“The bigger they are, the harder they fall.” This statement proves to be true again as Bitcoin, the biggest cryptocurrency by market value, falls hard into a drop it has not seen since April.

Bitcoin was trading at an all-time high just sometime this year. In fact, it was March 13, 2024, when Bitcoin reached its ATH (all-time high) of $73,084, but fast forward to April 13, Humpty Dumpty had a great fall, and prices dropped to $58,528. In the following months, all the queen’s horses and all the king’s men managed to put Humpty Dumpty together again with an upward and relatively stable trend in its price.

Related: Bitcoin Stuck in Endless $64K-$65K Loop, Can't Seem to 'Make Up Its Mind'

However, come Monday, it’s humpty dumpty all over again as Bitcoin fell below $60,000 for the first time since early May. These things happen a lot, but this drop could not have come at a worse time. Bitcoin ETFs just got approved by the SEC, and it seemed like Bitcoin couldn’t put a foot wrong. Bitcoin had fallen to a daily low of $59,962 by Tuesday, according to CoinGecko.

$BTC Price: $59,485 #Bitcoin #BTC #BitcoinPrice #Crypto #blockchain #cryptocurrency pic.twitter.com/enTQ7tMkAG

— Bitcoin Price Tracker (@BTCPriceUpdate) June 24, 2024

But who’s to blame for Bitcoin's demise? People need someone to point their fingers at, right? Well, the closest we can get to a cause is Mt. Gox. The now-defunct Japanese crypto exchange was hacked in 2014, leading to a loss of $63.6 million BTC at 2014 prices.

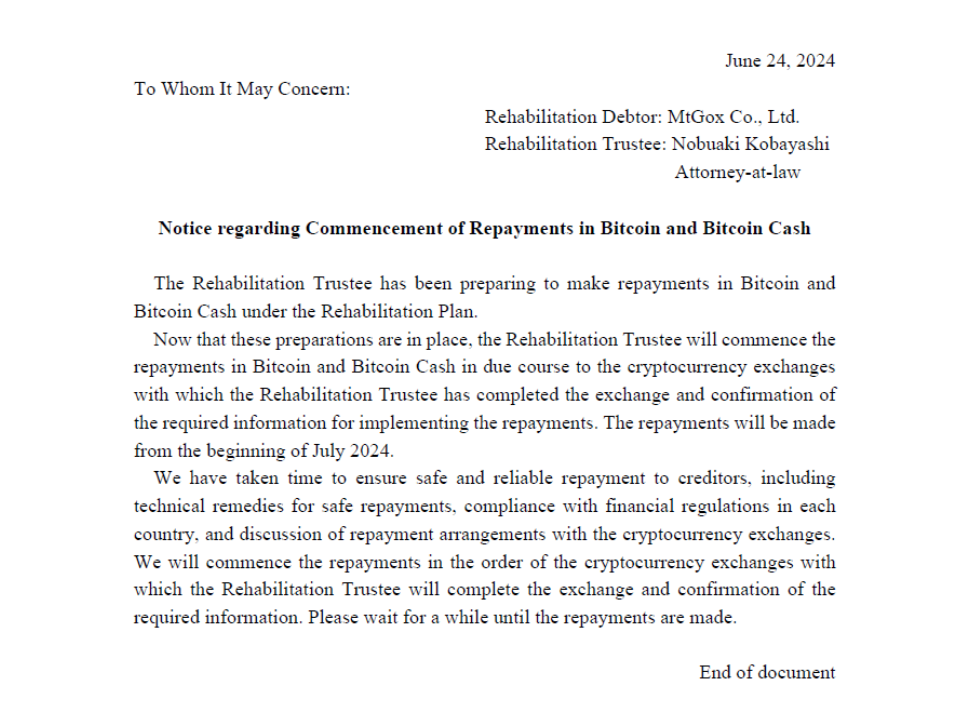

The loss is worth some $46 billion at today’s price, and imagine everyone’s surprise when Rehabilitation Trustee Nobuaki Kobayashi announced that old Mt. Gox creditors would be getting paid in Bitcoin and Cash in July.

They say, “One man’s food is another man’s poison,” and they were right. That announcement was good news for those who would be getting out of that fat pay in July, but it was terrible news for the Bitcoin market. The market went crazy with the fear that Mt.Gox creditors would sell off their reclaimed coins immediately after they got them back.

That’s like over half of all the ETF inflows being negated in one shot. Damn. https://t.co/rBrFb6xpX1

— Eric Balchunas (@EricBalchunas) June 24, 2024

Of course, they can’t see the future, but their fears are definitely valid. SpotonChain confirmed that the three wallets controlled by Mt. Gox had 141,686 BTC, worth approximately $8.71 billion. All those billions leaving the market at once would be a horror movie for Bitcoin prices.

Per CoinShares, over $1.2 billion worth of assets had already flowed out of Bitcoin U.S ETFs arguably because of the FED’s interest rate cut, and of course, this validates the new fears. But ironically, the same market that feared massive liquidation has started a chain of enormous liquidation. According to CoinGlass, more than $335 million worth of crypto positions have been liquidated, with Bitcoin taking the topmost spot on that list, with $145 million liquidated.

The market has successfully created its own fears, and it is really interesting to watch. It just goes to show you how volatile the crypto market is, and for science nerds, it provides a real-life example of the concept of causality.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL FM strongly recommends contacting a qualified industry professional.