Ki Young Ju, the CEO of CryptoQuant and a crypto analysis heavyweight, lately made a shocking announcement: the Bitcoin cycle theory is dead. And yes, he’s owning up to the fact that his past predictions might not have been the most spot-on. The market’s changed, and so has his outlook.

Why Bitcoin’s Old Cycle Theory No Longer Makes Sense

Remember when Ki Young Ju swore by the theory of buying when whales accumulate and selling when retail investors pile in? Well, he’s throwing that theory out the window. Back in March, he even boldly declared that the bull cycle was over; now he admits it’s not so simple anymore. In fact, he’s apologizing, expressing concern that his earlier calls might have messed with some people’s investment decisions.

#Bitcoin bull cycle is over, expecting 6–12 months of bearish or sideways price action. pic.twitter.com/f80bnNhjy4

— Ki Young Ju (@ki_young_ju) March 17, 2025

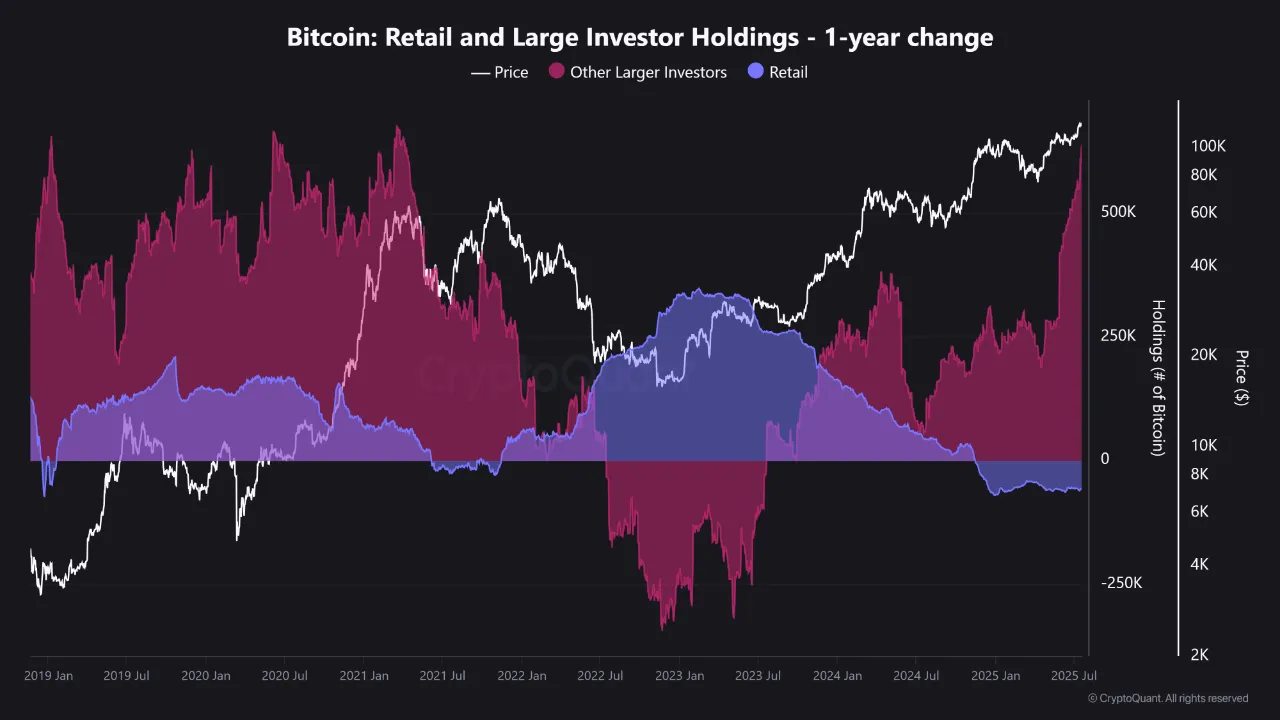

What changed? According to Ki Young Ju, it all comes down to whale behavior. In the past, these whales would dump Bitcoin to retail investors, but now? Old whales are selling to new long-term whales. The result? More holders than traders. A real game-changer.

Institutional adoption of Bitcoin has completely surpassed even his expectations, leading to a market environment so different that it’s hard to make any solid predictions. Traditional market dynamics just don’t apply here.

CryptoQuant’s own analysis supports this theory. Analyst Burakkesmeci pointed out that on-chain data shows we’re not seeing a retail frenzy this time around. Since early 2023, retail investors have been steadily unloading BTC, while institutional players, funds, and big wallets, including ETFs, have been stacking up on Bitcoin.

“This cycle looks nothing like the madness of 2021. No mass euphoria, no social media frenzy. It’s quiet, smart money making moves while the crowd sits on the sidelines,” Burakkesmeci observed.

With this new dynamic in play, predicting Bitcoin’s next move is tougher than ever. In past cycles, bear markets were recognized by retail panic. But what happens if the institutions start to panic instead? That’s the million-dollar question, and it’s got risk managers on edge.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource, and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice. HODL FM strongly recommends contacting a qualified industry professional.