitter.com/LyYddd259k

Moreover, the full approval of the Ethereum ETF by the SEC, set to launch in July, is expected to provide a significant stimulus for the cryptocurrency market.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL FM strongly recommends contacting a qualified industry professional.