Welcome to HODL FM, as we dive into this week’s perfomance of the largest cryptocurrency in the world.

Here is what happened to Bitcoin this week:

- Bitcoin price change: Bitcoin dropped by 17.65% from $66,500 K to $55,000 over the last seven days.

- Market capitalization: Bitcoin market capitalization is at $1,090,103,739,429.

- Top performing Bitcoin altcoins: CATS•IN•THE•SATS (CATS) and SATOSHI•RUNE•TITAN (Runes) TITAN led with the Bitcoin Runes ecosystem with mild gains over the week.

- Bitcoin ETF Inflows and Outflows: Spot Bitcoin ETF recorded $563.7 million total outflows.

More: Bitcoin Rollups Face Sustainability Issues, Vitalik Offers Solutions

Bitcoin’s $53K nosedive bounces back just enough for a sigh of relief

Bitcoin price faced a brutal sell-off this week on August 5. The sell-off was so 'mild' that after casually dipping below $60,000, the world's favorite cryptocurrency decided to go all-in and nosedive from $58,350 to $52,500 in just two hours. It's like Bitcoin saw the edge and thought, "Why not?"

Bitcoin lastly traded around $52,000 in February, shortly before the price rallied following the approval of spot Bitcoin ETFs in the U.S. Meanwhile, the cryptocurrency has regained ground and bounced back by 10% to $55,000.

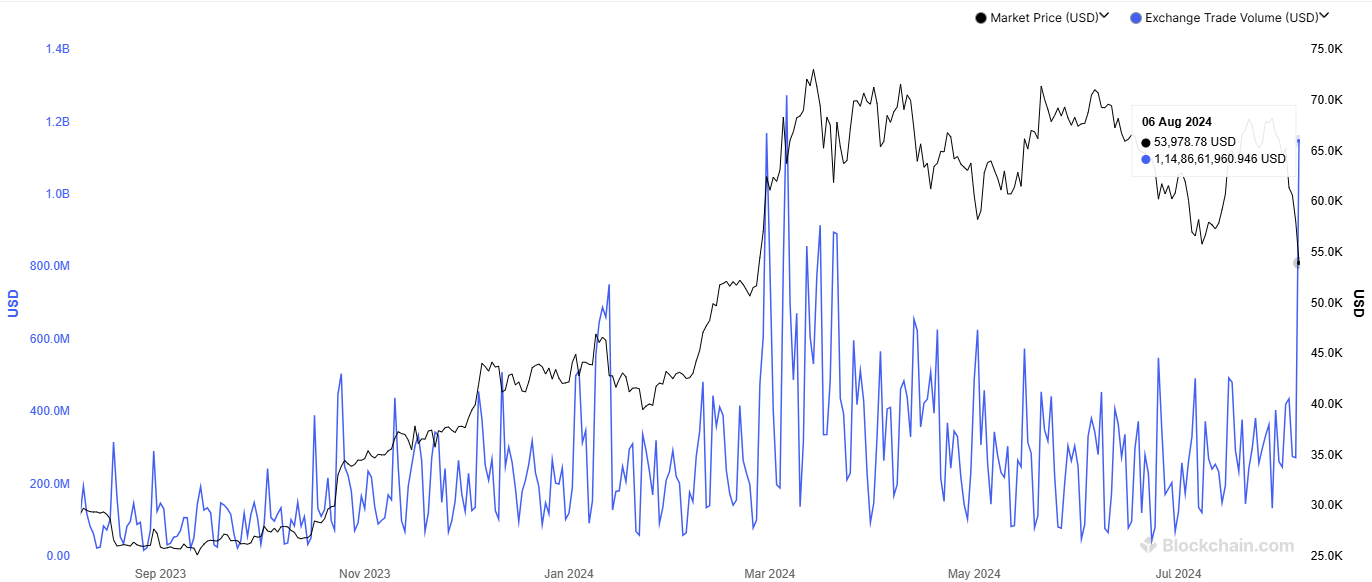

Bitcoin Trading Volume Rockets to Post-Halving ATH

With everyone dumping or swooping in to grab the $50,000 bargain, trading volumes came out to flex.

Bitcoin trading volumes stood their ground amidst this week’s market turmoil and registered a new all-time high since the previous halving event.

These high volumes can be attributed to increased activity in the face of the sell-off. The fear and greed index, which measures market behavior in relation to emotions, indicates that the market is already in extreme fear.

As such, a large number of participants might have chosen to sell their holdings, and another still large segment of the market took advantage of the discounted BTC trading at the $50,000 range to fill their bags. As a result, the total trading volume of Bitcoin across major cryptocurrency exchanges surpassed $1.14 billion on August 6, 2024.

Bitcoin Loves a Comeback Story

The recent sell-off is Serving 2016 pre-Bull Vibes. Historically, dramatic nosedives like the one we saw this week are often followed by jaw-dropping bounce-backs.

Take the March 12, 2020 plunge when Bitcoin took a drastic 39.63% cliff dive, only to rebound like a caffeinated kangaroo, leaping over 100% in only a few months.

During Bitcoin’s third-cycle of halving on July 9, 2016, the price was $650. Post the halving-event, the price retreated by 27% to a $474 low in one month before it rocketed to $20,000 the following year.

Related: Crypto Market Records $500 Billion Sell Off In 3 Days: Is Winter Coming?

Almost similar, Bitcoin’s decline this week is 26% from the $64,962 post halving price.However, despite this assessment providing a bullish perspective for Bitcoin, there are chances that the price could drop lower before charging back.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL FM strongly recommends contacting a qualified industry professional.