Bitcoin has been in the spotlight ever since it crossed the $100,000 mark. Even long-time skeptics are starting to ask whether it finally makes sense to buy into this “magic” asset. Governments worldwide are also paying closer attention, especially after the United States took the first step toward formal recognition.

Bitcoin is highly volatile, and no one can predict its price with precision. The only thing that seems certain is its long-term upward trend. Accordingly, the questions arise: how high can it go, and how quickly?

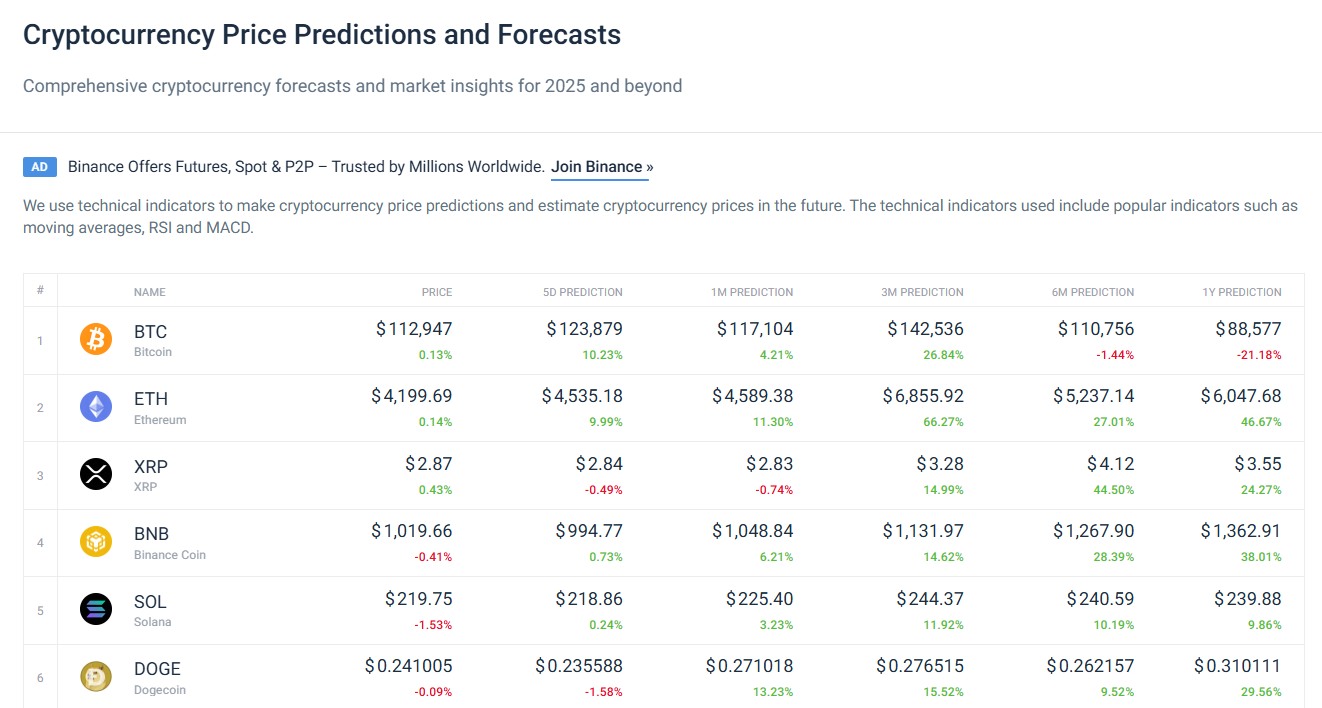

Since HodlFM is a media outlet and we don’t have our own analytical tools, we will review forecasts from CoinCodex, a cryptocurrency data aggregator that tracks thousands of assets across hundreds of exchanges. We’ll also look at the main factors and risks that could influence Bitcoin’s future.

Keep in mind that all forecasts, by definition, cannot be completely accurate. They exist only to give people a rough idea of what Bitcoin's price might look like in the future.

Historical Bitcoin performance

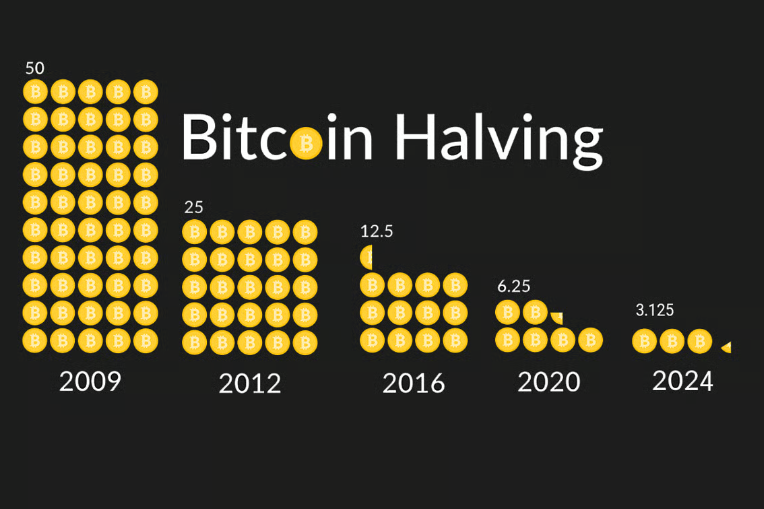

Bitcoin halving is one of the most important events in crypto. Roughly every four years, the reward miners earn for securing the network is cut in half. That means fewer new coins enter circulation, making the supply tighter.

In this way, halvings set Bitcoin’s long-term cycles in motion. After each halving, markets often follow the same rhythm: accumulation, a sharp pump, distribution, and a decline.

History shows that the most explosive growth usually happens 500–720 days after a halving. So, halvings don’t trigger instant rallies, but they prepare the ground for what comes next. Let’s look at how past halvings have influenced Bitcoin’s price:

- 2012: reward dropped from 50 to 25 BTC. The value surged from $12 to over $1,100 within a year.

- 2016: reward cut to 12.5 BTC, with Bitcoin rising from $640 to nearly $20,000 in 2017.

- 2020: reward reduced to 6.25 BTC. The coin climbed from $8,500 to almost $67,000 in 2021.

- 2024: reward now 3.125 BTC. Bitcoin stood above $64,000 and hit $109,000 in January 2025.

By 2025, Bitcoin had broken multiple all-time highs, topping $124,000. As of now, there are still 32 halvings left until all 21 million BTC are mined. It’s exciting to think about how many more times the price might surge.

Bitcoin annual price performance (2016-2025)

*2025 data represents current levels as of September 2025

Bitcoin price prediction 2026 forecast

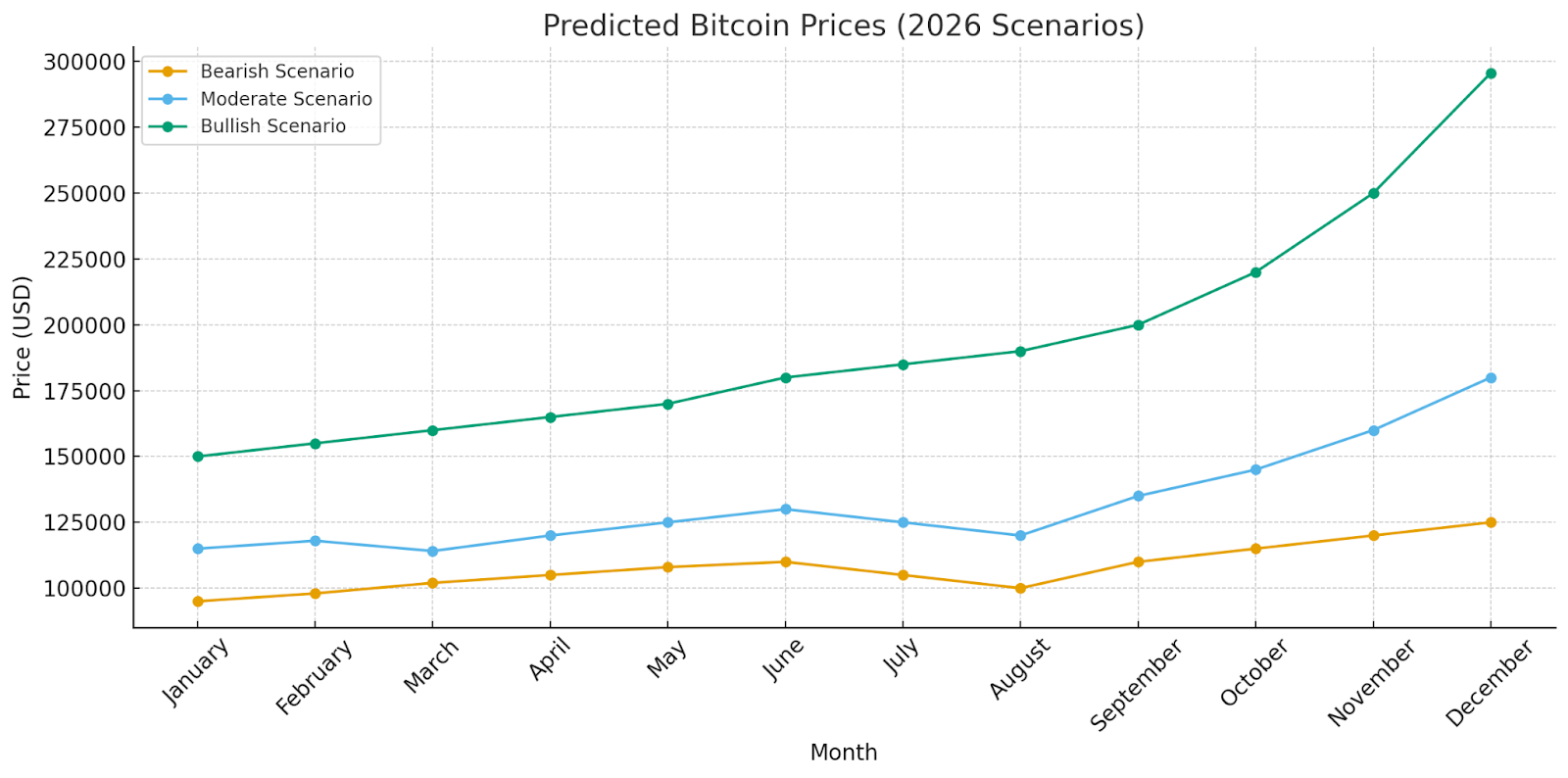

Bitcoin’s 2026 outlook illustrates the rhythm of halving cycles in action. According to CoinCodex predictions, there are three possible paths:

- a bullish start with January averages near $133,000 and peaks around $138,000;

- a moderate mid-year correction to about $106,000 by June;

- and a bearish late-year scenario where Bitcoin dips to roughly $77,000 by December. This 42% drop aligns with historic post-halving corrections and sets the stage for the next cycle.

Bitcoin price prediction January 2026

January 2026 could mark the very top of Bitcoin’s current cycle. Because it lands exactly 21 months after the April 2024 halving, which is right in the sweet spot where Bitcoin has historically peaked. CoinCodex forecasts an average price of $133,674, with a trading range between $122,380 and $138,446.

This forecast overlaps at its upper bound with the lower bound of the prediction from Traders Union, a financial and market analytics portal. They give a range of $138,918.91 – $169,789.79.

Bitcoin price prediction March 2026

By March 2026, the story begins to change. The first quarter closes with Bitcoin shifting from euphoria into consolidation. Forecasts place the average price around $112,524, with a range of $102,841 to $123,100—a healthy 16% drop from January’s highs.

Changelly, a cryptocurrency exchange and API provider, offers a similar but narrower range: $108,943.32 – $119,545.57.

Bitcoin price prediction April 2026

Starting in April, the CoinCodex forecast turns more bearish and cautious, no longer aligning with projections from other platforms.

This shift marks the beginning of Q2 2026, with Bitcoin settling into what looks like the classic post-peak correction phase. CoinCodex projects an average price of about $108,386, with trading between $103,713 and $112,941.

Bitcoin price prediction June 2026

By June 2026, Bitcoin sits about 26 months post-halving, well into the correction phase that usually defines the back half of a cycle. CoinCodex forecasts an average of $106,166, with prices moving between $101,868 and $110,541.

Bitcoin price prediction December 2026

By December 2026, Bitcoin will be about 32 months past the 2024 halving, right at the point where cycles often bottom out before the next buildup begins. CoinCodex projects an average price of $77,229, with trading expected between $74,425 and $81,620.

Monthly Price Scenarios for 2026

Bitcoin price prediction 2025, 2026, 2027, 2028, 2029, 2030

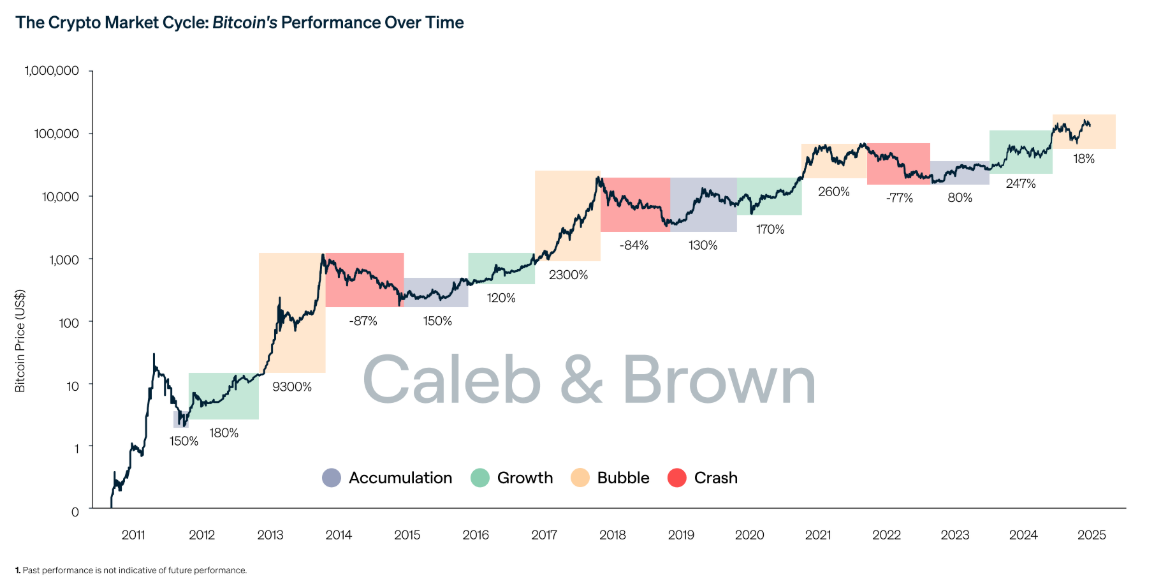

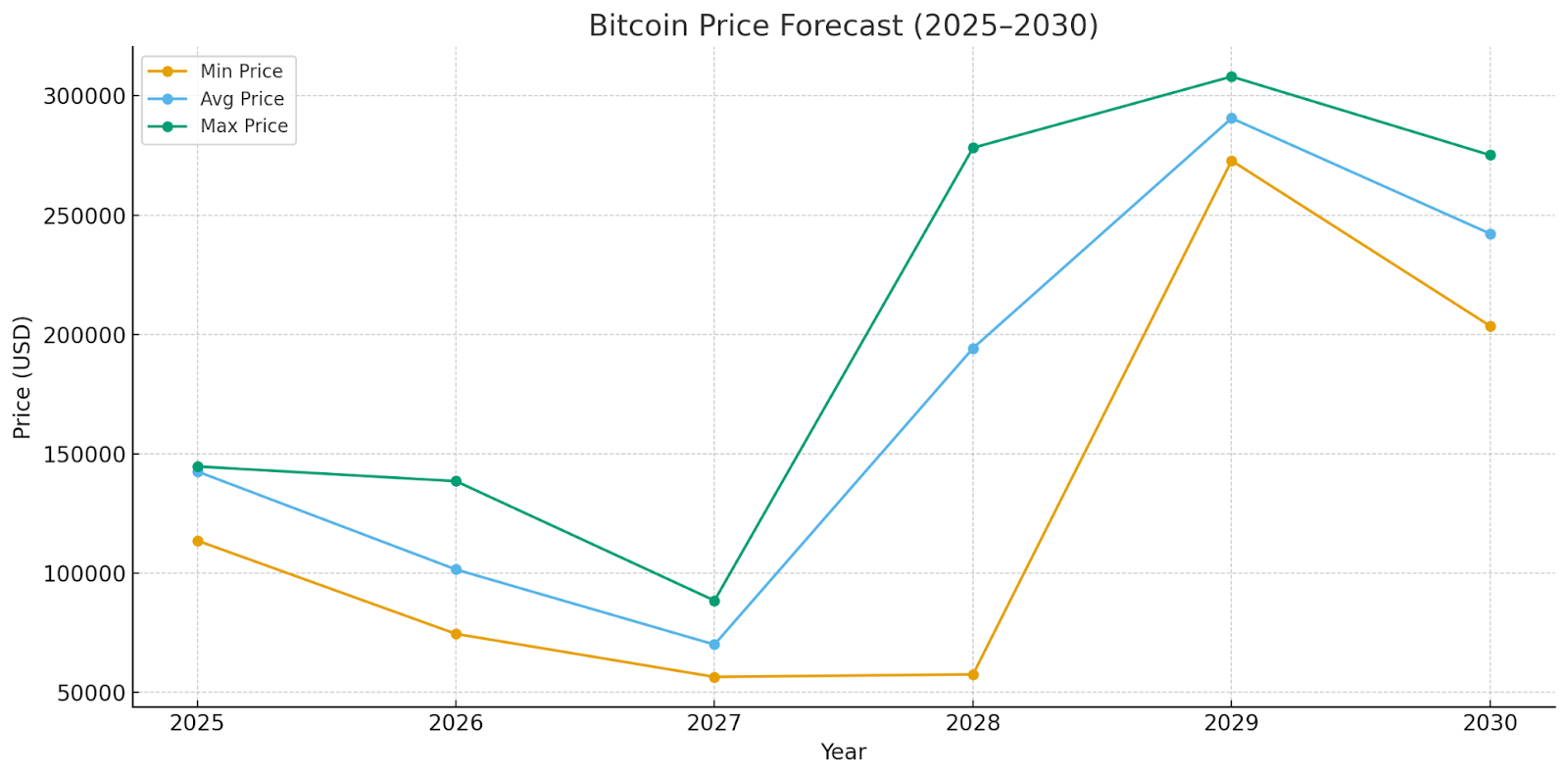

Halving gives us two cycles to analyze: the current 2024–2028 cycle and the next one stretching to 2032.

In the current cycle, CoinCodex projects 2025 as the peak year, with Bitcoin averaging around $142,000 and hitting highs near $145,000. By 2026, the cycle moves into consolidation, with averages dropping to about $101,000. 2027 looks like the cycle’s bottom, averaging near $70,000, which fits the pattern of corrections 36 months post-halving.

Then comes the rebound. The 2028 halving sparks fresh momentum, pushing averages above $194,000 and highs near $278,000. 2029 could bring the next peak, with projections close to $300,000, before 2030 levels off around $242,000.

Multi-Year Bitcoin Price Forecast Table (2025-2030)

Factors influencing Bitcoin price in 2026

We can’t predict exactly what will happen or how quickly countries will add Bitcoin to their strategic reserves. However, we can summarize, based on history, the main categories of events that tend to move Bitcoin’s price.

- The halving effect: The reduced supply of new BTC, caused by the halving in 2024, creates upward pressure on the price as demand competes for fewer coins. Historically, this has triggered a global cycle of rapid growth followed by inevitable corrections.

- Institutional adoption: Big players like banks, pension funds, and ETFs are adding Bitcoin to their portfolios. Their capital brings more liquidity into the market and helps keep prices higher.

- Regulation: Clear rules like the EU’s MiCA law or Japan’s crypto framework give investors more confidence. But strict bans in some countries, like in China, still limit adoption and local crypto markets.

- Macro conditions: in countries with high inflation, like Argentina and Turkey, people often turn to Bitcoin as a safer store of value. At the same time, low interest rates can make BTC more attractive compared to traditional savings.

- Sentiment: public reactions will determine how steep corrections become. Positive narratives, such as ETF successes, can extend rallies, while negative events, like critical posts from Donald Trump on X, could make downturns worse. Together, these forces make 2026 a year of both opportunity and volatility.

Risks and uncertainties in Bitcoin predictions

This is the favorite part of Bitcoin skeptics. Jokes aside, no one wants their futures position liquidated. So let’s look at the factors that can negatively impact Bitcoin’s price.

- Market volatility: With lower trading volumes, even one big order can swing the price, and rumors alone can cause sudden drops or spikes.

- Geopolitical and macroeconomic risks: Wars, sanctions, or economic crises can push investors into safer assets, pulling money out of Bitcoin. For example, during the early stages of the Russia–Ukraine war in 2022, Bitcoin fell nearly 10% in a single day, from about $38,500 to $34,700.

- Technological threats: Bitcoin’s security depends on cryptography. While still theoretical, quantum computing could one day threaten private keys and even put dormant coins at risk.

Hold on tight!

Bitcoin price prediction for 2026 follows the familiar cycle: strong highs early in the year, corrections through the middle, and potentially deeper drops by year’s end. Estimates range from over $130,000 in January to around $77,000 by December. Looking further ahead, the 2026–2030 outlook suggests Bitcoin could even climb as high as $300,000.

But as we know, the price will inevitably be shaped by both positive and negative factors. So get ready for an exciting journey following the pillar of the crypto market — Bitcoin.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource, and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice. HODL FM strongly recommends contacting a qualified industry professional.